STMicroelectronics Faces Major Stock Decline Amid Industry Challenges

STMicroelectronics STM shares have plunged 50.2% in 2024, in stark contrast to the Zacks Semiconductor-General industry and the Zacks Computer & Technology sector, which saw returns of 119% and 30.4%, respectively.

During this same period, STMicroelectronics lagged significantly behind competitors like NVIDIA NVDA and Amtech Systems ASYS, whose shares rose 171.1% and 29.7%, respectively, in 2024.

The dismal performance can be attributed to ongoing challenges in the automotive and industrial markets, negatively impacting STMicroelectronics’ financial health. A marked shift in consumer preferences, reflected in moves from fully battery electric vehicles (EVs) to hybrids and from premium to lower-cost models, is influencing customers’ decisions.

Despite these challenges, STMicroelectronics is diversifying its holdings across the industrial and automotive sectors to drive long-term growth.

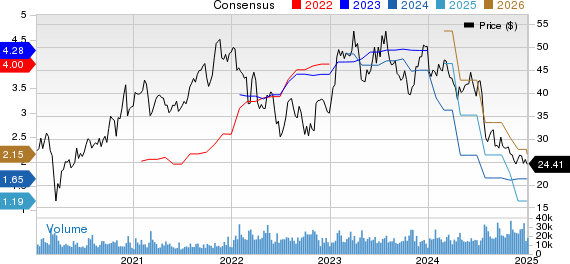

STMicroelectronics N.V. Price and Consensus

STMicroelectronics N.V. price-consensus-chart | STMicroelectronics N.V. Quote

Growth Driven by Industrial Market Initiatives

STMicroelectronics is strategically enhancing its industrial market portfolio, which is expected to stimulate long-term growth. Recently, the company introduced the EVLDRIVE101-HPD motor-drive reference design—a compact circular PCB measuring just 50mm in diameter. This design houses a 750W power stage, STM32G0 microcontroller, and a 3-phase gate driver, making it suitable for robots, drones, and various industrial machinery like pumps.

The company is also focused on improving its STM32 microcontrollers. The latest ultra-low-power STM32 MCUs can cut energy consumption by up to 50%, catering to industrial applications that utilize energy harvesting technologies, such as solar cells, which can operate without batteries.

Furthermore, STMicroelectronics unveiled a new product as part of its partnership with QUALCOMM Incorporated QCOM. The collaboration aims to develop IoT modules, leveraging QUALCOMM’s wireless solutions together with STM’s STM32 ecosystem.

The initial module, ST67W611M1, integrates a Qualcomm QCC743 multiprotocol connectivity SoC that is pre-loaded with Wi-Fi 6 and Bluetooth 5.3. This connectivity option is positioned for future expansion with the Matter protocol, allowing easy access to the STM32 portfolio.

Automotive Sector Enhances Long-Term Prospects

In a significant development, Ampere announced a multi-year agreement with STMicroelectronics and Renault Group for the supply of Silicon Carbide (SiC) power modules, set to commence in 2026. This partnership centers on the design of a powerbox for Ampere’s electric powertrain, blending EV expertise from Ampere with advanced power electronics from STMicroelectronics.

A recent innovation from STMicroelectronics is their fourth-generation STPOWER SiC MOSFET technology. This new generation excels in robustness, efficiency, and power density, tailored specifically for traction inverters vital to EV powertrains. The company has plans to advance its SiC technology further through 2027.

Unfavorable Q4 and FY24 Projections for STM

Looking ahead, STM forecasts midpoint revenues of $3.32 billion for the fourth quarter of 2024, which represents a 22.4% decline compared to the same period last year. The Zacks Consensus Estimate for revenues aligns with this projection. Gross margin is expected to hover around 38%, suffering a 400 basis point drop primarily due to product mix, pricing, and increased unused capacity charges. Earnings consensus is set at 35 cents per share, reflecting an 18.6% decrease, translating to a staggering 69.3% year-over-year decline.

For the entire year, revenues are estimated to reach $13.27 billion, signaling a 23.2% drop from the previous year. This decline is predominantly linked to reduced Automotive and Industrial revenues, moderately compensated by a slight uptick in Personal Electronics revenues. The earnings consensus remains at $1.65 per share, marking a possible 63% decrease year-over-year.

STMicroelectronics has expressed concerns over expectations for the automotive market’s growth declining in the second half of the year compared to the first half, paralleled by slower recovery rates in the Industrial sector.

Conclusion: A Cautious Stance on STM Stock

STMicroelectronics demonstrates potential for long-term growth through ongoing product innovations. However, investors should remain vigilant concerning short-term challenges, including inventory management, macroeconomic factors, and high valuation risks. Currently, the stock holds a Zacks Value Style Score of C, indicating concerns regarding its valuation.

With a Zacks Rank of #4 (Sell), current shareholders may want to consider selling their stock, while potential buyers might be wise to hold off for a more favorable entry point. For more insights, check out the complete list of today’s Zacks #1 Rank (Strong Buy) stocks.

Research Chief Reveals Top Stock Pick

From a pool of thousands of stocks, five experts at Zacks have identified their strongest candidates poised for significant growth, with one handpicked by Director of Research Sheraz Mian as the best bet for explosive increases.

This particular company, catering to millennial and Gen Z audiences, achieved nearly $1 billion in revenue last quarter. A recent price dip presents an advantageous opportunity for investors. While not every pick may rise, this stock has the potential to outperform earlier Zacks projections like Nano-X Imaging, which surged by +129.6% within just nine months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to access this free report.

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

STMicroelectronics N.V. (STM): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Amtech Systems, Inc. (ASYS): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.