Analyst Targets Suggest Strong Upside for Invesco S&P SmallCap Momentum ETF

Through careful analysis of its underlying holdings, the Invesco S&P SmallCap Momentum ETF (Symbol: XSMO) reveals potential for growth based on analyst predictions.

The calculated implied analyst target price for XSMO stands at $75.69 per unit. This figure suggests an upside of 13.01%, given the ETF’s recent trading price of $66.98. Notable among XSMO’s underlying holdings are M/I Homes Inc (Symbol: MHO), Innovative Industrial Properties Inc (Symbol: IIPR), and CoreCivic Inc (Symbol: CXW). Each of these companies shows significant potential based on analysts’ target prices.

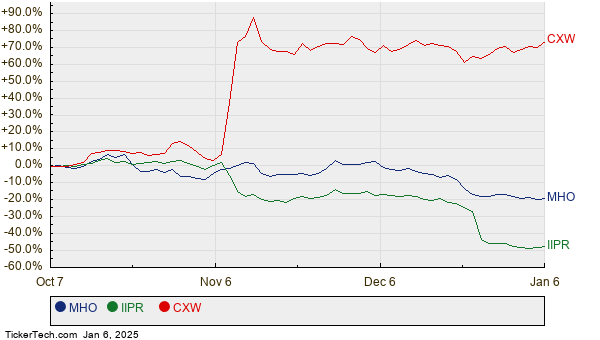

MHO is currently priced at $131.95 per share, with analysts setting an ambitious target of $197.50, representing a 49.68% increase. In a similar vein, IIPR’s recent share price of $68.06 translates to a potential upside of 36.06% if it reaches the average target price of $92.60. Finally, CXW, trading at $22.22, has an expected target of $28.75, yielding a potential increase of 29.39%. The following chart illustrates the 12-month performance history for these three companies:

Below is a summary table of the significant analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P SmallCap Momentum ETF | XSMO | $66.98 | $75.69 | 13.01% |

| M/I Homes Inc | MHO | $131.95 | $197.50 | 49.68% |

| Innovative Industrial Properties Inc | IIPR | $68.06 | $92.60 | 36.06% |

| CoreCivic Inc | CXW | $22.22 | $28.75 | 29.39% |

Investors may wonder whether these analyst targets are realistic or overly optimistic. Analysts often set high targets based on expected future growth, but there is the risk of downgrades if market conditions change. As with all investments, thorough research is advisable.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Advertising Dividend Stocks

JCOM Insider Buying

Funds Holding IQV

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.