Why Micron Technology Could Be a Hidden Gem in the Semiconductor Market

Semiconductor stocks have seen impressive gains due to the booming artificial intelligence (AI) sector. While high-profile companies like Nvidia, Taiwan Semiconductor Manufacturing, and Broadcom capture most of the headlines, investing in the broader chip industry over the past two years has led to significant returns.

As of market close on Dec. 20, the VanEck Semiconductor ETF had risen by 39% in 2024, outperforming both the S&P 500 (SNPINDEX: ^GSPC) and the Nasdaq Composite (NASDAQINDEX: ^IXIC).

Where should you invest $1,000 today? Our analyst team has identified the 10 best stocks to consider right now. See the 10 stocks »

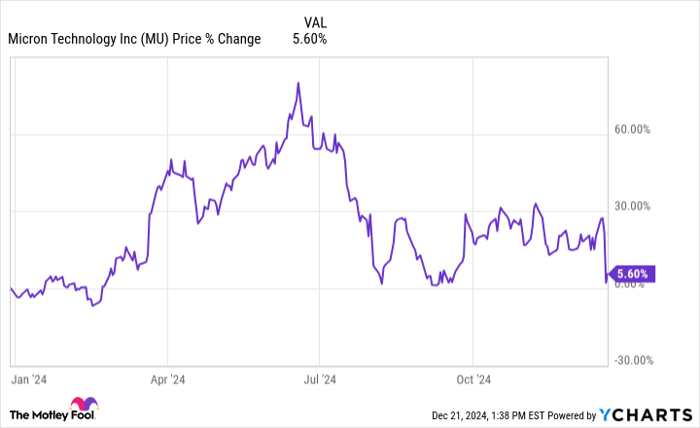

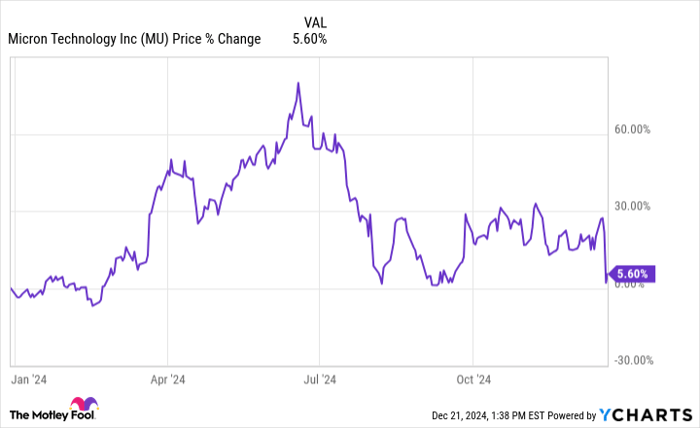

However, not all semiconductor companies are thriving. For instance, Micron Technology (NASDAQ: MU) has only seen a modest 6% increase in its shares in 2024, leading some investors to view it as a poor investment.

Smart investors realize that a stock’s return is just one part of the bigger picture. Below, I will explore the factors affecting Micron’s stock price this year and explain why 2025 may lead to a strong recovery for the company.

Micron’s Volatile Stock Movement

The chart below shows how Micron’s shares have fluctuated throughout 2024. The highs and lows clearly indicate that the stock is quite volatile, especially over the last six months, during which it has dropped around 38% since June.

MU data by YCharts

The main reason behind Micron’s volatility appears to be market expectations. When companies like Nvidia, Taiwan Semiconductor, and Broadcom maintain high growth rates, investors often expect a similar performance from all semiconductor firms.

It’s essential for investors to recognize the fallacy in this thinking. Not every semiconductor company produces the same products or faces the same challenges, leading to different opportunities and risks for each business.

Micron specializes in memory and storage for AI applications. Although it has shown impressive top-line growth, investors grew anxious about a potential significant miss in its financial forecast for the 2025 fiscal second quarter.

However, I believe this panic is misplaced. Let’s examine why Micron’s recent decline may not be justified.

Potential for a Rebound in 2025

Since AI emerged as a major trend two years ago, graphic processing units (GPUs) have become crucial to the tech industry. Companies like Nvidia and Advanced Micro Devices create GPUs that can execute complicated algorithms swiftly, powering numerous AI applications. Meanwhile, Taiwan Semiconductor provides GPUs for Nvidia and AMD, while Broadcom produces networking equipment essential for data centers housing these GPUs.

Given this context, it’s understandable that those particular firms have seen impressive growth recently.

I believe Micron is nearing its breakthrough moment. As investment in AI infrastructure is expected to reach trillions of dollars in the coming years, it’s likely that the demand for GPUs and data center services will only continue to climb.

As AI technologies advance, the requirements for memory and storage solutions will grow stronger. Micron is well-positioned to meet that demand.

This is not mere speculation. According to Micron’s 2025 fiscal first quarter report (ending Nov. 28), the company’s data-center revenue skyrocketed by 400% year over year, reaching a record high. Notably, the data center segment now contributes over 50% of its total revenue. These trends illustrate the rising need for Micron’s memory chips, which should support growth well into the future.

The company’s current challenges do not overshadow its long-term vision. Management estimates that the total addressable market for high-bandwidth memory could hit $100 billion by 2030—more than six times its current size. With Micron’s trailing revenue at approximately $29 billion, it is clear that there remains considerable upside potential.

Image source: Getty Images.

Is Micron Stock Worth Buying Now?

Evaluating Micron’s value can be complex. While the company is generating positive earnings, it has only recently achieved profitability. Therefore, determining its price-to-earnings (P/E) ratio might not be the best approach.

Instead, I recommend using the PEG ratio, which considers analyst projections for future earnings growth. A PEG ratio below 1 typically signals that a stock may be undervalued. Currently, Micron’s PEG ratio stands at a remarkable 0.23.

This low ratio suggests that investors may be overlooking the increasing importance of memory and storage chips as AI workloads expand. Over time, the necessity for Micron’s offerings will likely become more apparent. For long-term investors, now could be an opportune moment to buy Micron shares at an attractive price.

Should You Invest $1,000 in Micron Technology Now?

Before making a purchase in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team has identified their own 10 best stocks for investors right now, which does not include Micron Technology. The selected stocks have the potential to deliver strong returns in the coming years.

For example, when Nvidia appeared on this list on April 15, 2005, if you had invested $1,000 at that time, you would have $855,971 today!

Stock Advisor offers clear guidance for successful investing, including tips for building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has outperformed the S&P 500 by more than four times since 2002.

See the 10 stocks »

*Stock Advisor returns as of December 23, 2024

Adam Spatacco has positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.