Reviving Confidence: Alphabet’s Bold Moves in AI and Quantum Tech

Recent Developments: Alphabet Inc.’s GOOG GOOGL is making headlines with its newest advancements in artificial intelligence and quantum computing, and these efforts appear to be strengthening its image among investors.

Context: Following the launch of OpenAI’s ChatGPT in late 2022, Google was compelled to declare a “Code Red” as the competitive landscape shifted dramatically. The tech giant was under fire for falling behind competitors, notably Microsoft Corporation MSFT, which swiftly integrated ChatGPT features into its offerings.

However, recent developments have caused a positive shift in perception, according to a report from the Financial Times.

Noteworthy Innovations: “Alphabet has been scrutinized since the debut of ChatGPT,” stated Tiffany Hsia, a U.S. equity portfolio manager at AllianceBernstein and a Google shareholder. “The launch of Gemini 2.0 and the quantum chip has invigorated investor confidence, signaling that they are still a leader in the tech sector.”

This year, Google introduced several new models including Gemini 2.0, Veo 2, and Imagen 3, which enhance video and image generation. Additionally, the company made strides in quantum computing with its Willow chip.

The tech giant also rolled out a custom AI accelerator chip, called the Trillium Tensor Processing Unit, aiming to challenge the supremacy of Nvidia Corporation NVDA.

Other projects include Project Mariner, which consolidates research reports and operates on behalf of users, as well as Project Astra, enabling real-time responses across various media formats using smart glasses.

Competitive Landscape: While Google continues to lead the search market with a 90% share, it faces increasing competition from emerging players like OpenAI and Anthropic. Moreover, regulatory challenges loom, as the U.S. Department of Justice is actively pursuing actions to dismantle parts of Google’s advertising technology business and is questioning its dominance in search services.

Recently, Google announced the reduction of 10% of its top management positions as part of a long-term initiative aimed at streamlining operations and improving efficiency.

Despite these hurdles, Alphabet’s Class A and C shares have surged approximately 38% year-to-date.

The company now boasts a market capitalization of $2.351 trillion, positioning it as the fifth most valuable company globally, trailing only Apple, Nvidia, Microsoft, and Amazon.

Market Performance: On Friday, Alphabet’s Class A shares increased by 1.54%, closing at $191.41, while Class C shares rose by 1.72% to finish at $192.96, as reported by Benzinga Pro data.

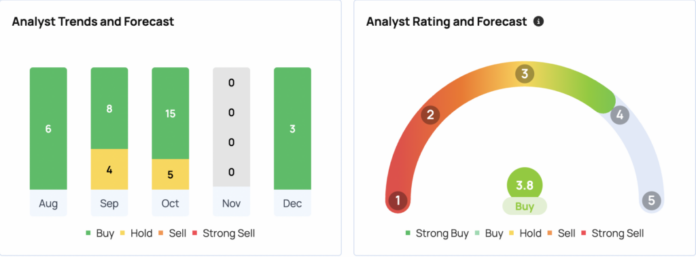

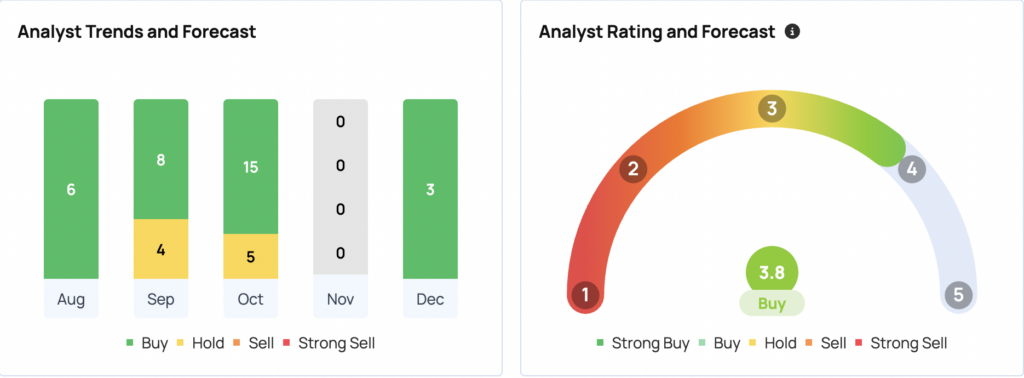

Recent analyst assessments from JP Morgan, Goldman Sachs, and Baird yield an average price target of $215.67 for Alphabet’s Class A shares, indicating a potential increase of 11.87%.

Furthermore, Oppenheimer, Jefferies, and Pivotal Research have established an average price target of $225 for Class C shares, projecting an upside of 15.9%.

Read Next:

Disclaimer: This content was partially produced with the assistance of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs