Natural Gas Market: Will Winter 2023 Bring Another Surprise?

Hello, Reader.

Tom Yeung here with today’s Smart Money.

Natural gas traders faced uncertainty as winter approached in 2022.

The northern hemisphere was under the influence of La Niña, a climate pattern known for promoting colder temperatures in North America and Europe. Adding to the concern, winter storm Uri had severely impacted Texas just a year earlier.

Then came the Russian invasion of Ukraine in February, which cut off essential gas supplies to the European Union.

Such events contributed to growing fears among natural gas investors, leading to a spike in Henry Hub prices, a primary U.S. gas index, which soared over 100% to $8.81 amid concerns of potential shortages.

However, the anticipated crisis for winter 2022 did not occur.

Instead, the United States experienced an unusually mild winter, with cities like New York recording record-low snowfalls. Europe, too, enjoyed its second warmest winter, with Poland reaching a record 19°C (66.2°F) in January 2023. In fact, the Western Alps recorded its least snowfall since 1989, prompting some climatologists to speculate on the future of skiing in that region.

This unexpected turn of events led to a sharp drop in natural gas prices, adversely affecting energy companies’ stock values.

Winter 2023 also brought mild weather. Germany’s heating demand was 25% below average, while strong winds increased wind turbine productivity, further reducing the need for natural gas. As a result, Europe ended the season with a record 62% of its gas storage full, well above the typical 41% average.

Because of these developments, predictions of a colder-than-usual winter this year sound reminiscent of the “Boy Who Cried Wolf.”

In this edition, I will explore three key questions arising from this situation:

- Can gas markets be lucky three times in a row?

- Does this suggest that investing in natural gas is wise?

- And if so, where should one invest?

Let’s analyze these questions.

The Case for Investing in Natural Gas

Our candid answer to these questions is…

“We won’t know until March.”

The National Weather Service has indicated a 59% chance of a La Niña year, typically associated with colder temperatures in the Pacific Northwest and Western Europe. Currently, a severe polar vortex is impacting America and Europe due to a disrupted jet stream. In such situations, predicting a rough winter becomes more straightforward.

This uncertainty has reignited concerns within natural gas markets. Since mid-December, Henry Hub prices have climbed 20% to $3.50, while Dutch TTF Futures, representing the European market, increased by 22%.

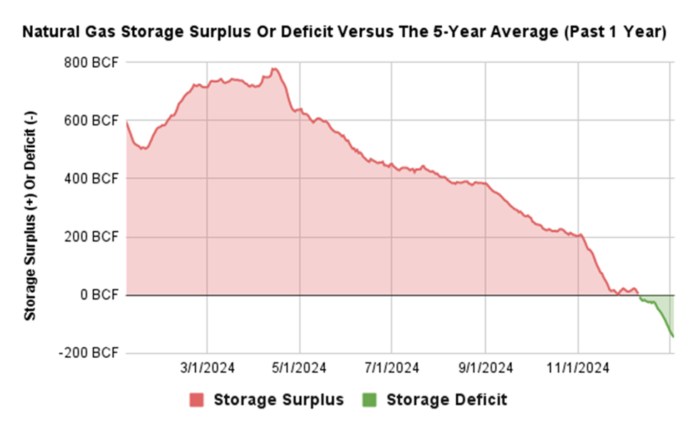

The risk of a natural gas shortage in Europe is also rising.

Bloomberg reports that cold weather is causing European natural gas storage to deplete at the fastest rate observed since 2018. Currently, storage is only 70% full compared to 86% at this time last year. Additionally, Ukraine’s recent closure of its last significant natural gas pipeline from Russia raises the odds of shortages.

These developments suggest optimism about natural gas prices. The fuel represents a fifth of total European energy consumption and nearly 40% of household heating needs.

Additionally, this situation bodes well for natural gas prices and the companies involved in trading it—particularly one company that Eric recommends to his members of Fry’s Investment Report.

This leading energy firm boasts a strong market position by:

- Holding a monopolistic share,

- Focusing on low-cost assets,

- And expanding into green energy initiatives.

Increased buying of natural gas in Europe will likely boost this stock. The company currently supplies 30% of Europe’s gas, and its shares previously surged by 100% above historical standards following the onset of the Ukraine crisis in 2022. Even a moderate rise in demand could elevate prices by 10% or more.

So, Eric advises investors to consider this blue-chip producer and purchase it below a specific price point.

To learn more about this influential natural gas company, you can click here to find out how to join Fry’s Investment Report today.

Additionally, tomorrow, Eric will issue special reports for paid-up members of Fry’s Investment Report. He’ll discuss the implications of humanity’s next significant breakthrough in artificial general intelligence (AGI) for investors and the steps to prepare for its imminent arrival.

Eric will share further insights on this exciting opportunity in the next edition of Smart Money. Be sure to watch your inbox.

Regards,

Thomas Yeung

Markets Analyst, InvestorPlace