“`html

The Future of Satellite Technology: Opportunities and Challenges Ahead

The Satellite and Communication sector has experienced significant growth in recent years, fueled by a surge in commercial space exploration and Earth observation. Innovations such as 5G and the Internet of Things (IoT) are transforming how we connect, especially in remote areas. Companies like Gilat Satellite Networks (GILT), Globalstar (GSAT), and Iridium Communications (IRDM) are well-positioned to capitalize on these advancements by 2025.

The Essential Role of Satellite Communication

Global Connectivity: Satellites are essential for providing communication and internet services in remote regions lacking traditional infrastructure. They ensure reliable internet access for various modes of transport—ships, aircraft, or even emergency responders—thus facilitating effective disaster management. Through real-time monitoring, satellites play a vital role in responding to environmental disasters like wildfires, hurricanes, and floods.

According to a report from Grand View Research, the global satellite communication market is set to expand at a compound annual growth rate (CAGR) of 10% from 2024 to 2030. This expansion is largely driven by growing needs for High-throughput Satellite (HTS) systems that offer enhanced capacity and faster data speeds for applications like video streaming and remote sensing. The demand is also notably strong in government and defense sectors.

Technological Advancements: The landscape of satellite manufacturing has evolved significantly. Standardized designs and advanced computer tools expedite the process, making production more efficient and cost-effective. Today, satellites are often built on assembly lines, benefiting from automation in integration and testing.

Another industry trend is the emergence of Low Earth Orbit (LEO) satellite networks, which are especially tailored for IoT applications. These satellites bring advantages like low latency and high data speeds, tailored for advanced IoT communication technologies utilizing narrowband and low-power protocols.

Countries with advanced space programs enjoy not only military advantages but also economic and scientific benefits. However, the complexity of space technology keeps these capabilities limited to a select few countries. Demand for small satellites continues to rise globally. North America currently leads this trend, driven by various government satellite launches as companies gear up to fulfill U.S. defense and intelligence needs.

Challenges Facing the Satellite Industry

Despite technological advancements lowering the costs of satellite development, the overall expenses for building, launching, and operating satellites remain substantial. Such high costs create barriers for smaller companies and less developed nations. Increasing demand for satellite communication frequencies translates to heightened competition and regulatory hurdles. Furthermore, the spread of satellite technology often intersects with national security interests, escalating geopolitical tensions.

A significant portion of revenue in this industry is derived from U.S. government contracts, which may increase in light of rising defense budgets. Demand for space-based intelligence and communication services could attract further investments. However, a sluggish global economy might curtail spending, compounded by supply-chain disruptions and inflation leading to increased costs and project delays.

Three Satellite Stocks to Watch in 2025

Globalstar: Headquartered in Covington, LA, Globalstar provides satellite voice and data services to over 120 countries. Their range of products includes mobile and fixed satellite telephones alongside data modems. This company serves various sectors, including oil and gas, government, and transportation.

Globalstar’s strategy emphasizes expanded spectrum and wholesale capacity services, particularly aimed at government and commercial markets. Recently, the company completed its first 5G data call utilizing the Band n53 spectrum, enabling impressive download speeds of 100 Mbps and upload speeds of 60 Mbps for advanced applications like robotics and augmented reality. These advancements underscore the potential for Band n53 in future mobile technology developments.

Image Source: Zacks Investment Research

At the Investor Day 2024, Globalstar affirmed its revenue outlook for 2024 at $245-250 million with an adjusted EBITDA margin of 54%. Looking toward 2025, revenues are expected to range between $260-285 million, with an anticipated adjusted EBITDA margin around 50%. Long-term forecasts suggest revenues may exceed $495 million, accompanied by adjusted EBITDA margins above 54%.

The Zacks Consensus Estimate for the current year projects a loss of 2 cents per share, unchanged over the last month. Notably, the stock has experienced a remarkable 77.5% increase in the past six months, holding a Zacks Rank #2 (Buy). For more insights, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

Gilat Satellite Networks: Operating from Petah Tikva, Israel, Gilat is a leading provider of satellite-based broadband services, focusing on advanced equipment and technologies. Their offerings support various applications ranging from broadband access to defense communications.

