Zeta Global Surpasses Market in 2024: What Analysts Recommend

Zeta Global Holdings Corp ZETA has made notable gains in 2024, outpacing the NYSE Composite index, while many competitors struggle. Analysts are weighing in on whether to buy, sell, or hold the stock. Read on for their insights.

As of Thursday’s close, shares of Zeta were priced at $18.97 each, reflecting a 1.23% increase. This rise represents an impressive 125.83% gain this year, in contrast to the NYSE Composite’s 14.98% rise.

In comparison, its competitors have not fared well: Freshworks Inc FRSH is down 27.26%, and Temenos ADR TMSNY has declined by 21.52% this year.

Technical indicators show a short-term bearish trend for Zeta. The latest closing price of $18.97 falls below its eight-day and 50-day simple moving averages of $19.52 and $21.69, respectively. Moreover, it is also beneath the 200-day moving average of $24.42, suggesting a persistent downtrend. The relative strength index (RSI) stands at 38.38, indicating that the stock is moderately oversold, yet remains in a neutral zone.

Recent Mergers and Benefits for Zeta

Zeta Global can potentially gain from the recent acquisition of Interpublic by Omnicom. On December 9, co-founder and CEO David A. Steinberg expressed optimism regarding their relationships within the industry, stating, “We are proud of our extensive relationships with the top Holdcos, including both Omnicom and IPG, and believe that today’s announcement is a positive one for the industry and Zeta.” He indicated that they would monitor developments closely and lend support as needed.

During a recent investor summit, Zeta highlighted its potential to utilize the improved data infrastructure and financial strength from the merger, aiming to enhance AI-driven customer insights and scalability.

Strategic Acquisition to Boost Performance

The acquisition of LiveIntent by Zeta Global aims to enhance the Zeta Marketing Platform significantly. According to Steinberg’s statement on October 8, 2024, the addition of LiveIntent is expected to bring vast data assets, direct channel capabilities, and a strong publisher network, improving gross margins and transitioning revenue sources from agency clients to direct channels. This foundation positions Zeta to cater effectively to Omnicom’s merged entity.

Forecasting ZETA’s Revenue and Earnings

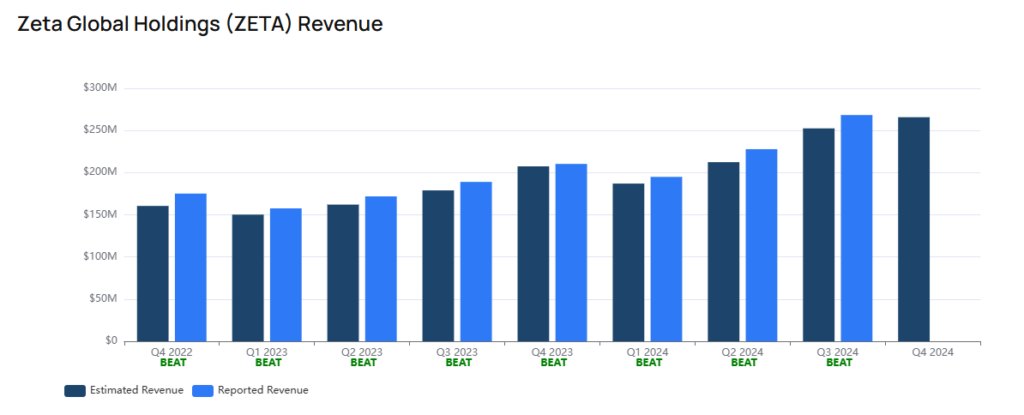

Benzinga anticipates fourth-quarter revenues for Zeta to reach approximately $265.73 million, reflecting a 26.34% increase from last year’s $210.32 million during the same quarter.

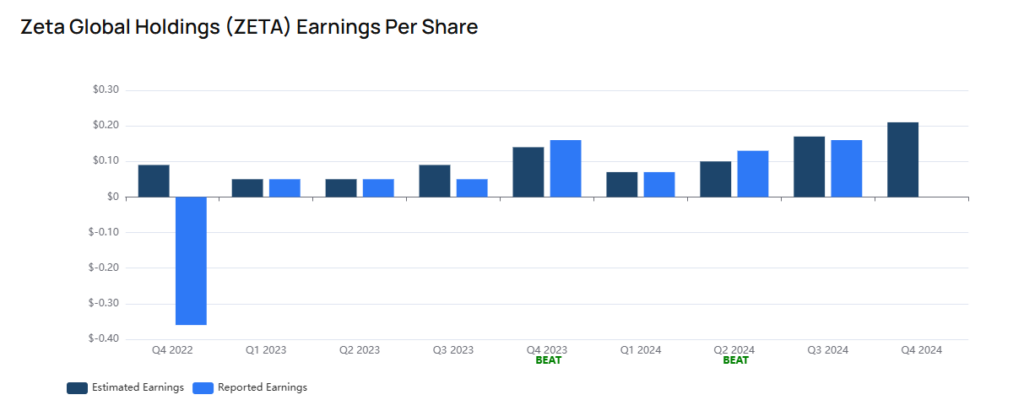

For earnings per share (EPS), the consensus estimate is set at 21 cents, up from 16 cents during the corresponding quarter last year, marking a 31.25% increase.

Zeta’s Financial Stability

The current ratio for Zeta stood at 3.319 at the end of the third quarter, well above the industry average of 2.16. This ratio indicates a solid capability to meet short-term obligations, representing a 67.7% increase from the prior quarter.

What Are Analysts Saying: Per Benzinga, the consensus rating for Zeta is ‘hold’, with a price target of $32.59 set by 17 analysts.

Craig-Hallum stands out with the highest price target of $45 and a ‘buy’ recommendation given on November 12, 2024. Analyst Jason Kreyer praised Zeta Global’s performance, linking it to the success of the LiveIntent acquisition and the potential for strong cross-selling. He is optimistic about further penetration within a customer base exceeding $100 billion.

On the other hand, Goldman Sachs analyst Gabriela Borges initiated coverage with a ‘neutral’ rating and set a price target of $30. She noted key risks such as potential erosion of proprietary data value and stricter privacy laws which might threaten Zeta’s data-driven model.

The lowest price target remains at $9.5, reflecting a ‘neutral’ stance from Credit Suisse, which adjusted its target down from $12 per share on August 4, 2022. Collectively, estimates from Goldman Sachs, RBC Capital, and Needham suggest a mean price target of $38.67, indicating a potential upside of 105.13% for Zeta.

Read Next:

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.