Wall Street Wrap-Up: Strong Finish Amid Mixed Data

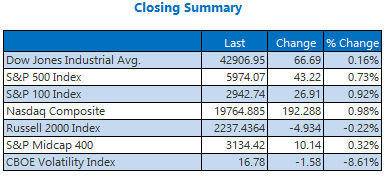

Stocks ended the day on a positive note, with the Dow recovering from early losses to add 66 points by the closing bell. The S&P 500 and Nasdaq also saw gains, aided notably by tech giant Nvidia (NVDA). Despite two disappointing economic reports, traders maintained their confidence. Consumer sentiment dropped in December to levels not seen since September, and durable goods orders also decreased in November.

Read on for a closer look at today’s market highlights, featuring:

- A potential buy opportunity in a defense stock.

- Honda’s stock soars following merger news.

- Insights on AMD call options, developments in the auto sector, and recent updates in sleep apnea treatment.

Key Market Updates for Today

- Nordstrom (JWN) is preparing to go private. (CNBC)

- Record levels seen in catastrophe-bond issuance for 2024. (Bloomberg)

- AMD call traders remain optimistic despite a recent decline.

- The auto sector’s response to the Honda-Nissan news.

- Eli Lilly’s positive news impacts sleep apnea stocks.

No significant earnings reports were released today.

Commodity Prices Dip Ahead of the Holidays

Oil prices declined today due to ongoing demand concerns. West Texas Intermediate (WTI) crude for February delivery fell by 22 cents—about 0.3%—to settle at $69.24 per barrel.

The strong U.S. dollar and high bond yields pushed gold prices down as well, with December delivery gold dropping 0.6% to settle at $2,628.20 an ounce.

The views and opinions expressed herein belong solely to the author and do not necessarily represent those of Nasdaq, Inc.