Growth in the defense sector plays a significant role for Gilat, as demand for satellite communication solutions continues to rise due to geopolitical factors. The company anticipates completing the acquisition of Stellar Blu Solutions by late 2024, which is expected to contribute $120-$150 million in annual revenues and improve financial outcomes. Once Stellar Blu reaches full production capacity in the second half of 2025, projected EBITDA margins are expected to exceed 10%.

Image Source: Zacks Investment Research

However, the company’s recent decision to discontinue operations in Russia highlights the complexities and challenges faced by businesses operating in sensitive geopolitical landscapes.

“`

2024 Outlook: GILT Adjusts Revenue Forecast While Iridium Communications Shows Growth Potential

Gilat Satellite Networks Reassesses Earnings Guidance

Gilat Satellite Networks Ltd. (GILT) is adapting its revenue expectations for 2024, tightening overall guidance to a range of $305-$315 million. This adjustment signifies a 17% increase year-over-year at the midpoint.

The Zacks Consensus Estimate for GILT’s current-year earnings stands at 48 cents per share, unchanged over the last 30 days. GILT holds a Zacks Rank #2, with its stock having appreciated 32.7% in the past six months.

Image Source: Zacks Investment Research

Iridium Communications Enters Positive Territory

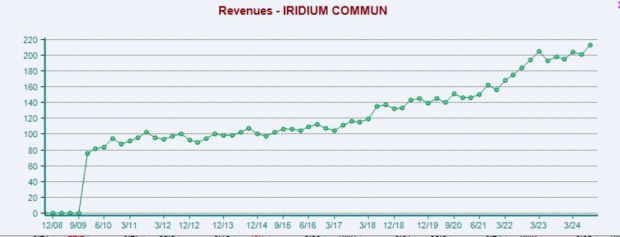

Iridium Communications (IRDM), located in McLean, VA, provides satellite communications services for voice and data to businesses, governments, and NGOs worldwide. The company operates in three segments: Service, Subscriber Equipment, and Engineering and Support Services.

Rising demand is benefiting all three segments, along with strong cost management. Revenue from Engineering and Support is expected to rise because of ongoing projects with the Space Development Agency. Encouraged by this positive momentum, Iridium has updated its full-year 2024 guidance, revising OEBITDA expectations to between $465 million and $470 million—slightly higher than the previous forecast of $460-$470 million. Service revenue is also expected to grow around 5%, slightly below the earlier estimate of 4-6%.

Image Source: Zacks Investment Research

Challenges Ahead for Iridium Communications

Despite the forecasted growth, IRDM anticipates a decline in equipment sales for 2024, expected to fall back to pre-2022 levels. The company’s significant debt and increased competition are additional hurdles to overcome.

The current earnings estimate for Iridium stands at 80 cents per share, unchanged in the past 60 days. The stock currently holds a Zacks Rank #3 (Hold) and has climbed 7.4% in the last six months.

Image Source: Zacks Investment Research

Looking Ahead: Zacks Lists Top Stocks for 2025

Interested in early insights on the 10 top stocks set to shine in 2025? History shows these picks could perform remarkably well.

Since 2012, when Sheraz Mian took over the Zacks Top 10 Stocks portfolio until November 2024, these stocks gained +2,112.6%, significantly outpacing the S&P 500’s +475.6% gain. Sheraz is currently sifting through 4,400 companies to select the best 10 tickers to hold in 2025. Don’t miss your opportunity to get in on these selections, available January 2.

Be First to New Top 10 Stocks >>

Download 5 Stocks Set to Double and receive Zacks’ latest recommendations for free.

Iridium Communications Inc (IRDM): Free Stock Analysis Report

Gilat Satellite Networks Ltd. (GILT): Free Stock Analysis Report

Globalstar, Inc. (GSAT): Free Stock Analysis Report

For the full article on Zacks.com click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.