Invest Like Warren Buffett: Affordable Strategies for Smart Investors

Most investors would be pleased with Warren Buffett’s track record. As the leader of Berkshire Hathaway, he has achieved a compounded annual gain of nearly 20% over the last 58 years. In comparison, the S&P 500 has seen a compounded annual increase of about 10% during that same period. Clearly, Buffett and his team have consistently outperformed the market over the long haul.

One way to emulate Buffett is by purchasing stocks he supports. However, truly replicating his success may require investing in many stocks, which can become costly and complex. Additionally, investors must keep track of which stocks Buffett sells or reduces his stake in.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy now. See the 10 stocks »

Fortunately, there’s a simpler and more budget-friendly way to invest like Buffett in 2025 and beyond. In addition to various top stocks such as Apple and Coca-Cola, Buffett endorses another investment option that’s accessible for everyday investors. Let’s explore this Buffett-approved choice to enhance your portfolio now and potentially reap rewards later.

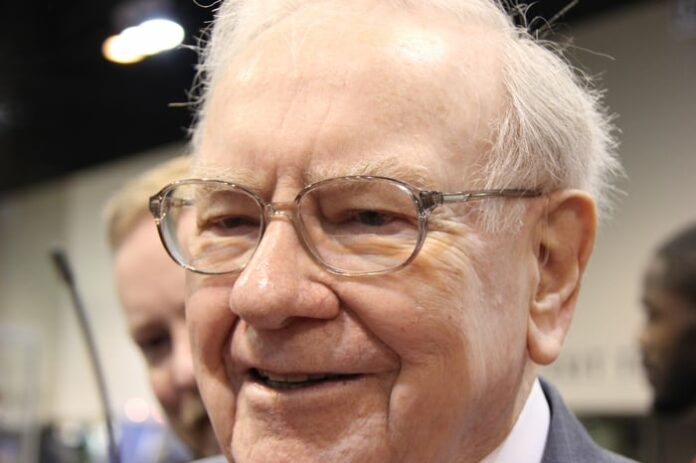

Image source: The Motley Fool.

Investing in American Businesses

To understand this investment, consider one of Buffett’s core strategies: supporting strong American companies. In his 2013 letter to shareholders, Buffett stated, “American business has done wonderfully over time and will continue to do so.”

A look at Buffett’s portfolio confirms this approach. He has consistently invested in companies that significantly contribute to the U.S. economy, including Apple, American Express, Bank of America, and Coca-Cola — all prominent American brands. Notably, American Express and Coca-Cola were among his top holdings a decade ago as well.

Now, let’s discuss the investment option that reflects Buffett’s approach. He incorporates an S&P 500 index fund into his portfolio to enhance his stock selection. Buffett has shares in both the SPDR S&P 500 ETF Trust (NYSEMKT: SPY) and the Vanguard S&P 500 ETF (NYSEMKT: VOO). These exchange-traded funds (ETFs) track the S&P 500 index, ensuring they mimic the same performance.

Why Following the S&P 500 Makes Sense

Why should investors consider aligning their returns with the S&P 500? Historically, this index has showcased the strength of leading companies, achieving an average annual gain of around 10% since its establishment in the late 1950s. While history is not a guarantee, the overall quality of S&P 500 companies suggests a good chance for future growth.

Buffett doesn’t just hold these index funds; he also instructed that 90% of his cash be allocated to an S&P 500 index fund for his wife after his passing, highlighting his belief in the long-term value of this investment strategy.

Investing in these ETFs is straightforward; they are traded daily just like stocks. A notable distinction is their expense ratios. Choosing an ETF with a ratio below 1% minimizes the impact on your returns, and both the SPDR and Vanguard funds feature low expense ratios of 0.09% and 0.03%, respectively.

Once you add one of these funds to your portfolio, it’s crucial to heed one more piece of advice from Buffett: maintain long-term holdings. This approach allows your investments time to grow, potentially increasing your wealth.

Seize This Second Chance for Profitable Opportunities

Have you ever felt you missed out on buying the most successful stocks? If so, this news will interest you.

Our expert analysts occasionally issue a “Double Down” stock recommendation for companies they believe are on the verge of significant growth. If you’re worried about missing the investment boat again, now could be the perfect time to buy before it’s too late. The figures are compelling:

- Nvidia: A $1,000 investment when we doubled down in 2009 would now be worth $349,279!*

- Apple: If you invested $1,000 when we doubled down in 2008, it would be worth $48,196!*

- Netflix: A $1,000 investment when we doubled down in 2004 would now stand at $490,243!*

Currently, we’re issuing “Double Down” alerts for three outstanding companies, presenting an opportunity that may not arise again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 16, 2024

Bank of America is an advertising partner of Motley Fool Money. American Express is an advertising partner of Motley Fool Money. Adria Cimino has positions in American Express. The Motley Fool has positions in and recommends Apple, Bank of America, Berkshire Hathaway, and Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.