Randstad N.V. Receives Upgrade from BNP PARIBAS EXANE

Positive Outlook as Price Targets Show Potential Upside

On January 5, 2025, BNP PARIBAS EXANE upgraded their rating for Randstad N.V. (OTCPK:RANJF) from Neutral to Outperform.

Price Forecast Indicates Potential 7.19% Growth

The average price target for Randstad N.V. as of July 4, 2024, stands at $54.02 per share. Estimates range from a low of $41.21 to a high of $96.67. This average suggests a possible 7.19% rise from the last closing price of $50.40 per share.

The company’s projected annual revenue is expected to be $27,904 million, reflecting a growth of 15.21%. Additionally, the anticipated annual non-GAAP EPS is forecasted at 4.46.

Fund Sentiment Overview

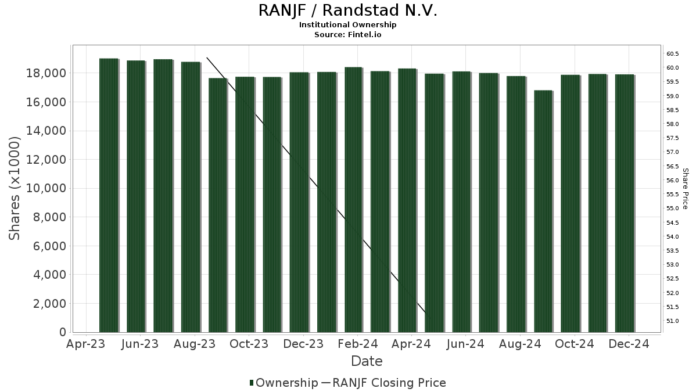

Currently, 252 funds or institutions have reported holding positions in Randstad N.V., showing a decrease of 6 owners or 2.33% from the previous quarter. The average portfolio weight dedicated to RANJF among all funds has increased by 1.65%, now standing at 0.20%. In total, institutional ownership dropped by 0.54% in the last three months, resulting in 17,789K shares held.

Insight from Other Shareholders

BBIEX – Bridge Builder International Equity Fund holds 1,533K shares, representing 0.88% of the company. This reflects a slight increase from 1,500K shares previously, marking a growth of 2.12%. The firm has upped its portfolio allocation in RANJF by 0.84% over the last quarter.

VGTSX – Vanguard Total International Stock Index Fund Investor Shares owns 1,485K shares, accounting for 0.85% of the company. This is an increase from 1,481K shares reported earlier, but the firm has reduced its allocation in RANJF by 5.14% over the last quarter.

VHGEX – Vanguard Global Equity Fund Investor Shares retains 934K shares with no change reported from the last quarter.

VTMGX – Vanguard Developed Markets Index Fund Admiral Shares increased its holding from 893K to 910K shares, now representing 0.52% ownership, which is an increase of 1.87% in its portfolio allocation over the past quarter.

IEFA – iShares Core MSCI EAFE ETF holds 699K shares (0.40% ownership), an increase from the previous 682K shares, but this firm has reduced its allocation in RANJF by 3.60% in the last quarter.

Fintel provides extensive investment research tailored for individual investors, traders, asset managers, and small hedge funds.

Our data encompasses a global view and presents fundamentals, analyst insights, ownership information, fund sentiment, options trading data, and more. Furthermore, our proprietary stock picks are based on advanced quantitative models designed to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.