On December 24, three stocks are drawing attention for investors due to their strong growth prospects and favorable ratings:

Three High-Potential Stocks to Consider This December

Greenbrier Companies, Inc. (GBX)

Greenbrier Companies, Inc. (GBX) is a manufacturer of railroad freight car equipment and holds a Zacks Rank of #1. The Zacks Consensus Estimate for its earnings this year has risen by 18.2% over the past two months.

Price and Consensus Data

Greenbrier Companies, Inc. (The) price-consensus-chart | Greenbrier Companies, Inc. (The) Quote

With a PEG ratio of 1.81, the company remains lower than the industry average of 2.37. It also boasts a Growth Score of A.

PEG Ratio Information

Greenbrier Companies, Inc. (The) peg-ratio-ttm | Greenbrier Companies, Inc. (The) Quote

LATAM Airlines Group S.A. (LTM)

LATAM Airlines Group S.A. (LTM), an aviation services provider, also holds a Zacks Rank of #1. In the last 60 days, the consensus estimate for its current-year earnings has increased by 26.4%.

Price and Consensus Data

LATAM Airlines Group S.A. price-consensus-chart | LATAM Airlines Group S.A. Quote

LATAM Airlines Group has a PEG ratio of 0.65, significantly lower than the industry average of 1.38, and it earns a Growth Score of B.

PEG Ratio Information

LATAM Airlines Group S.A. peg-ratio-ttm | LATAM Airlines Group S.A. Quote

Sterling Infrastructure, Inc. (STRL)

Sterling Infrastructure, Inc. (STRL), which specializes in e-infrastructure and transportation solutions, carries a Zacks Rank of #1 too. The Zacks Consensus Estimate for its earnings has risen by 5.3% in the past two months.

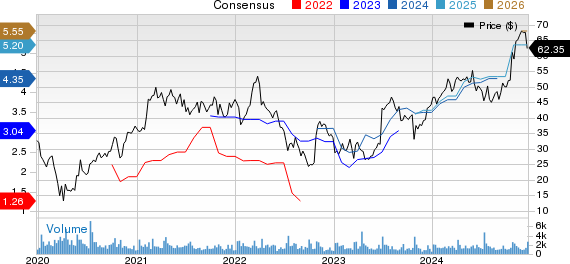

Price and Consensus Data

Sterling Infrastructure, Inc. price-consensus-chart | Sterling Infrastructure, Inc. Quote

Sterling Infrastructure holds a PEG ratio of 1.96, close to the industry’s 2.01, and also has a Growth Score of A.

PEG Ratio Information

Sterling Infrastructure, Inc. peg-ratio-ttm | Sterling Infrastructure, Inc. Quote

For more details, see the full list of top-ranked stocks.

To learn more about the Growth score methodology, you can find additional information here.

5 Stocks Set to Double in 2024

Zacks experts have selected five stocks that are projected to gain +100% or more next year. Historically, previous recommendations have seen substantial returns, such as +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these stocks are currently off the radar, representing an excellent opportunity for investors to act early.

Today, check out these 5 potential home runs >>

For the latest stock recommendations from Zacks Investment Research, download our report on the 5 Stocks Set to Double for free!

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Greenbrier Companies, Inc. (GBX) : Free Stock Analysis Report

LATAM Airlines Group S.A. (LTM) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.