Challenges Ahead for Intel as Competitors Surge

Key Players Gain Ground

Intel Corp’s INTC difficulties are proving to be more severe than initially thought. Competitors, including Nvidia Corp NVDA and others, along with former partners such as Microsoft Corp MSFT, are quickly moving to capture Intel’s crucial market share.

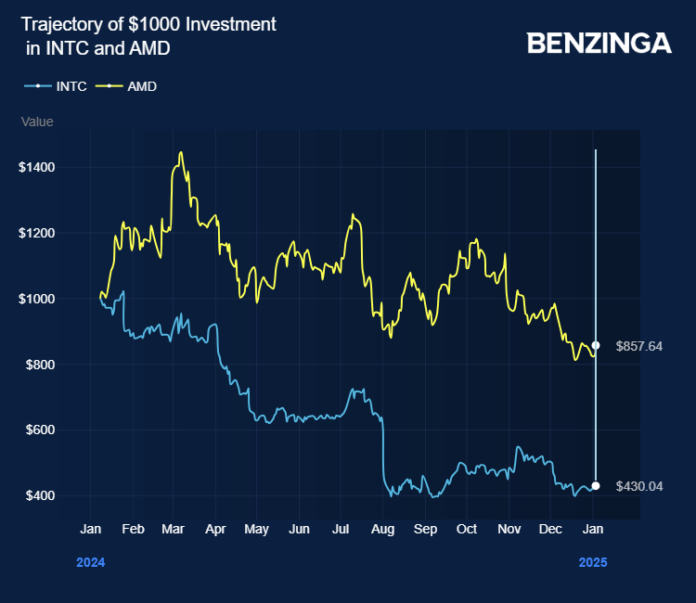

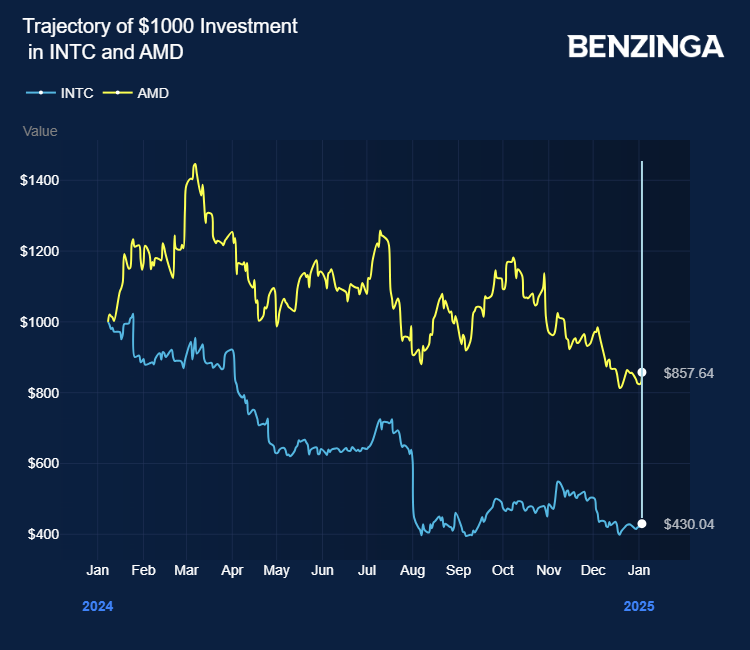

Massive Stock Decline

In the past year, Intel’s stock has dropped a staggering 58%. The Wall Street Journal highlighted insights from Doug O’Laughlin of SemiAnalysis, indicating that Intel has not successfully engaged with the rising demand for new computing technologies and diversified chip applications.

AMD’s Rise in Data Center Revenue

In a significant turn of events, Advanced Micro Devices, Inc AMD has overtaken Intel in data center chip revenue in the last quarter. This shift contrasts sharply with 2022, when Intel’s data center revenue was three times that of AMD.

Additional Insights: Nvidia and Intel Competition Threaten AMD’s Growth, Analyst Says

Advanced Chip Rivalry

AMD has positioned itself as a formidable adversary, effectively taking over Intel’s stronghold in the central processing unit (CPU) market. Compounding matters, Intel has struggled to penetrate growth areas like the data center chip and graphics processing unit markets, which have significantly benefited Nvidia, contributing to its $1 trillion valuation.

Market Share Overview

Interestingly, Intel maintains around 75% of the data center CPU market yet finds its revenue from these chips declining markedly. This raises critical questions about how the company manages its market presence amid shifting consumer preferences.

Tech Giants Bypass Intel

Tech leaders like Amazon.com Inc AMZN, Microsoft, and Alphabet Inc GOOG GOOGL are investing heavily in constructing new data centers while choosing to move away from Intel’s proprietary x86 architecture. These companies are increasingly opting for ARM Holdings plc’s ARM architecture along with their own chip designs.

Significant Shifts in PC Gaming

Intel has also lost critical ground in the PC gaming sector to AMD. An Intel spokeswoman told the Wall Street Journal that the company is concentrating on improving its product lineup, manufacturing, and foundry capabilities.

Leadership Changes at Intel

Intel is in search of a new CEO following the dismissal of long-standing leader Pat Gelsinger in December. His attempts at revitalizing the company to compete with Taiwan Semiconductor Manufacturing Co TSM were unable to convince the board of directors.

Intel’s Remaining Strength

Despite these challenges, Intel retains a strong legacy, due in large part to the dedicated software developed for its chips over the decades. This existing foundation may help stabilize its market share even in a tightening landscape.

Forecasts and Future Goals

Analysts predict that Intel’s revenue will hover around $55 billion in 2024, compared to Nvidia’s anticipated $60 billion. Nevertheless, Intel continues to hold a leading position in the desktop and notebook CPU market, as noted by Mercury Research.

Strategic Moves and Partnerships

Furthermore, AMD has recently engaged Intel to assist with the x86 ecosystem, and Intel has secured a chipmaking partnership with Amazon, leveraging its 18A technology. Looking forward, Intel plans to debut a new AI chip named Falcon Shores in 2025.

Market Outlook

Goldman Sachs analysts, including Toshiya Hari, have raised concerns over the competitive landscape and margin pressures facing Intel.

Investing in Intel

For those interested in Intel’s market performance, exposure can be gained through investment in the Vanguard S&P 500 ETF VOO and the SPDR S&P 500 SPY.

Current Stock Performance

Price Actions: Intel’s stock has decreased by 1.88%, trading at $20.17 in the latest updates on Monday.

Additional Reading:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs