Understanding Analyst Ratings: Is CleanSpark (CLSK) a Smart Investment?

Analyst recommendations play a pivotal role in investment decisions. Many investors closely watch media reports on rating changes made by brokerage analysts, but just how significant are these ratings?

To explore this further, we will examine the opinions of analysts on CleanSpark (CLSK) and discuss how you can effectively use brokerage recommendations in your investment strategy.

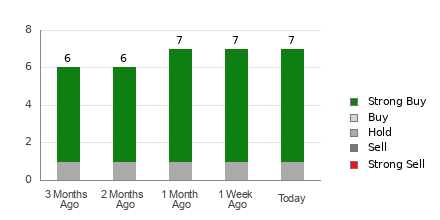

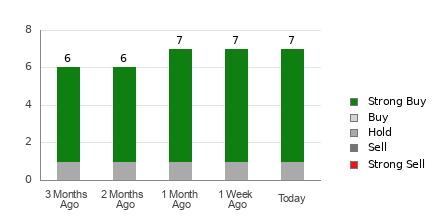

CleanSpark boasts an average brokerage recommendation (ABR) of 1.29 on a scale from 1 to 5, where 1 represents Strong Buy and 5 signifies Strong Sell. This average is determined from the recommendations of seven brokerage firms and indicates a leaning between Strong Buy and Buy. Notably, six out of these seven recommendations are categorized as Strong Buy, making up 85.7% of the total.

Current Trends in CLSK Brokerage Recommendations

Explore CleanSpark’s price target and stock forecast here>>>

While the ABR suggests a favorable outlook for buying CleanSpark, investing decisions should not rely exclusively on this figure. Research indicates that brokerage recommendations often fall short when it comes to identifying stocks with noteworthy price appreciation potential.

Why is this the case? Brokerage analysts frequently have vested interests in the companies they cover. As a result, they may exhibit a positive bias in their ratings. Our findings suggest that for every “Strong Sell,” there are five “Strong Buy” recommendations.

This discrepancy implies that the interests of brokerage firms do not always align with those of retail investors. Consequently, it is wise to use the ABR as a supplement to your own detailed research rather than as the sole driver of investment decisions.

To assist investors, our proprietary tool, the Zacks Rank, provides an audited track record of reliability. This ranking system categorizes stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell) based on quantitative analysis, making it a valuable resource for assessing near-term stock performance. Cross-referencing Zacks Rank with ABR can enhance investment choices.

Understanding the Differences: ABR vs. Zacks Rank

Even though both ABR and Zacks Rank utilize a 1-5 scale, they measure different aspects of stock performance.

The ABR is derived from the ratings provided by brokerage analysts and often has decimal values (e.g., 1.28). Conversely, Zacks Rank is based on earnings estimate revisions and is presented in whole numbers. Research consistently shows that brokerage analysts tend to be overly optimistic due to their firms’ vested interests, often leading to misleading ratings.

In contrast, Zacks Rank relies on earnings estimate revisions, which have been shown to correlate with stock price movements. The model applies Zacks Rank grades uniformly across all relevant stocks, ensuring a balanced assessment.

Additionally, ABR ratings can become outdated, while Zacks Rank promptly reflects changes in analysts’ earnings estimates, providing timely indications of potential price changes.

Is CleanSpark a Good Investment?

The consensus estimate for CleanSpark’s earnings has remained unchanged at $0.18 for the current year, based on recent earnings estimate revisions. This stability in analysts’ outlook suggests that CleanSpark may perform in line with market trends in the near future.

Due to the recent consensus and other earnings-related factors, CleanSpark has received a Zacks Rank #3 (Hold). You can check today’s Zacks Rank #1 (Strong Buy) stocks here>>>>.

Given the circumstances, it may be wise to approach the positive ABR for CleanSpark with caution.

Access Zacks’ Research for Just $1

This is not a gimmick.

A few years back, we offered our members a unique opportunity to access all our stock picks for 30 days at just $1, with no hidden fees. Many took advantage of this offer, while others hesitated, suspecting a catch. Our goal remains transparent: we want you to explore our expert services like Surprise Trader, Stocks Under $10, Technology Innovators, which achieved substantial gains in 2023 alone.

Get a Free Stock Analysis on CleanSpark, Inc. (CLSK)

For complete coverage of this article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.