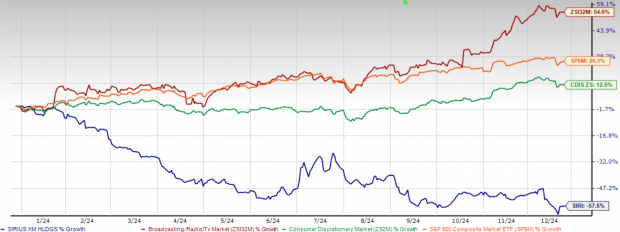

SiriusXM (SIRI) is working through a tough market but is positioning itself for a possible rebound in 2025, even amidst a significant 57.5% drop this year. The company’s Q3 2024 performance shows it’s in a transitional phase after separating from Liberty Media and initiating bold plans to address subscriber and revenue issues.

2024 Year-to-Date Review

Image Source: Zacks Investment Research

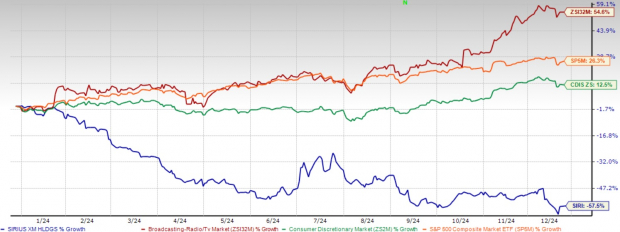

SiriusXM has set ambitious goals of achieving 50 million subscribers and $1.8 billion in free cash flow. However, the current market situation points to cautiousness among investors. The company’s trailing 12-month P/E ratio stands at 14.91X, far above the Zacks Broadcast Radio and Television industry average of -187.47X, casting doubt on short-term stock prospects.

SIRI’s Elevated P/E TTM Ratio

Image Source: Zacks Investment Research

Subscriber Stability and New Pricing

Despite challenges, SiriusXM appears to be stabilizing its subscriber base. The company added 14,000 self-pay subscribers in Q3, a notable improvement from earlier figures. A new pricing strategy, starting at $9.99 for both streaming and in-car services, reflects a thoughtful approach to broadening the customer base while preserving revenue. This strategy aims to meet the needs of budget-conscious consumers and offers possibilities for upselling additional packages, likely helping to keep subscriber churn low.

Innovations in Content and Advertising

SiriusXM is heavily focused on content, particularly in podcasting. Recent acquisitions, such as the Unwell network known for “Call Her Daddy,” and ongoing content expansion, position the company to benefit from the growing podcast sector. Podcast advertising revenues have climbed 6%, hinting at potential growth in this area.

Scott Greenstein, President and Chief Content Officer, emphasized the firm’s strategy of curating content that resonates across different demographic groups. The addition of notable figures like Alex Cooper and the ongoing conversations about Howard Stern’s future show commitment to a robust content lineup.

Financial Discipline and Cost Management

Though SiriusXM reported a net loss of $2.96 billion—primarily due to a non-cash impairment charge—the company maintains solid financial prospects. CFO Tom Barry stressed the commitment to cutting costs, targeting $200 million in savings for 2024. The adjusted EBITDA of $693 million with a steady 32% margin reflects this fiscal discipline.

Furthermore, the company has updated its free cash flow projection to about $1 billion, factoring in costs from transactions. This financial stewardship underscores a long-term focus on value rather than just short-term stock gains.

Technological Developments and Future Initiatives

SiriusXM is making substantial investments in technology, including the rollout of a new tech platform and 360L technology that allows for more precise advertising targeting. The aim is for 40% of new car trial starts to utilize the 360L platform this year, increasing to over 50% by 2025, which could unveil new revenue opportunities, particularly in targeted advertising.

Management recognizes challenges in the advertising sphere, such as growing competition and changing spending habits. Nonetheless, they maintain a positive outlook by focusing on programmatic and podcast advertising. Programmatic advertising increased by 9%, while programmatic podcasting saw 50% growth.

Confronting Strong Rivals in Audio Entertainment

SiriusXM faces heightened competition from various sources, which raises concerns about its sustainability. The automotive market—previously its stronghold—is experiencing disruptive shifts. The emergence of electric vehicles and self-driving technology encourages tech firms and startups to challenge SiriusXM’s dominance in in-car entertainment. Tesla (TSLA) has begun integrating its own entertainment system in vehicles, effectively sidestepping traditional satellite radio.

The streaming audio sector, formerly seen as an ally, now presents a substantial threat. Competitors like Spotify (SPOT), Apple (AAPL) Music, and Amazon Music are enhancing their offerings with personalized playlists and exclusive content, drawing users away from SiriusXM.

Despite SiriusXM’s investments in podcasts and technology, it contends with formidable rivals in platforms dedicated to podcasts, such as Spotify and Apple Podcasts, and newer entrants like Substack and Patreon that empower content creators.

Investment Insights

For investors, SiriusXM offers a nuanced opportunity as its significant decline this year reflects potential for recovery supported by the company’s strategic initiatives. Management’s focus on retaining subscribers, innovating content, and enhancing technology creates a compelling narrative for future growth.

The Zacks Consensus Estimate for 2024 revenue stands at $8.68 billion, marking a 3% decrease from last year. The projected loss is expected to be $6 per share.

Image Source: Zacks Investment Research

Final Recommendation

Investors might consider a “hold” position with cautious optimism. SiriusXM’s comprehensive strategy targeting subscriber growth, content expansion, and tech innovation points toward a potential recovery by 2025. The newly structured pricing, continued podcast development, and tech enhancements form a firm basis for future progress.

Key factors to monitor include the success of the $9.99 pricing strategy, growth in podcast content and advertising revenues, the deployment of 360L technology, and metrics on subscriber retention and growth, along with new content initiatives.

Despite the ongoing challenges, SiriusXM’s proactive strategy and commitment to innovation could enable a turnaround in its stock performance as early as next year. Currently, SiriusXM holds a Zacks Rank #3 (Hold). Check out the complete list of Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Poised for Potential Doubling

These stocks were carefully selected by a Zacks expert as the top candidates to gain +100% or more in 2024. Historically, prior recommendations have soared by +143.0%, +175.9%, +498.3%, and +673.0%.

Many stocks in this report remain under the radar of Wall Street, presenting a unique chance to capitalize early.

Explore These 5 Potential High-Growth Stocks >>

Interested in the latest recommendations from Zacks Investment Research? Download the 5 Stocks Set to Double for free today.

Apple Inc. (AAPL): Free Stock Analysis Report

Sirius XM Holdings Inc. (SIRI): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.