Mid-Cap ETF Shows Promising Potential with Analyst Targets

In our analysis of ETFs at ETF Channel, we assessed the trading prices of holdings against the analysts’ average 12-month target projections. The findings for the iShares S&P Mid-Cap 400 Growth ETF (Symbol: IJK) indicate an implied target price of $104.96 per unit, based on its underlying assets.

Current Trading Price vs. Analyst Expectations

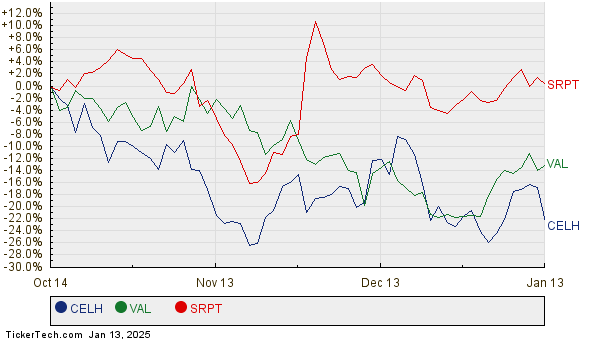

Currently, IJK trades at approximately $90.78 per unit, which suggests a potential upside of 15.62% as analysts anticipate better performance based on their target prices. Noteworthy among IJK’s holdings are Celsius Holdings Inc (Symbol: CELH), Valaris Ltd (Symbol: VAL), and Sarepta Therapeutics Inc (Symbol: SRPT). At its recent price of $26.76 per share, CELH has a target price of $43.76, indicating a significant upside of 63.54%. Valaris Ltd is similar; its recent price stands at $45.53, while analysts predict it could reach $68.53, marking a potential increase of 50.52%. Lastly, Sarepta Therapeutics Inc is priced at $124.79, but analysts expect it to rise to $185.84 per share—a potential jump of 48.92%. Below is a chart that illustrates the price trends of these companies over the last year:

Summary of Analyst Target Prices

The table below summarizes the key analyst target prices for the discussed companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares S&P Mid-Cap 400 Growth ETF | IJK | $90.78 | $104.96 | 15.62% |

| Celsius Holdings Inc | CELH | $26.76 | $43.76 | 63.54% |

| Valaris Ltd | VAL | $45.53 | $68.53 | 50.52% |

| Sarepta Therapeutics Inc | SRPT | $124.79 | $185.84 | 48.92% |

Analyzing Analyst Optimism

Questions remain about whether these price targets are justifiable or overly optimistic. Investors must consider if analysts have valid reasons for their projections or if they are lagging behind recent developments in the industry and within the companies themselves. A high target price relative to current trading can indicate optimism, but it may also signal potential downgrades if those targets reflect outdated information. Thorough research is essential for investors navigating these evaluations.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Related Information:

• Funds Holding TYBS

• Top Ten Hedge Funds Holding NKSH

• PTX Split History

The views and opinions expressed herein are those of the author and do not necessarily reflect the beliefs of Nasdaq, Inc.