Bitcoin ETFs Surge with Impressive Returns While Tech Giants Struggle

Bitcoin BTC/USD ETFs achieved remarkable gains of over 100% in 2024, outpacing the S&P 500 index by a factor of four. In contrast, the Roundhill Magnificent Seven ETF MAGS showed a more modest return of 65%, highlighting how even top technology stocks can sometimes fall behind the crypto market.

The SPDR S&P 500 ETF Trust SPY achieved a solid 24.4% gain over the past year but has recently seen a decline of 2.51% in the last month.

Chart created using Benzinga Pro

SPY currently trades below its eight-, 20-, and 50-day simple moving averages (SMAs), indicating a strongly bearish trend. However, its 200-day SMA at $555.48 offers some hope, as this reflects a potential bullish undertone against SPY’s current price of $589.49. While there may be short-term challenges ahead, buying pressure suggests that long-term gains could follow.

Read Also: Is SPY Losing Its Spark? The S&P 500’s Risk Conundrum

Bitcoin ETFs Excel amid Market Challenges

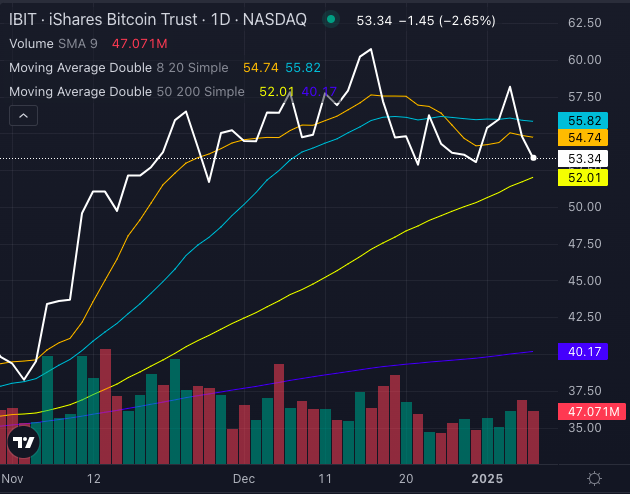

The iShares Bitcoin Trust ETF IBIT boasted a remarkable 100.3% return for 2024, outperforming traditional financial benchmarks.

Chart created using Benzinga Pro

Despite a slight decline of 2.54% last month, AWIT remains strong compared to its 200-day SMA at $40.17. However, it trades at $53.34, below the eight and 20-day SMAs, indicating a short-term bearish trend.

Bitcoin ETFs have clearly outperformed expectations, continuing to shine even with minor setbacks.

MAGS: Tech Stocks Show Stability but Stagnation

The Roundhill Magnificent Seven ETF MAGS registered a significant increase of 64.89% over the previous year. While this is a noteworthy achievement, it falls short of the returns seen by Bitcoin ETFs.

MAGS offers an equal-weight investment in the following Magnificent Seven stocks:

- Alphabet Inc GOOGL GOOG

- Amazon.com Inc AMZN

- Apple Inc AAPL

- Meta Platforms Inc META

- Microsoft Corp MSFT

- Nvidia Corp NVDA

- Tesla Inc TSLA.

Chart created using Benzinga Pro

Recently, MAGS has seen limited movement with only a 0.24% gain over the past month and some signs of short-term selling pressure. Its current price of $55.04 sits below the eight and 20-day SMAs but above the 50 and 200-day SMAs, showing a blend of caution and resilience in the tech sector.

With the cryptocurrency market thriving, traditional tech stocks such as SPY and MAGS are facing challenges. The question remains: will Bitcoin ETFs maintain their lead through 2025?

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs