Recent evaluations of ETF holdings reveal promising opportunities for investors in the iShares Morningstar Value ETF (Symbol: ILCV). The projected analyst target price suggests significant upside potential.

Current Valuation Overview

The implied analyst target price for the iShares Morningstar Value ETF, based on its underlying holdings, is $92.09 per unit. Currently, the ETF trades around $82.09 per unit. This indicates that analysts expect a 12.18% increase in its value over the next year, guided by the average targets from the underlying holdings.

Notable Holdings with Upside Potential

Among ILCV’s underlying holdings, three companies stand out due to their significant upside relative to analyst target prices:

- Seagate Technology Holdings PLC (Symbol: STX): The recent trading price is $88.49, while analysts project the target price at $121.89, reflecting a potential upside of 37.74%.

- Zoetis Inc (Symbol: ZTS): This stock currently trades at $164.70, with an expected target price of $220.14, representing a 33.66% increase.

- Baxter International Inc (Symbol: BAX): Priced at $29.08, its average analyst target is $37.83, indicating a 30.10% growth potential.

Price Performance Comparison

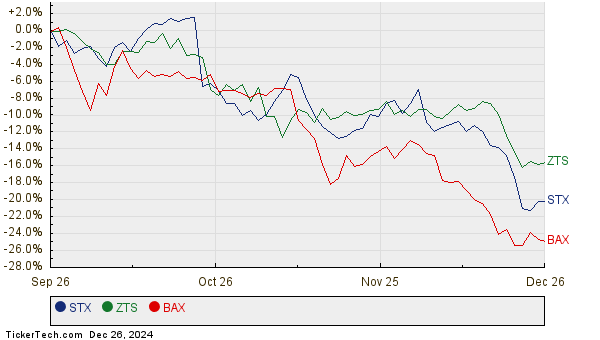

Below is a chart showcasing the stock performance over the past twelve months for STX, ZTS, and BAX:

Summary of Current Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Morningstar Value ETF | ILCV | $82.09 | $92.09 | 12.18% |

| Seagate Technology Holdings PLC | STX | $88.49 | $121.89 | 37.74% |

| Zoetis Inc | ZTS | $164.70 | $220.14 | 33.66% |

| Baxter International Inc | BAX | $29.08 | $37.83 | 30.10% |

Evaluating Analyst Predictions

As investors consider analyst price targets, questions arise regarding their validity. Are these projections grounded in solid reasoning, or reflective of overoptimism? While high price targets might indicate expectations for a stock’s future success, they can also precede revisions if market conditions change. These complexities warrant careful examination by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Related Content:

• ETF Finder

• EGY Options Chain

• Top Ten Hedge Funds Holding OAPH

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.