Nvidia’s Secret Weapon: How Taiwan Semiconductor Manufacturing Fuels AI Innovation

The semiconductor industry is dominated by Nvidia, known for its cutting-edge graphics processing units (GPUs) that are essential for generative AI applications. However, it’s important to recognize the significant role of Taiwan Semiconductor Manufacturing (NYSE: TSM) in Nvidia’s success in this competitive landscape.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Understanding Taiwan Semiconductor’s Vital Role in AI

Taiwan Semiconductor specializes in manufacturing GPUs, supporting major players like Nvidia and Advanced Micro Devices (AMD). Although these companies design their chips, they rely on TSMC for production, showcasing the importance of TSMC in the semiconductor supply chain.

TSMC collaborates with industry giants, including Amazon, Broadcom, Qualcomm, Sony, as well as AMD and Nvidia, highlighting its pivotal role in the semiconductor ecosystem.

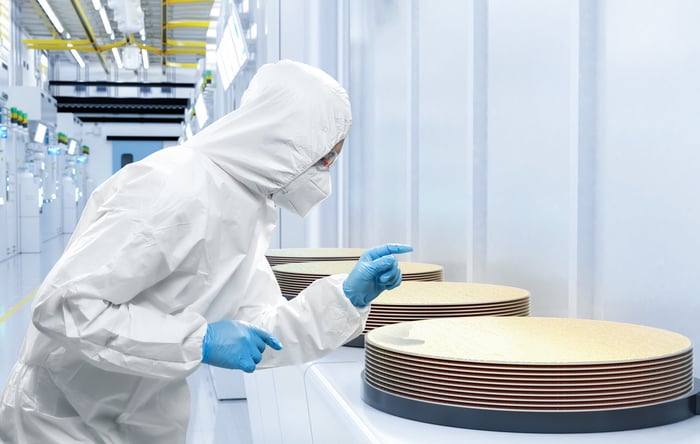

Image source: Getty Images

Positive Long-Term Trends for Taiwan Semiconductor Manufacturing

Mordor Intelligence reports that the global addressable market (TAM) for GPUs is expected to grow at a compound annual growth rate (CAGR) of 33% from 2024 to 2029, potentially reaching $274 billion by 2030. This surge presents a significant growth opportunity for TSMC.

With Nvidia planning the launch of its Blackwell chips and next-generation Rubin GPUs in 2026, alongside AMD’s upcoming AI accelerators, TSMC is positioned to gain additional market share as demand for GPUs increases.

Evaluating Taiwan Semiconductor Manufacturing’s Valuation

As of December 20, TSMC’s shares have risen nearly 90% in 2024, outperforming both the S&P 500 and Nasdaq Composite indexes. Despite this impressive growth, some analysts believe TSMC’s shares may still be undervalued.

Currently, TSMC has a forward price-to-earnings (P/E) ratio of 22.2, comparable to that of the S&P 500 (SNPINDEX: ^GSPC). This suggests that investors view TSMC’s potential and the broader market as equally appealing.

However, two risk factors should be considered: the geopolitical tensions between Taiwan and China, and the potential boost to Intel‘s foundry business under the incoming Trump administration, which may include increased domestic production.

Given TSMC’s alignment with the S&P 500’s forward P/E ratio, it’s possible that investors are accounting for these risks in the stock’s valuation.

Nevertheless, investing in TSMC seems to present a stronger option compared to broader market investments. The driving forces behind AI development should not be overlooked, with the semiconductor sector being crucial to advancements in this field.

At its present valuation, TSMC appears to be a compelling investment opportunity. Long-term investors should consider acquiring the stock while it remains relatively affordable.

Don’t Miss This Opportunity for Growth

Do you feel you might have missed out on buying stocks that have performed exceptionally well? There’s still potential to invest now.

Our analysts occasionally recommend a “Double Down” stock when they believe a company is poised for significant growth. If you have hesitated, now might be the right moment to invest before you miss your chance. The impressive numbers back up this advice:

- Nvidia: Investing $1,000 in 2009 would now be worth $362,166!*

- Apple: A $1,000 investment in 2008 would be worth $48,344!*

- Netflix: $1,000 invested in 2004 would grow to $491,537!*

Currently, our team is issuing “Double Down” alerts for three outstanding companies, and this opportunity may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco holds positions in Alphabet, Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Intel, Meta Platforms, Microsoft, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft, short February 2025 $27 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.