CrowdStrike’s Strong Valuation Amidst Recent Challenges

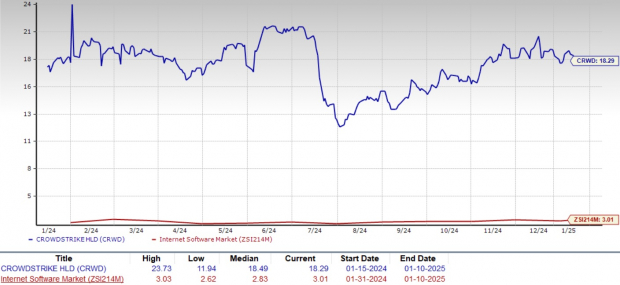

CrowdStrike Holdings, Inc. CRWD boasts a significant valuation, trading at a forward 12-month price-to-earnings (P/E) ratio of 81.68, which is notably higher than the Zacks Internet – Software industry average of 35.37. Additionally, its forward 12-month price-to-sales (P/S) ratio stands at 18.29, far surpassing the industry average of 3.01.

Understanding CrowdStrike’s P/S Valuation

Image Source: Zacks Investment Research

Surprisingly, CrowdStrike maintains this high valuation even after a 7.6% decline in its stock price over the last six months. During this same period, the broader industry has grown by 14.6%. Major competitors like Fortinet Inc. FTNT and CyberArk Software Ltd. CYBR have experienced considerable gains, rising 57.8% and 24.8%, respectively.

Revisiting Six-Month Price Performance

Image Source: Zacks Investment Research

Despite being outperformed, CrowdStrike’s high valuation indicates that investors remain confident in its long-term potential, despite current challenges.

Examining Recent Challenges for CrowdStrike

CrowdStrike faced scrutiny after a global IT outage in July 2024 linked to its Falcon platform. This situation disrupted numerous Microsoft Corporation MSFT Windows devices, leading to extended sales cycles and postponed agreements, which in turn affected the company’s annual recurring revenue (ARR) growth.

The company’s revenue growth has slowed down, with forecasts of around 20% for fiscal years 2025 and 2026, down from more than 50% in previous fiscal years.

Image Source: Zacks Investment Research

Recently, the Zacks Consensus Estimate for fiscal 2025’s earnings per share (EPS) has been slightly adjusted upwards to $3.74, while the estimate for fiscal 2026 EPS has decreased by 6 cents to $4.30.

Discover the latest EPS projections and surprises on Zacks Earnings Calendar.

In response to these setbacks, CrowdStrike is actively enhancing its platform and recovering trust. New features in Falcon’s automated recovery and security systems demonstrate its commitment to customer confidence and ongoing innovation.

CrowdStrike’s Fundamental Strengths Persist

CrowdStrike upholds its status as a leader in cybersecurity. Notably, in Q3 of fiscal 2025, the company secured several contracts worth eight figures, showcasing the strength of its sales pipeline. The Falcon platform, with over 28 modules for endpoint protection, identity security, and next-gen SIEM, remains central to its diverse offerings.

Additionally, the “Falcon Flex” subscription model stands out by allowing modular adoption of security features, simplifying procurement while enhancing customer retention. This approach fosters a stable revenue flow, positioning CrowdStrike as a reliable partner in today’s complicated cybersecurity landscape.

Final Thoughts: A Hold Recommendation for CrowdStrike Stock

Although CrowdStrike encounters short-term challenges, including high valuation metrics and slowed growth, its long-term outlook remains promising. The company’s dedication to innovation, strong customer relationships, and diverse product lineup lay a robust foundation for future growth.

For investors, keeping CrowdStrike stock appears practical as the company navigates these difficulties while remaining a strong player in cybersecurity. Currently, CrowdStrike holds a Zacks Rank #3 (Hold).

Discover the Top 7 Stocks for the Upcoming Month

Experts have identified 7 exceptional stocks from a list of 220 Zacks Rank #1 Strong Buys, labeling these stocks as “Most Likely for Early Price Pops.”

Since 1988, the full list has outperformed the market by more than double, with an average annual gain of +24.1%. Consider giving these selected stocks your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download our report on the 7 Best Stocks for the Next 30 Days. Click to access this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Fortinet, Inc. (FTNT): Free Stock Analysis Report

CyberArk Software Ltd. (CYBR): Free Stock Analysis Report

CrowdStrike (CRWD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.