“`html

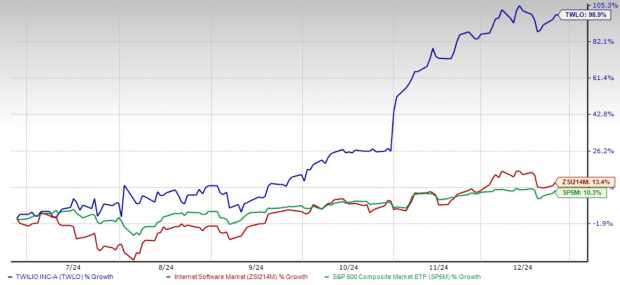

Twilio Inc. TWLO has emerged as a notable player in 2024, boasting a remarkable 98.9% increase in its stock price over the last six months. This impressive performance significantly outpaces the Zacks Internet – Software industry’s 13.4% rise and the S&P 500’s 10.3% growth during the same timeframe.

Strong Growth Over the Past Six Months

Image Source: Zacks Investment Research

Given this swift climb, many investors are questioning whether Twilio’s stock still presents a solid investment opportunity or if it has peaked. Let’s examine the factors supporting its ongoing appeal as a buy right now.

Valuation Signals Further Growth Potential

Despite its notable increase, Twilio is still attractively priced. The company’s forward 12-month price-to-sales (P/S) ratio stands at 3.6, which is significantly lower than the Zacks Computer and Technology sector average of 6.57. This indicates an undervaluation, making it an attractive option for value-oriented investors.

Image Source: Zacks Investment Research

Furthermore, the technical indicators for TWLO stock are trending positively. Currently trading above its 50-day moving average, Twilio reflects a strong short-term bullish trend that could further bolster its gains.

Positive Indicators from the 50-Day Moving Average

Image Source: Zacks Investment Research

Leadership in Customer Engagement and AI Technologies

Twilio has solidified its role as an industry leader in the customer engagement and communications sector. Its platform enables real-time, personalized interactions for businesses worldwide, setting it apart as a trailblazer in customer communication.

Key to this growth is Twilio’s strategic investment in artificial intelligence (AI). Tools like Twilio Verify and Voice Intelligence leverage AI to automate customer interactions, helping businesses streamline operations and enhance customer satisfaction. As AI-driven solutions gain traction, Twilio stands ready to capitalize.

Additionally, Twilio’s Segment business, which consolidates customer data from various channels, is increasingly popular. By providing richer insights and facilitating targeted marketing, Segment could substantially contribute to revenue growth. This data-centric focus sets Twilio apart in a congested marketplace and aligns with future trends in customer engagement.

Strong Financial Performance Reflects Corporate Resilience

Twilio’s recent financial results highlight its market strength. In Q3 2024, the company recorded a 10% year-over-year revenue increase, alongside a 76% surge in non-GAAP earnings per share (EPS). For the upcoming fourth quarter, management projects a revenue growth of 9.5%–10.5%, with non-GAAP EPS anticipated to rise by 10.5%–16.5%.

The robust balance sheet adds further value to Twilio. By the end of Q3 2024, it held $2.70 billion in cash and short-term marketable securities. Over the first three quarters, Twilio generated $608 million in operating cash flow, showcasing its financial health and efficiency.

Shareholder returns also shine brightly. Since launching its $3 billion share repurchase plan in February 2023, Twilio has repurchased $2.7 billion in shares. This action demonstrates the company’s confidence in its sustained performance.

Competitive Strength in a Tough Market Landscape

In a fiercely competitive environment, Twilio competes against major players like Cisco Systems CSCO, Microsoft MSFT, and Amazon AMZN, all of which provide similar communication solutions. Products such as Cisco’s Webex Connect, Microsoft’s Azure Communication Services, and Amazon’s AWS Communication Developer Services pose significant competition. Nevertheless, Twilio has successfully carved out its own niche.

The developer-friendly platform and extensive API ecosystem have made Twilio a go-to choice for companies seeking custom communication solutions. Its ability to provide highly customizable tools, combined with its global reach encompassing over 180 countries, offers Twilio a distinct competitive advantage. In contrast, rivals frequently provide more standardized or region-focused services.

Twilio’s API-first strategy has attracted a diverse range of clients, from startups to large enterprises, reinforcing its market position. While competitors benefit from broader cloud service options, Twilio’s specialization in communications allows for rapid innovation that directly meets client needs. This agility is vital as Twilio navigates the rapidly evolving customer engagement technology sector.

Conclusion: TWLO Stock Remains a Buy

Though Twilio’s remarkable surge may have caught many off guard, it is far from being overpriced. With an appealing valuation, strong financial backing, and innovative AI products, Twilio is poised to continue its growth trajectory.

The company’s leadership in customer engagement and ongoing investments in analytics and AI underscore its distinction in the tech industry. Investors looking to seize opportunities in a forward-thinking communications company should find Twilio to be an attractive option for investment.

TWLO stock currently holds a Zacks Rank #1 (Strong Buy) and has a Growth Score of A, based on key metrics from its financial reports. According to Zacks’ evaluation, stocks that combine a Zacks Rank #1 or #2 (Buy) with a Growth Score of A or B offer compelling investment prospects. You can see the complete list of today’s Zacks #1 Rank stocks here.

Free: 5 Stocks to Buy as Infrastructure Spending Soars

With trillions in federal funds designated for upgrading America’s infrastructure, significant investments will also flow into AI data centers, renewable energy, and beyond.

In this report, discover five unexpected stocks set to benefit the most from this ongoing investment boom.

Download the guide on profiting from the trillion-dollar infrastructure initiative absolutely free today.

Want the latest insights from Zacks Investment Research? Download 5 Stocks Set to Double today at no cost.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Twilio Inc. (TWLO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`