Is It Time to Hit the Brakes on Tesla Investments?

Picture being Elon Musk, the CEO of Tesla.

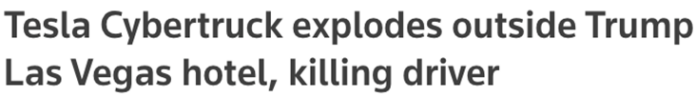

This isn’t about being the world’s richest person or having a direct line to the President-elect. Rather, it’s the day when reports surfaced about your flagship product malfunctioning and catching fire outside the Trump International Hotel in Las Vegas. Headlines like these from Reuters dominate the news.

For an electric car manufacturer, few issues can tarnish a reputation more than reports of vehicles catching fire.

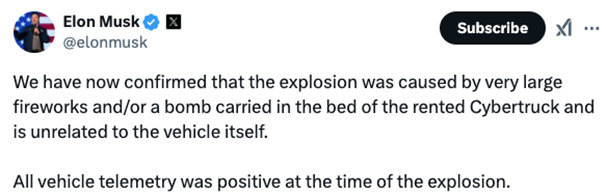

As always, Musk took to his social media platform, X, sharing facts about the incident and often revealing details even before law enforcement had finished their investigation.

In this type of scenario, any CEO would naturally be anxious about their company’s stock performance. Following Donald Trump’s election, Tesla’s stock experienced an impressive rise, buoyed by Musk’s close association with the new president.

Regardless of your opinion on Tesla or its CEO, the current climate indicates it’s not the best time to buy Tesla stock.

This perspective doesn’t stem from the recent explosion or any news involving Elon Musk. It also isn’t influenced by Tesla’s missed annual delivery targets.

A comprehensive analysis of Tesla’s stock history suggests that there are much more favorable moments for investing in Tesla.

Data backs this claim.

TradeSmith has conducted research over the past 15 years, pinpointing specific times when Tesla’s stock enters bullish market trends and when those periods end.

Now, this valuable information is available to all Trade Cycles subscribers.

Unveiling Seasonal Investing Insights

Regular readers might be familiar with our groundbreaking system from TradeSmith that monitors stock seasonality. This innovative technology identifies “green days”—periods when stocks are likely to trend upward—for around 5,000 different stocks.

At a special event on January 8, TradeSmith CEO Keith Kaplan discussed how this system could transform your investment strategies heading into 2025.

Revamping Investment: TradeSmith Introduces a Game-Changing Tool for Market Success

In a recent event, Keith Kaplan from TradeSmith revealed a new investment strategy that promises substantial returns.

Keith leads a team that has enabled over 72,000 individuals in 86 countries to manage personal assets totaling $30 billion. His algorithms aim to refine buy-and-sell decisions, consistently outperforming many top Wall Street managers in backtests.

The latest innovation from Keith is being touted as potentially the most lucrative opportunity TradeSmith has offered in its 20-year history.

At the event, he unveiled details about this new system, which claims an impressive 83% accuracy rate in backtesting. It highlights specific days when stocks are expected to see significant price increases.

This new offering features a user-friendly online calendar that identifies crucial dates for potential stock gains. The development is grounded in 33 years of market data analysis, incorporating 50,000 daily tests and insights drawn from leading hedge fund strategies.

Understanding the Impact of “Green Days”

Rather than imagining being a renowned entrepreneur like Elon Musk, consider a more relatable scenario.

Now, picture being almost certain that buying Tesla stock on May 19 would lead to a significant price jump.

Why select May 19? Historically, over the last 14 years, Tesla has seen an average increase of 24% over the following 55 days when purchased on this date.

This strategy can lead to an impressive annualized return of 161% by focusing on a single significant day each year.

TradeSmith’s system does not stop with Tesla; it reveals numerous similar opportunities across various stocks.

For example:

- Advanced Micro Devices (AMD): November 16 has an 86% success rate over the last 15 years.

- Lululemon (LULU): March 14 shows an 87% success rate annually for over a decade.

- Broadcom (AVGO): May 23 has a perfect 100% success rate historically.

- Lithia Motors (LAD): June 19 demonstrates a 93% success rate for gains.

This approach allows investors to focus on high-probability trades, significantly boosting their chances of success compared to average market performance.

A Portfolio Built for Superior Performance

Back tests from TradeSmith show that a $10,000 investment in the new model portfolio, created specifically using the seasonality tool, could have expanded to $85,700.

This results in a 99% outperformance against the S&P 500 on average.

On January 8, Keith Kaplan made a bold market forecast while explaining how the green day strategy aligns well with current market conditions.

For a limited time, you can access a replay of his presentation, where he discussed:

- Why traditional buy-and-hold investing could negatively impact your returns in 2025.

- How to double your portfolio using this innovative strategy.

- A complimentary stock recommendation designed to boost your returns.

TradeSmith’s new seasonality tool presents an exciting opportunity for investors to revolutionize their financial outlook. Be sure to seize the chance to view the January 8 event replay and take a crucial step towards enhancing your portfolio in 2025.

Regards,

Luis Hernandez,

Editor in Chief, InvestorPlace