Vertex Pharmaceuticals Receives FDA Approval for Innovative Cystic Fibrosis Treatment

Vertex Pharmaceuticals (VRTX) has announced the approval of its new vanza triple therapy by the FDA, designed for the treatment of cystic fibrosis (CF) in patients aged six and older. This medication will be sold under the name Alyftrek.

Alyftrek, which will be available for an annual wholesale acquisition cost of $370,269, is indicated for those CF patients who possess at least one F508del mutation or another mutation in the CF transmembrane conductance regulator (CFTR) gene known to respond to the drug. Remarkably, the FDA’s approval arrived well ahead of the anticipated PDUFA date of January 2, 2025. This decision is founded on robust data from clinical trials, showing that Alyftrek offers greater patient benefits than Vertex’s existing CF treatment, Trikafta (known as Kaftrio in Europe), which requires administration twice daily. Notably, Alyftrek can also be prescribed to patients who have stopped using Trikafta or other Vertex CF therapies. Additionally, similar applications for approval are currently under review in Europe.

It’s important to note that Alyftrek carries a boxed warning regarding potential drug-induced liver injury and failure.

This new therapy combines three drugs: vanzacaftor (a CFTR potentiator), deutivacaftor (a CFTR corrector), and tezacaftor. Vertex anticipates that Alyftrek will contribute significantly to its growth in the coming years.

Vertex is also exploring the use of Alyftrek in younger cystic fibrosis patients aged 2 to 5 years.

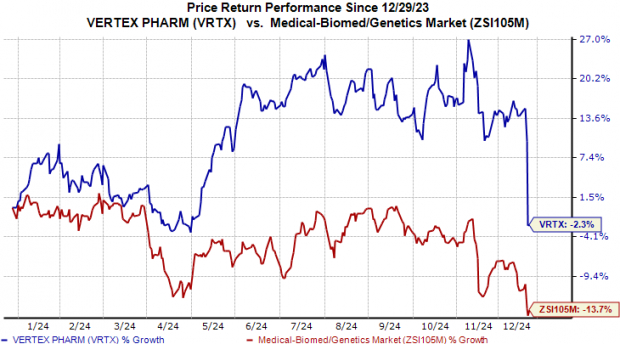

Vertex Stock Movements in 2024

So far this year, Vertex Pharmaceuticals’ shares have declined by 2.3%, while the broader industry has seen a more significant drop of 13.7%.

Image Source: Zacks Investment Research

Expansion of Trikafta’s Approved Uses

In another recent announcement, Vertex disclosed that the FDA has broadened Trikafta’s approved label to include an extra 94 non-F508del CFTR mutations. This expansion means that nearly 300 additional CF patients in the U.S. are now eligible to receive the treatment.

Notably, the FDA has upgraded the safety warning on Trikafta concerning liver injury, moving it to a boxed warning.

Vertex’s Robust Cystic Fibrosis Product Line

Vertex Pharmaceuticals stands as a leader in the cystic fibrosis sector, having pioneered treatments that target the root causes of the disease. In addition to Alyftrek and Trikafta, the company also markets three other CF drugs: Symdeko/Symkevi, Orkambi, and Kalydeco.

Sales for Vertex’s CF drugs are increasing, particularly driven by Trikafta, which generated $7.52 billion in revenue during the first nine months of 2024. This reflects a year-over-year growth of nearly 14%, demonstrating the drug’s solid performance across various markets.

To expand its treatment options, Vertex is developing an mRNA therapy, VX-522, in collaboration with Moderna (MRNA). This treatment aims to benefit approximately 5,000 CF patients who do not produce CFTR protein and therefore cannot use existing CFTR modulators. The initial phase I/II trial’s single ascending dose (SAD) segment has been completed, while the multiple ascending dose (MAD) segment is still underway, with data expected in the first half of 2025.

Current Zacks Rankings for Vertex Pharmaceuticals

Vertex Pharmaceuticals currently holds a Zacks Rank of #3 (Hold).

Vertex Pharmaceuticals Incorporated Stock Overview

Vertex Pharmaceuticals Incorporated price | Vertex Pharmaceuticals Incorporated Quote

Notable Biotech Stock Recommendations

Other well-rated stocks in the biotech sector include Castle Biosciences (CSTL) and CytomX Therapeutics (CTMX), both currently holding a Zacks Rank of #1 (Strong Buy). For the complete list of today’s Zacks #1 Rank stocks, click here.

In recent months, bottom-line estimates for Castle Biosciences have changed dramatically, improving from an anticipated loss of 59 cents per share to expected earnings of 34 cents for 2024. Estimates for 2025 loss per share have also narrowed, dropping from $2.15 to $1.84. Year-to-date, Castle Biosciences’ shares are up 27.6%.

CSTL has surpassed earnings expectations in the last four quarters, achieving an average surprise of 172.72%.

Meanwhile, projections for CytomX Therapeutics indicate a narrowing of the 2024 loss per share estimates from 29 cents to 5 cents. Estimates for 2025 have also improved from 56 cents to 35 cents. Year-to-date, CTMX’s shares have dropped by 29.7%.

CytomX has beaten earnings expectations in two of the last four quarters but has missed in the other two, averaging a surprise of 115.70%.

Zacks Highlights 10 Stocks for 2025

Interested in early insights on Zacks’ top picks for 2025?

Historically, these selections have yielded impressive results.

From 2012, when our Director of Research Sheraz Mian began overseeing the portfolio, until November 2024, the Zacks Top 10 Stocks offered gains of +2,112.6%, significantly outpacing the S&P 500’s +475.6%. Sheraz is currently analyzing 4,400 companies to identify the best 10 stocks to hold for 2025. Don’t miss your chance to be informed on these stocks when they’re revealed on January 2.

Be the First to Know About New Top 10 Stocks >>

Vertex Pharmaceuticals Incorporated (VRTX) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

CytomX Therapeutics, Inc. (CTMX) : Free Stock Analysis Report

Castle Biosciences, Inc. (CSTL) : Free Stock Analysis Report

Read the article on Zacks.com here.

The views expressed here are those of the author and may not reflect those of Nasdaq, Inc.