Chevron Sets Ambitious Free Cash Flow Goals Amid Market Challenges

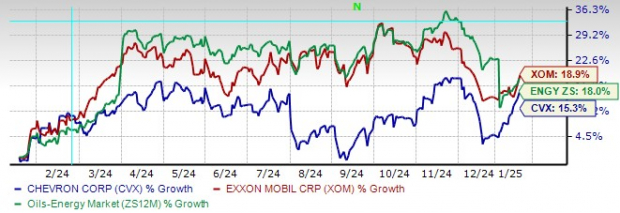

Chevron Corporation (CVX) is targeting $6-$8 billion in free cash flow growth for the upcoming year, driven by strategic plans and improved operations. The company expects significant growth to come from its expansion in the Gulf of Mexico, the integration of Hess Corporation’s HES assets, and continuous cost management. However, Chevron’s stock has lagged compared to ExxonMobil (XOM) and the wider Oil/Energy sector over the past year. This, combined with decreasing earnings forecasts for 2024 and 2025, makes Chevron’s investment appeal complicated.

Chevron vs. ExxonMobil: Stock Performance Over the Last Year

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Chevron’s Growth Drivers

Expansion in the Gulf of Mexico and Permian Basin: Chevron plans to boost Gulf of Mexico production from 200,000 barrels of oil equivalent per day (BOE/d) in 2023 to 300,000 BOE/d by 2026. Important projects like the Whale facility, which is set to reach a peak of 75,000 BOE/d, and the Anchor project are already operational. These high-margin ventures complement the ongoing growth in the Permian Basin, where 80% of the land has low or no royalty expenses, which will help cash flow.

Acquisition of Hess Corporation: Chevron is in the process of acquiring Hess for $53 billion, a strategic move that focuses on long-term growth, particularly through Hess’ promising Guyana assets. Once the acquisition is complete, it should significantly enhance Chevron’s upstream production and cash flow. However, complications related to arbitration with ExxonMobil and China’s CNOOC concerning Guyana’s assets add an element of risk with a ruling anticipated by mid-2025.

Financial Stability and Shareholder Returns

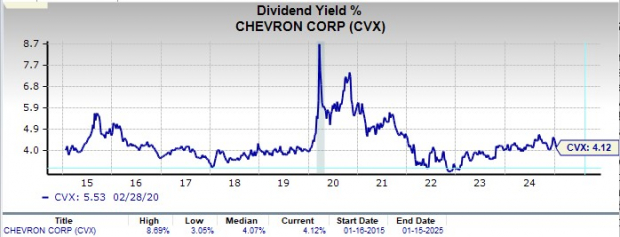

Chevron shows a commitment to solid capital management, evidenced by its capex forecast of $14.5-$15.5 billion for 2025. This approach is part of its strategy to ensure financial stability. The company’s strong balance sheet supports a robust return to shareholders, having delivered a record $7.7 billion in Q3 2024 through dividends and stock buybacks. With a 4.1% dividend yield that exceeds its 10-year average, Chevron continues to appeal to income-focused investors.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Despite its strengths as an oil powerhouse, Chevron faces several key risks, such as:

Challenges Ahead for Chevron

Falling Earnings Predictions and Market Performance: Recent reductions in earnings forecasts for 2024 and 2025 stem from reduced downstream margins and fluctuating commodity prices. Additionally, Chevron’s 15% stock price gain over the last year falls short compared to its competitors, raising concerns about its market position.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Risks Related to Hess Merger: While the acquisition of Hess holds significant potential, it may face delays due to ongoing arbitration regarding Guyana’s assets. A negative outcome could hinder Chevron’s ability to fully benefit from these promising projects.

Cost Management Challenges: Chevron aims to save $2-$3 billion by 2026 through cost efficiency initiatives. However, the recent $6.5 billion sale of its interests in the Athabasca Oil Sands Project and Duvernay Shale will decrease near-term production by 84,000 BOE/d. Although these divestments are part of a strategy to optimize the portfolio, they could increase costs and negatively affect revenue in the short term.

Conclusion: A Hold Rating for Chevron

Chevron’s focus on high-return projects and cautious capital management underpins its potential for growth. The company’s Gulf of Mexico expansion, Permian growth, and Hess acquisition serve as key opportunities for increased cash flow and shareholder value. Nevertheless, issues like falling earnings estimates, integration uncertainties, and production declines from asset sales pose risks that temper the bullish outlook.

Considering all these aspects, Chevron stock currently appears fairly valued. While the company’s solid fundamentals and dependable dividend yield provide some security, current challenges suggest a more careful approach may be necessary. Investors might find more lucrative opportunities in other areas of the energy sector. Presently, CVX holds a Zacks Rank #3 (Hold).

For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Zacks Highlights Top Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which has surged more than +800% since our initial recommendation. While NVIDIA remains strong, our leading chip stock shows greater potential for growth.

Featuring strong earnings and a growing customer base, this company is well-positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor market is expected to increase from $452 billion in 2021 to $803 billion by 2028.

Discover This Stock for Free >>

Get a Free Stock Analysis Report on Chevron Corporation (CVX)

Get a Free Stock Analysis Report on Exxon Mobil Corporation (XOM)

Get a Free Stock Analysis Report on Hess Corporation (HES)

Read this article on Zacks.com

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.