Investing in AI: Exploring the Potential of ETFs

Artificial intelligence (AI) has captivated the investing public, similar to past tech booms. Companies that were once only recognized by tech enthusiasts have stepped into the spotlight. As a result, many firms in Silicon Valley have seen their stock prices soar to historic heights fueled by excitement about AI’s potential.

The Transformative Power of AI Unfolds

While the journey of AI is still unfolding, it presents significant economic promise. Even if one doesn’t buy into the most extravagant predictions about AI’s potential, it is clear that this technology could profoundly impact the global economy.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Here are some notable forecasts from respected organizations:

- The International Monetary Fund (IMF) recently estimated that 40% of global employment will be influenced by AI, rising to 60% in advanced economies such as the U.S.

- PwC, one of the “Big Four” accounting firms, predicts that AI could contribute $15.7 trillion to the global economy by 2030.

- McKinsey & Company, a leading consulting firm, suggests that generative AI alone may add $4.4 trillion annually to the global economy. For reference, the entire gross domestic product (GDP) of the United Kingdom is $3.1 trillion.

The Strength of ETFs in Investment

One effective way to invest is through exchange-traded funds (ETFs). These funds allow investors to acquire a collection of stocks or other assets by purchasing a single security. Unlike mutual funds, ETFs can be bought and sold like individual stocks and often carry lower fees.

While many ETFs track broad markets, such as the S&P 500 through options like the Vanguard S&P 500 ETF, there are others that target specific sectors, including AI.

A Range of ETFs to Explore

If you’re considering where to invest $500, the AI sector is buzzing with opportunities. Currently, there are around 40 ETF offerings focused on AI. Here are five of the most prominent based on assets under management (AUM):

- iShares U.S. Technology ETF

- Fidelity MSCI Information Technology Index ETF (NYSEMKT: FTEC)

- First Trust Dow Jones Internet Index Fund

- iShares Expanded Tech Sector ETF (NYSEMKT: IGM)

- iShares Global Tech ETF

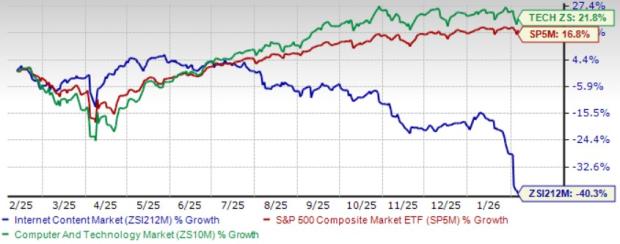

Many of these funds overlap with the broader technology sector. While there are options that focus on smaller, AI-specific companies, investing in a broader fund can often be less risky. For instance, although the Fidelity MSCI Information Technology Index ETF has the lowest expense ratio at 0.08%, my recommendation would be the iShares Expanded Tech Sector ETF for the $500 investment.

This ETF features a relatively low cost of 0.4%, translating to $40 annually for every $10,000 invested. Notably, it has outperformed Fidelity’s offering in recent years, compensating for the slightly higher fee. This year, the Expanded Tech Sector ETF even outperformed all other AI ETFs and the Nasdaq overall.

Moreover, the fund’s distribution of holdings is appealing. Fidelity’s ETF is heavily weighted, with the top three positions comprising nearly 44% of the fund’s value, while the iShares Expanded Tech Sector ETF distributes about 25% to its top three positions.

Meta Platforms: A Key Player in the AI Revolution

Understanding Meta’s Position in Tech Investments

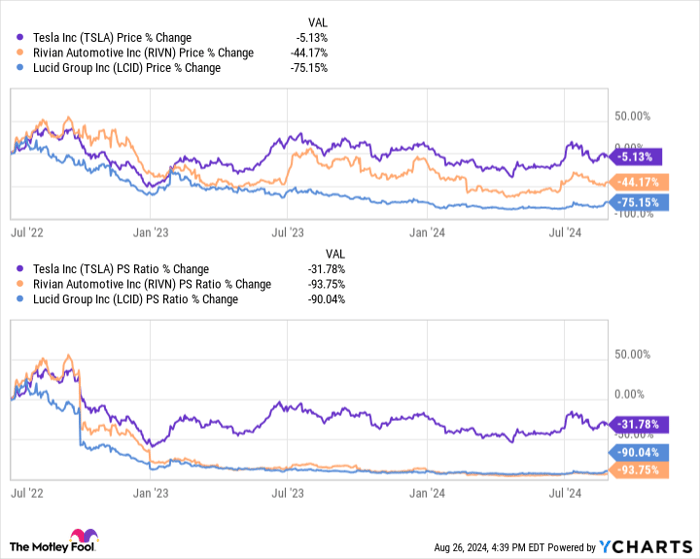

Currently, Meta Platforms (NASDAQ: META) stands out as one of the leading holdings in the iShares ETF. However, it is notably missing from Fidelity’s fund, FTEC, which comprises 296 equities. Many consider Meta one of the strongest investments in artificial intelligence within the tech sector, a sentiment echoed by numerous top hedge funds on Wall Street that include Meta in their portfolios.

The company excels in its core business and operates the first, third, fourth, and seventh most popular social media platforms globally, engaging around 3.29 billion users daily. Such vast reach significantly increases the value of its advertising space, enabling Meta to achieve double-digit revenue growth in every quarter since Q1 2023.

Meta’s current investment in artificial intelligence is also starting to bear fruit, enhancing the efficiency of their advertising through improved targeting algorithms. The successful launch of Meta AI highlights the company’s ability to create user-friendly AI solutions, a challenge even Apple faces. These initial successes suggest that Meta’s ongoing commitment to AI research may lead to innovations that could significantly transform its business operations.

Investing in firms that drive the AI revolution is potentially rewarding, whether your budget is $500 or $500,000. Consider diversifying your portfolio through an ETF, like the iShares Expanded Tech Sector fund, which provides a straightforward and cost-effective way to invest in technology.

Seize This Opportunity: Is it Time to Invest?

Have you ever felt you missed out on the chance to invest in top-performing stocks? If so, listen closely.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies poised for substantial growth. If you think you might have missed your window of opportunity, this might be your best chance to invest before prices rise. The evidence is compelling:

- Nvidia: An investment of $1,000 when we issued our recommendation in 2009 would be worth $349,279 today!*

- Apple: If you had invested $1,000 in 2008, it would have grown to $48,196!*

- Netflix: A $1,000 investment from 2004 would now be valued at $490,243!*

Currently, we are spotlighting three companies for our “Double Down” alerts that present promising opportunities. Chances like this don’t come around often.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Meta Platforms. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.