Target’s Stock Struggles: Investors Weigh Risks and Opportunities

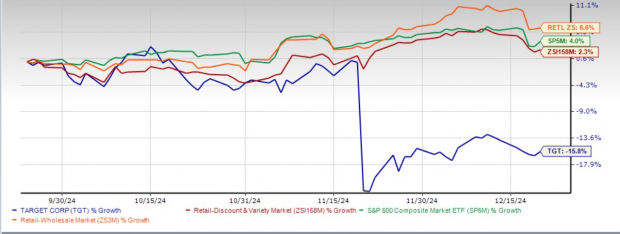

Shares of Target Corporation TGT have decreased by 15.8% in the last three months, leading investors to ponder whether this drop represents an opportunity to buy or signals deeper issues. Despite Target’s established reputation in retail and its focus on customer service, broader market conditions and specific challenges have likely impacted the recent stock performance.

Compared to the Retail–Discount Stores industry and the S&P 500 Index, which rose by 2.3% and 4% respectively during the same timeframe, Target has significantly lagged. The Retail-Wholesale sector also outperformed Target, boasting a growth of 6.6%.

Analyzing Target’s Performance Over the Last Three Months

Image Source: Zacks Investment Research

Closing at $131.48 last Friday, Target’s stock is now 27.7% below its peak of $181.86 reached on April 1. Additionally, TGT is trading below its 50-day moving average, indicating a downward trend.

Navigating Below the 50-Day Moving Average

Image Source: Zacks Investment Research

Challenges Impacting Target’s Stock Performance

Target faces several challenges that may hinder its attractiveness as an investment in the near future. The company’s fiscal third-quarter performance revealed ongoing difficulties, including reduced discretionary spending, shrinking profit margins, and rising operational costs. Consumers are prioritizing essential items over discretionary purchases, with apparel and home goods sales suffering from this shift.

During the third quarter, apparel sales saw a slight decline, while home goods reported a mid-single-digit dip in comparable sales, roughly 4 percentage points lower than the previous quarter. Consumers are increasingly engaging in “resourceful” shopping—waiting for significant discounts on non-essential items—which has further impacted sales. The average purchase size decreased by 2%, reflecting cautious household budgeting.

Profitability remains a critical concern, as Target faced multiple cost challenges including healthcare and general liability expenses, which drove up selling, general, and administrative (SG&A) costs. Additionally, increased shipping costs arose from rerouted shipments due to strikes affecting East Coast and Gulf ports, along with timing issues related to Asian imports.

The SG&A expense rate climbed by 50 basis points year-over-year in the most recent quarter, resulting in a 60 basis-point contraction in operating margin. This decline reflects a combination of reduced sales in higher-margin products and increased supply chain and fulfillment expenses.

For the fourth quarter, Target adopts a conservative outlook, predicting flat comparable sales as discretionary demand shows no signs of improvement. The company cited challenges such as a shortened holiday shopping period. Adjusted earnings are anticipated to fall between $1.85 and $2.45 per share, signaling a decline from the $2.98 reported in the same period last year.

Consensus Estimates Reflect Cautious Outlook for Target

The Zacks Consensus Estimate for Target’s earnings per share has seen downward revisions in light of a more cautious forecast. Over the past 30 days, expectations for earnings in the current and upcoming fiscal years decreased by 5.3% and 6.8%, now standing at $8.60 and $9.25 per share, respectively.

Image Source: Zacks Investment Research

Building Strategies for Future Growth

Although Target’s stock has struggled recently, the company is implementing strategic initiatives that could lead to future success. By capitalizing on its strong brand, varied product mix, and improving e-commerce operations, Target aims to solidify its market position and promote sustainable growth. Innovations and the integration of AI technology are helping the company lay a solid foundation for the future.

Combining its physical stores with a strong digital presence has enhanced the shopping experience for customers. Target’s emphasis on same-day delivery, curbside pickup, and tailored online services has reinforced its competitive position against giants like Amazon AMZN, Walmart WMT, and Dollar General DG. Comparable digital sales surged by 10.8% in the third quarter of fiscal 2024, with Drive-Up service alone generating over $2 billion in sales.

The diverse assortment of Target’s own labels and recognized national brands bolsters its reputation as a one-stop shopping location. The beauty category continues to thrive, with comparable sales rising more than 6% during the third quarter, driven by collaborations with Ulta Beauty and exclusive product launches. Additionally, popular private-label brands like Good & Gather and Hearth & Hand with Magnolia continue to attract consumer interest.

In today’s economic environment, Target’s pricing strategy effectively appeals to budget-conscious shoppers by lowering prices on thousands of items. This initiative aims to stimulate sales, while the Target Circle loyalty program has proven crucial in enhancing customer retention, with nearly 3 million new members joining in just the third quarter.

Target’s careful capital expenditure outlines its commitment to operational excellence and future expansion. For fiscal 2024, the company plans to invest nearly $3 billion, with increases anticipated to $4-$5 billion in fiscal 2025. With a trailing 12-month after-tax return on invested capital (ROIC) of 15.9% and an ongoing focus on high-performing categories, Target is strategically positioning itself for the future.

Examining Target’s Valuation

Currently, Target’s stock is trading at a discount relative to its industry peers, but this valuation gap may not indicate a favorable buying opportunity. The lower stock price could reflect deeper issues rather than a simple chance to invest.

Presently, Target’s stock trades below its historical and industry averages. It has a forward 12-month P/E ratio of 14.32, which is below the past year’s median level of 15.27, while the industry average stands at 30.82 for the same measurement.

Image Source: Zacks Investment Research

Investment Considerations for TGT Stock

While Target’s strategic investments position it for long-term growth, ongoing challenges make it less attractive for investors seeking stability in retail. Continuous weakness in discretionary spending and margin pressures indicate potential struggles in regaining momentum. Additionally, a cautious earnings forecast suggests that recovery may take more time than expected, leading TGT to carry a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Naming Top 10 Stocks for 2025

Want to be tipped off early to our 10 top picks for the entirety of 2025?

History suggests their performance could be sensational.

From 2012 (when our Director of Research Sheraz Mian assumed responsibility for the portfolio) through November 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Now Sheraz is combing through 4,400 companies to handpick the best 10 tickers to buy and hold in 2025. Don’t miss your chance to get in on these stocks when they’re released on January 2.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Target Corporation (TGT) : Free Stock Analysis Report

Walmart Inc. (WMT) : Free Stock Analysis Report

Dollar General Corporation (DG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.