Strong Signs for IPO Growth: U.S. and Stockholm Show Promising Trends for 2024

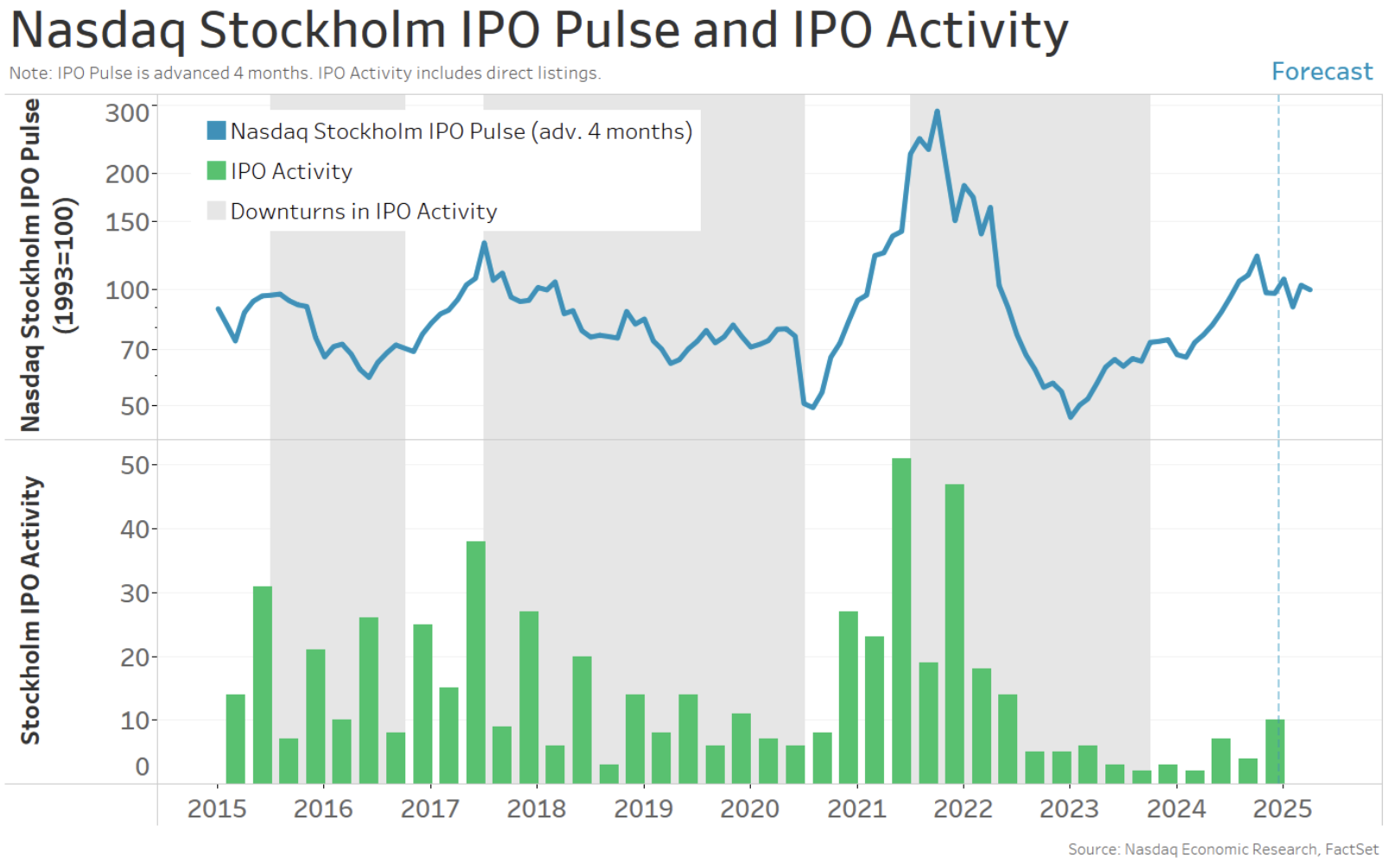

When Nasdaq first launched the IPO Pulse last year, we anticipated a positive trend for U.S. IPO activity as we approached 2024. Later, the launch of the Nasdaq Stockholm IPO Pulse in September indicated a similar optimistic outlook for Sweden’s IPO market.

Resurgence in IPO Activity for the U.S. and Stockholm in 2024

Our predictions were corroborated as both regions experienced a recovery in IPO activities in 2024.

Data from Nasdaq indicates that the U.S. recorded 179 non-SPAC IPOs in 2024, the highest number since 2021, marking a 40% increase from 127 in 2023. The total capital raised (excluding SPACs) also surged over 50% to reach $30 billion, the largest amount since 2021.

Additionally, the fourth quarter featured a remarkable peak, with 53 non-SPAC IPOs—the highest quarterly figure in three years.

Sweden experienced an impressive 60% increase in IPOs, reporting 23 in 2024, up from 14 in 2023. Similarly, Q4 concluded robustly with 10 IPOs, the most seen in 2½ years.

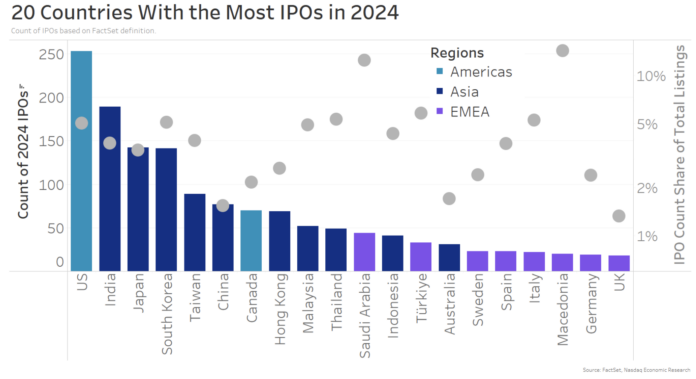

U.S. Dominates Global IPO Market; Some Regions Lag

The U.S. not only performed well compared to its recent history but also led the global IPO landscape. FactSet data reveals that the U.S. hosted over 250 IPOs in 2024.

