Palantir Technologies: A Cautionary Tale Amid 360% Surge

The stock of Palantir Technologies (NASDAQ: PLTR) has soared an incredible 360% in 2024, raising questions about the sustainability of such growth.

A Cautionary Perspective on Surging Stocks

While Palantir enjoys significant growth opportunities in artificial intelligence (AI) through its AIP platform, its underlying financial fundamentals may not justify the skyrocketing stock price.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider investing in today. See the 10 stocks »

Lessons from Microsoft’s Dot-Com Boom

Reflecting on the past, Microsoft (NASDAQ: MSFT) faced similar excitement over 20 years ago, leading to a significant stock price inflation. This came about during the rise of the internet in the late 1990s, which ultimately resulted in a market bubble that burst in early 2000.

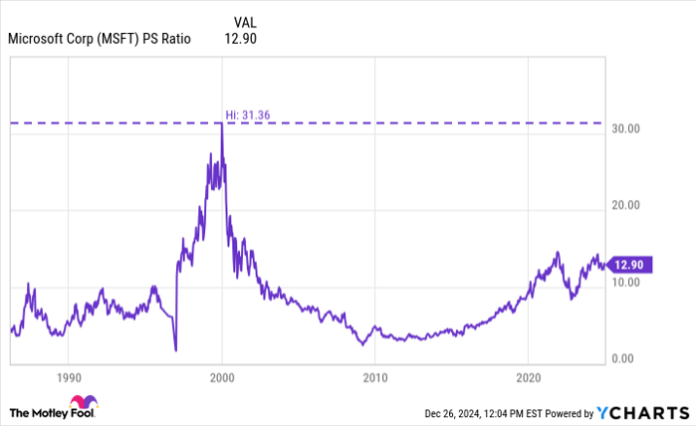

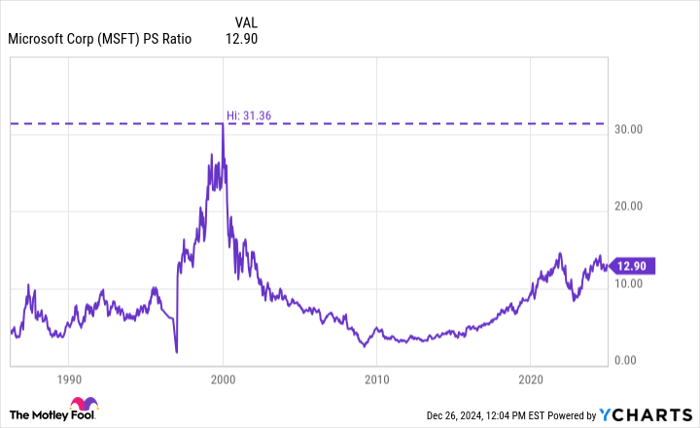

Microsoft’s stock flourished thanks to its successful Windows operating system. However, as excitement built, the company’s stock reached a price-to-sales (P/S) ratio that exceeded 31 at its peak:

MSFT PS Ratio data by YCharts

To put this in context, paying 31 times a company’s total revenue is notably expensive. An investor would need 31 years to recoup the initial investment through sales alone, disregarding revenue growth. This reflects poor investment returns, and emotions like greed often cloud such judgments.

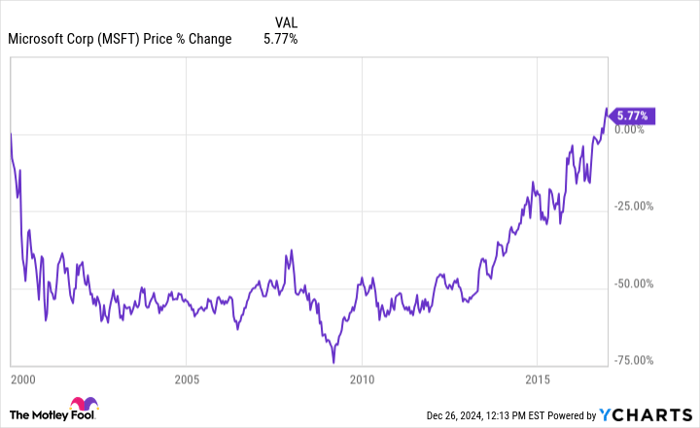

Despite Microsoft’s growth, buying shares at peak valuations was detrimental. The stock plummeted and took approximately 18 years to reach new highs, even though the company’s revenue grew by over 330% during that timeframe.

MSFT data by YCharts

Is Palantir Facing a Similar Fate?

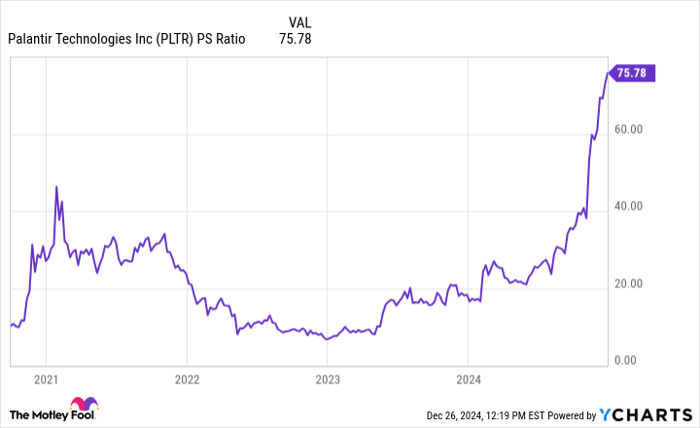

Today, parallels can be drawn between Palantir and early Microsoft. Palantir’s AIP platform has emerged as a leading solution for deploying AI applications. Yet, similar to the Microsoft scenario, enthusiasm has led the stock to inflated valuations.

Currently, Palantir’s P/S ratio has skyrocketed—more than double Microsoft’s peak ratio from the late 1990s:

PLTR PS Ratio data by YCharts

Palantir’s projected revenue for this year stands at approximately $2.8 billion, against a staggering market capitalization of $187 billion. This presents an even greater valuation challenge than the earlier bubble during low interest rates just a few years ago.

While timing the market remains elusive, history shows that price surges can’t last indefinitely. Eventually, rising valuations will correct themselves.

For investors who have jumped on board during Palantir’s rapid ascent, the coming adjustments in valuation could lead to a prolonged period of poor returns, even as the business continues to expand—much like investors experienced with Microsoft.

Given Palantir’s almost 400% gains this year, it stands out as a strong candidate for potential setbacks in 2025.

Explore New Investment Opportunities

If you’ve ever felt like you missed out on top-performing stocks, here’s a chance to reconsider your strategy.

Occasionally, analysts identify “Double Down” stock recommendations for companies anticipated to surge. If you’re concerned about missing your opportunity, now might be the perfect time to invest. Consider these impressive past returns:

- Nvidia: An investment of $1,000 when advised in 2009 would now be worth $362,841!*

- Apple: A $1,000 investment when recommended in 2008 would have grown to $49,054!*

- Netflix: Investing $1,000 at the doubling down alert in 2004 could yield $498,381!*

Currently, three exciting companies are on the “Double Down” alert list, and this may be a valuable opportunity not to be missed.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 23, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.