Nvidia vs. Microsoft: The Race for AI Leadership

Nvidia (NASDAQ: NVDA) has emerged as the second-largest company globally, achieving a market capitalization of $3.3 trillion. This remarkable growth is largely driven by the soaring demand for artificial intelligence (AI) chips, vital for the chipmaker’s current success.

The company’s impressive ascent can be traced back to its staggering increase in revenue and earnings over the last few years, due to its commanding presence in the AI chip market. Reports indicate that Nvidia holds approximately 80% to 85% of this lucrative sector.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy currently. See the 10 stocks »

Furthermore, Nvidia is exploring new opportunities in various sectors to ensure continued growth over the next decade.

Nvidia: Preparing for a Bright Future

Nvidia stands poised to sustain its growth trajectory, as the AI chip market is projected to reach $621 billion in revenue by 2032, according to market research provider SNS Insider. However, increasing competition in the AI chip arena and major cloud companies’ efforts to reduce their dependence on Nvidia may present future challenges.

Regardless, Nvidia aims to maintain its leadership in the AI chip market. The company is actively enhancing its supply chain and technological edge. Its expansion into fields such as enterprise software, AI agents, autonomous vehicles, and cloud gaming suggests that Nvidia has access to a market exceeding $1 trillion.

Projected results for fiscal year 2025 indicate Nvidia could report revenue of $129 billion, marking a significant 112% increase from the prior year. This vast potential suggests that plenty of growth opportunities remain for the chipmaker. However, another company, Microsoft (NASDAQ: MSFT), may challenge Nvidia’s current dominance in the next decade due to its established presence in various high-value markets.

Microsoft: A Strong Contender in AI

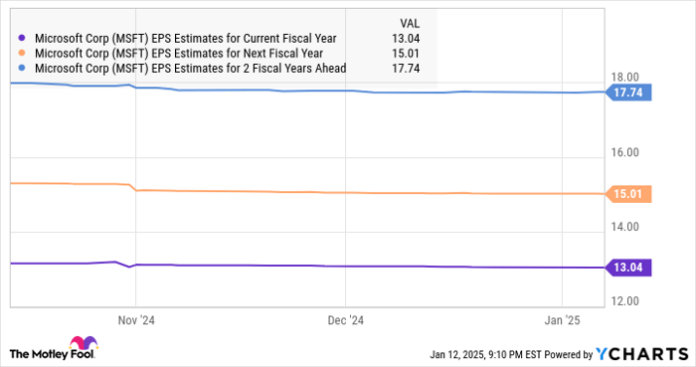

Microsoft ranks as the third-largest company worldwide, with a market cap of $3.11 trillion. While its growth rate currently lags behind Nvidia’s, Microsoft’s revenue for fiscal year 2025 is expected to increase by 13% to $278.6 billion, according to consensus estimates, with earnings projected to rise 10.5% to $13.04 per share.

Analysts anticipate that Microsoft’s growth rate will gain momentum in the coming years, fueled by significant investments in AI infrastructure. This strategy aims to create durable assets that support profitability over the next 15 years and beyond. Although there are concerns about when these AI investments will pay off, those savvy about market trends recognize Microsoft operates across multiple AI-focused segments poised for substantial growth in the next decade.

For instance, Goldman Sachs estimates that the global cloud computing market could generate $2 trillion in revenue by 2030, driven by generative AI offerings. The firm predicts a compound annual growth rate of 22% for this market from 2024 to 2030. If cloud spending increases by even 10% annually over the next five years, the market’s size could surpass $3.2 trillion.

With a 20% share, Microsoft is the second-largest player in the cloud computing market, gaining momentum thanks to AI. The company’s management noted that AI contributed 12 percentage points to the growth of its Azure cloud service last quarter.

If Microsoft captures a 25% market share in a decade, it could potentially generate $800 billion in revenue from cloud services alone, significantly up from the $105 billion generated by its Intelligent Cloud business in fiscal 2024.

Another promising area is the market for AI agents, which Roots Analysis estimates could see 40% annual growth through 2035, yielding nearly $217 billion annually. This sector is expected to blossom as agentic AI systems are adopted for their ability to solve complex problems autonomously. Microsoft is already leveraging this potential with its Copilot generative AI assistant, available to enterprise and individual customers alike. As of October 2024, the service had nearly 70% adoption among Fortune 500 companies, with 28 million active users reported.

Microsoft’s Copilot Studio aims to expand its offerings further, allowing users to create and manage agents easily. The company is also launching autonomous agents for various professional sectors and plans to introduce even more in the future. With a global market share of over 67% in operating systems, Microsoft has a robust user base to drive Copilot’s growth.

All these factors suggest that Microsoft could emerge as a larger company than Nvidia over the next decade. By potentially increasing its share in the cloud computing market and capitalizing on emerging AI opportunities, Microsoft could sustain significant growth. Furthermore, with Microsoft trading at 35 times earnings compared to Nvidia’s 54 times, it presents an appealing long-term investment opportunity.

Is Microsoft a Smart Investment Right Now?

Before making an investment in Microsoft, it’s worth considering the following:

The Motley Fool Stock Advisor analyst team has recently highlighted the 10 best stocks for investors to consider, and Microsoft was not included this time. The selected stocks have the potential for substantial returns in the coming years.

For context, when Nvidia was recommended on April 15, 2005, investing $1,000 would have grown to $807,495!*

Stock Advisor offers a straightforward approach for investors, including guidance on portfolio management, regular analyst updates, and two new stock picks every month. Since 2002, Stock Advisor has delivered returns that have more than quadrupled the S&P 500 performance.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.