IonQ Stock Soars and Dips: Is Now the Time to Buy?

IonQ (NYSE: IONQ) experienced a remarkable surge, closing 237% higher in 2024 compared to 2023, fueled by impressive revenue growth and a surge in investor interest. However, the stock has recently lost ground, dropping over 40% from its January peak, following skeptical remarks from a prominent tech CEO.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Despite this downturn, the sell-off may represent a strategic buying opportunity. Here’s why.

IonQ’s Growth Trajectory Remains Strong

Quantum computing, while not a recent concept, has struggled for commercial application in the past. The idea of leveraging the quantum properties of subatomic particles for rapid computation has garnered significant attention from researchers and tech enthusiasts alike.

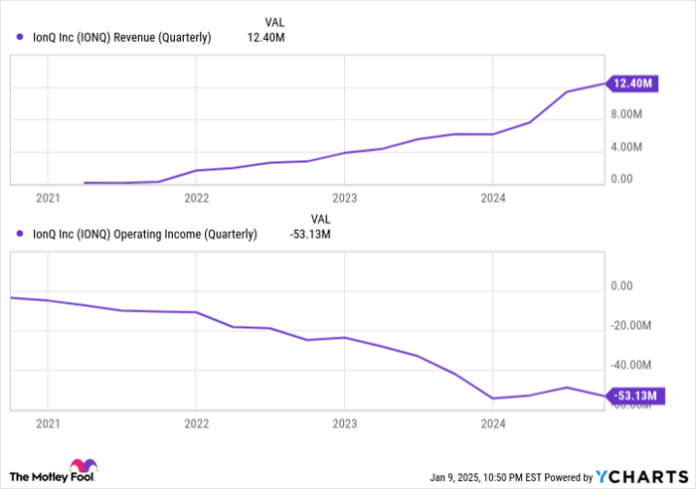

But IonQ changed the game, driving substantial growth in revenue-bearing bookings for its quantum-computing platforms throughout late 2022:

IONQ Revenue (Quarterly) data by YCharts.

Some notable clients have already begun testing IonQ’s technology, including the U.S. Air Force Research Laboratory and the Applied Research Laboratory for Intelligence and Security (ARLIS). IonQ has also partnered with Oak Ridge National Laboratory and NVIDIA (NASDAQ: NVDA). These partnerships demonstrate solid commercial interest, leading to increased investor confidence in the company’s future.

However, the momentum was abruptly halted. NVIDIA CEO Jensen Huang recently remarked that effective commercial applications for quantum computers might still be two decades away, causing several stocks, including IonQ, to plummet.

Investors Were Right to Be Optimistic

Are Huang’s claims justified?

There are still considerable hurdles to overcome in quantum computing, particularly in reducing error rates from about 1 per 1,000 operations to 1 per trillion. This disparity raises questions about when companies can effectively integrate quantum computing with traditional IT systems. There is also a pressing need for more software to bridge these technologies.

Nevertheless, IonQ is already making strides in the quantum computing space. Competitor D-Wave Quantum (NYSE: QBTS) is also developing practical applications, such as enabling Mastercard to combat fraud and streamline cross-border settlements. IonQ has successfully sold its added capacity in recent quarters, reflecting immediate commercial demand.

Considering that quantum computing is generating revenue before reaching full maturity, Huang’s 20-year estimate appears overly pessimistic. The current drop in IonQ shares could present an excellent entry point for investors.

Should You Consider Investing $1,000 in IonQ Now?

Before you decide to invest in IonQ, think about this:

The Motley Fool Stock Advisor analysts recently highlighted what they consider the 10 best stocks for investors today, and IonQ was not on that list. According to their analysis, these selected stocks could yield remarkable growth in the coming years.

For instance, if you had invested $1,000 in NVIDIA shortly after it made the list on April 15, 2005, your investment would have grown to $858,668!*

Stock Advisor offers investors a straightforward approach for success, providing guidance on portfolio building and regular updates with two new stock recommendations each month. Since its launch in 2002, the service has significantly outperformed the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

James Brumley has no positions in any stocks mentioned. The Motley Fool has positions in and recommends Mastercard and NVIDIA. The Motley Fool discloses various options and has a clear policy on disclosures.

The views expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.