Understanding Analyst Ratings: A Closer Look at Hercules Capital (HTGC)

When it comes to making decisions on buying, selling, or holding stocks, investors often turn to analyst recommendations. These insights can influence stock prices significantly, but how reliable are they?

We will analyze what Wall Street analysts say about Hercules Capital (HTGC) before examining how to navigate these recommendations effectively.

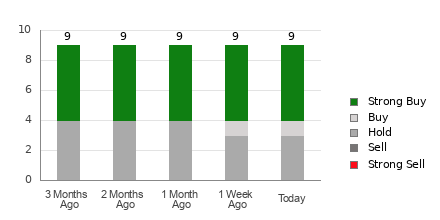

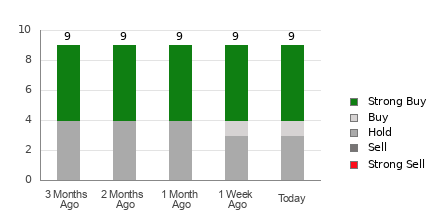

Currently, Hercules Capital holds an average brokerage recommendation (ABR) of 1.78, where 1 equals Strong Buy and 5 equals Strong Sell. This rating is based on the recommendations from nine brokerage firms, indicating a preference somewhere between Strong Buy and Buy.

Out of the nine ratings, five are classified as Strong Buy and one as Buy, making Strong Buy and Buy account for 55.6% and 11.1% of all recommendations, respectively.

Current Trends in Analyst Ratings for HTGC

Explore Hercules Capital’s price target & stock forecast here>>>

Although the ABR suggests buying Hercules Capital, it is crucial not to base investment decisions solely on this number. Research indicates that brokerage recommendations often fall short in identifying stocks with the highest potential for price increases.

Why is that? Brokerage analysts may have biases due to the interests of the firms they work for, often providing overly optimistic ratings. Our findings show a striking ratio of five “Strong Buy” recommendations for every one “Strong Sell.”

This disparity suggests that brokerage interests may not align with retail investors, making their recommendations less reliable for predicting future stock prices. It can be beneficial to use this information to support your own analysis or to combine it with other proven tools.

One such tool is the Zacks Rank, which categorizes stocks into five groups from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). It has a strong track record of effectively predicting stock performance based on earnings estimate revisions.

Understanding the Difference Between Zacks Rank and ABR

Despite both using a 1 to 5 scale, Zacks Rank and ABR measure different aspects. The ABR is a reflection of broker recommendations, calculated as a decimal (e.g., 1.28), while Zacks Rank is a quantitative model based on earnings forecast updates and uses whole numbers.

Historically, analysts at brokerage firms have demonstrated a tendency to overrate stocks, often providing more favorable ratings than warranted by their research. This can misguide investors rather than assist them.

In contrast, Zacks Rank centers on earnings estimate revisions, which empirical studies show are closely linked to short-term stock price movements.

Moreover, the different Zacks Rank grades are evenly distributed among all stocks with current earnings estimates from analysts. This approach ensures a balanced assignment across all five ranks.

A notable difference between ABR and Zacks Rank is timeliness. The ABR may not reflect the most up-to-date market conditions, whereas Zacks Rank is regularly updated based on real-time earnings estimate revisions, making it a more reliable predictor of stock performance.

Assessing Potential for Investment in HTGC

Recent updates to Hercules Capital’s earnings estimates show that the Zacks Consensus Estimate for the current year has dipped by 0.1% over the last month, landing at $2.01.

The decreasing optimism among analysts regarding the company’s earnings, as displayed by a strong consensus on lowering EPS estimates, could indicate a potential decline in the stock’s value.

The significant reduction in consensus estimates, coupled with several other earnings-related factors, has led to a Zacks Rank #4 (Sell) for Hercules Capital. For a list of top-rated stocks, you can check today’s Zacks Rank #1 (Strong Buy) stocks here >>>>.

Therefore, it may be prudent to approach the Buy-equivalent ABR for Hercules Capital with caution.

Zacks Reveals Top 10 Stocks for 2025

Are you interested in early insights on our top 10 picks for 2025?

Past performance suggests these selections could yield impressive results. From 2012 (under the guidance of our Director of Research Sheraz Mian) through November 2024, the Zacks Top 10 Stocks achieved a remarkable +2,112.6% return, greatly outperforming the S&P 500’s +475.6%. Sheraz is currently reviewing 4,400 companies to curate the best 10 stocks to buy and hold in 2025. Don’t miss the opportunity to invest in these stocks when they become available on January 2.

Be First to New Top 10 Stocks >>

Get your free analysis report on Hercules Capital, Inc. (HTGC).

Read the full article on Zacks.com for more insights.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.