Nike’s Path to Recovery: A Closer Look at Q2 Results and Future Strategies

Nike (NYSE: NKE) shares struggled following the company’s fiscal second-quarter report last week. The athletic apparel giant managed to exceed expectations, yet its new CEO warned of a difficult turnaround ahead. As of now, the stock is down nearly 30% in 2023.

This article delves into Nike’s fiscal Q2 performance, the strategies introduced by the new CEO, and the potential for a stock rebound.

Sales Decline and the New Strategy

Nike exceeded low estimates for the quarter but faced significant challenges. New CEO Elliott Hill expressed concerns about a lack of new products and inspirational marketing. Consequently, the brand has become overly reliant on discounts, with only about half of direct sales occurring at full price. This trend has negatively affected sales and profit margins.

Sales for the period ending November 30 fell 8% year over year to $12.35 billion, surpassing the $12.12 billion analyst expectation. Nike brand revenue decreased by 7% to $12 billion, while Converse saw a 17% drop to $529 million. When breaking down by channel, Nike’s direct revenue dropped 13% to $5 billion, and wholesale revenue fell 3% to $6.9 billion.

The gross margin dropped 100 basis points to 43.6%, largely due to increased discounting. Although Nike reduced selling, general, and administrative (SG&A) costs by 3%, it still increased marketing expenses while cutting overhead by 5%.

Adjusted earnings per share (EPS) fell 24% to $0.78, which, however, is significantly higher than the $0.63 expected by analysts.

Inventory is another crucial metric to watch during tough times. Elevated inventories can lead to further discounts and ongoing margin pressure. Nike’s inventory levels remained relatively stable year-over-year, but with sales down 8%, this is a notable concern.

Looking ahead, Nike anticipates a low double-digit revenue decline for fiscal Q3, along with a gross margin reduction of 300 to 350 basis points. The company expects these challenges to increase heading into Q4.

Hill plans to pivot Nike Digital back to a full-price model and reduce reliance on sales promotions. This transition can be tricky, as marking down prices can change consumer habits. The company aims to refocus on product innovation and sport-specific marketing.

Image source: Getty Images.

Potential for Stock Recovery in 2025

Elliott Hill is familiar with Nike, having been part of the company since 1988 until 2020. He is focused on taking Nike back to its roots, correcting the strategic shifts made under former CEO John Donahoe, who concentrated heavily on direct sales without sufficient innovation. Hill’s plan will re-establish product innovation alongside rekindling wholesale partnerships.

While Hill’s strategy appears promising, it may take time to implement. Nike needs to manage its inventory effectively and introduce innovative products that will entice customers back to full-price purchases. The company’s current promotional strategy dilutes brand value, and rebuilding will require patience.

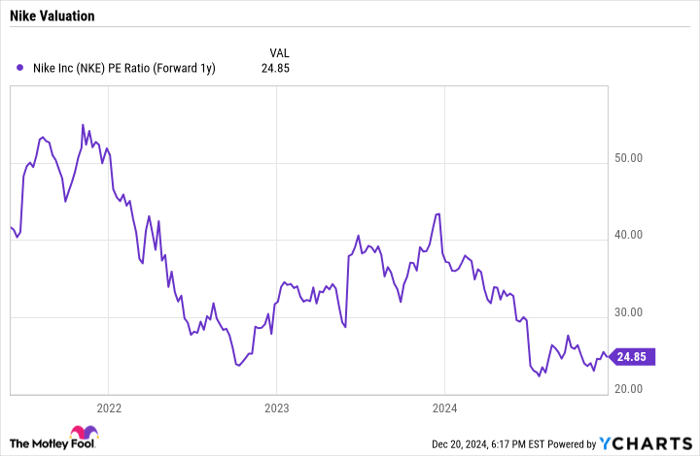

Presently, Nike stock has a forward price-to-earnings (P/E) ratio of about 25, marking one of its lower trading levels in recent years.

Data by YCharts.

Expectations are that the turnaround will not be complete before the end of this fiscal year, which concludes in May 2025. However, if signs of recovery appear, stock prices may begin to rise as investors look ahead.

It may become increasingly appealing to consider Nike stock during the latter half of 2025 as Hill’s strategies begin to take effect. Investors should also be prepared to take advantage of price drops in the interim, should the market grow restless.

Opportunity Awaits for Keen Investors

If you’ve ever felt regret about missing out on investing in top performers, there’s a current opportunity you might want to explore.

Occasionally, our team of analysts identifies a “Double Down” stock—companies they believe are nearing a significant breakthrough. If you’ve felt you missed your chance before, now could be the right moment.

- Nvidia: investing $1,000 back in 2009 would yield $349,279!*

- Apple: an investment of $1,000 back in 2008 would be worth $48,196!*

- Netflix: a $1,000 investment in 2004 would now stand at $490,243!*

Currently, our analysts are issuing “Double Down” alerts on three remarkable companies, and the window for opportunity might close soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.