Asian markets seized 12 of the top 14 spots following the U.S. on the list of global IPO activity. Europe’s markets filled in the remaining spots, but notable economies like France and the Netherlands failed to make the top 20.

Chart 1: U.S. Leads Global IPO Activity in 2024, with Asian Markets Following

Comparing IPO numbers across countries can be misleading due to the varying sizes of their economies and markets. A more equitable assessment involves examining the percentage increase in IPO listings. This method shows that 11 countries, including the U.S. with a 5% increase, fell into the 4%-6% range, while Macedonia (14%) and Saudi Arabia (12%) led the pack. In contrast, China, Australia, and the U.K. recorded the lowest gains.

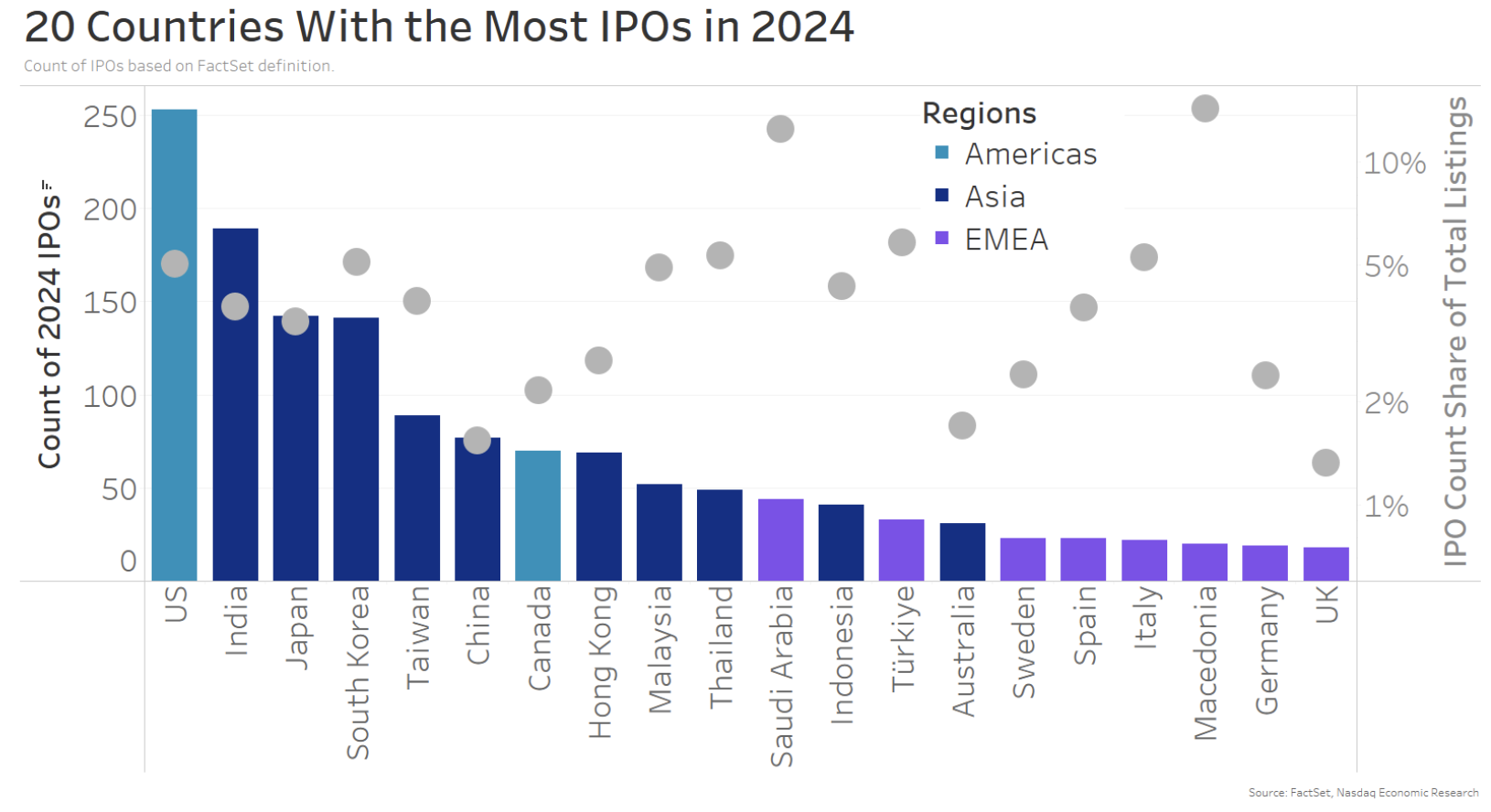

Nasdaq IPO Pulse Signals Continued Growth in U.S. IPOs

Although 2024 marked the highest level of U.S. IPOs in three years, some experts are optimistic about an even better 2025. Currently, the Nasdaq IPO Pulse suggests favorable conditions for ongoing IPO activity.

While there was a slight decline in the IPO Pulse in December, it remains near the 3¼-year high from October, indicating a positive outlook for U.S. IPOs into mid-2025.

Chart 2: The Nasdaq IPO Pulse Indicates Continued Activity into Mid-2025

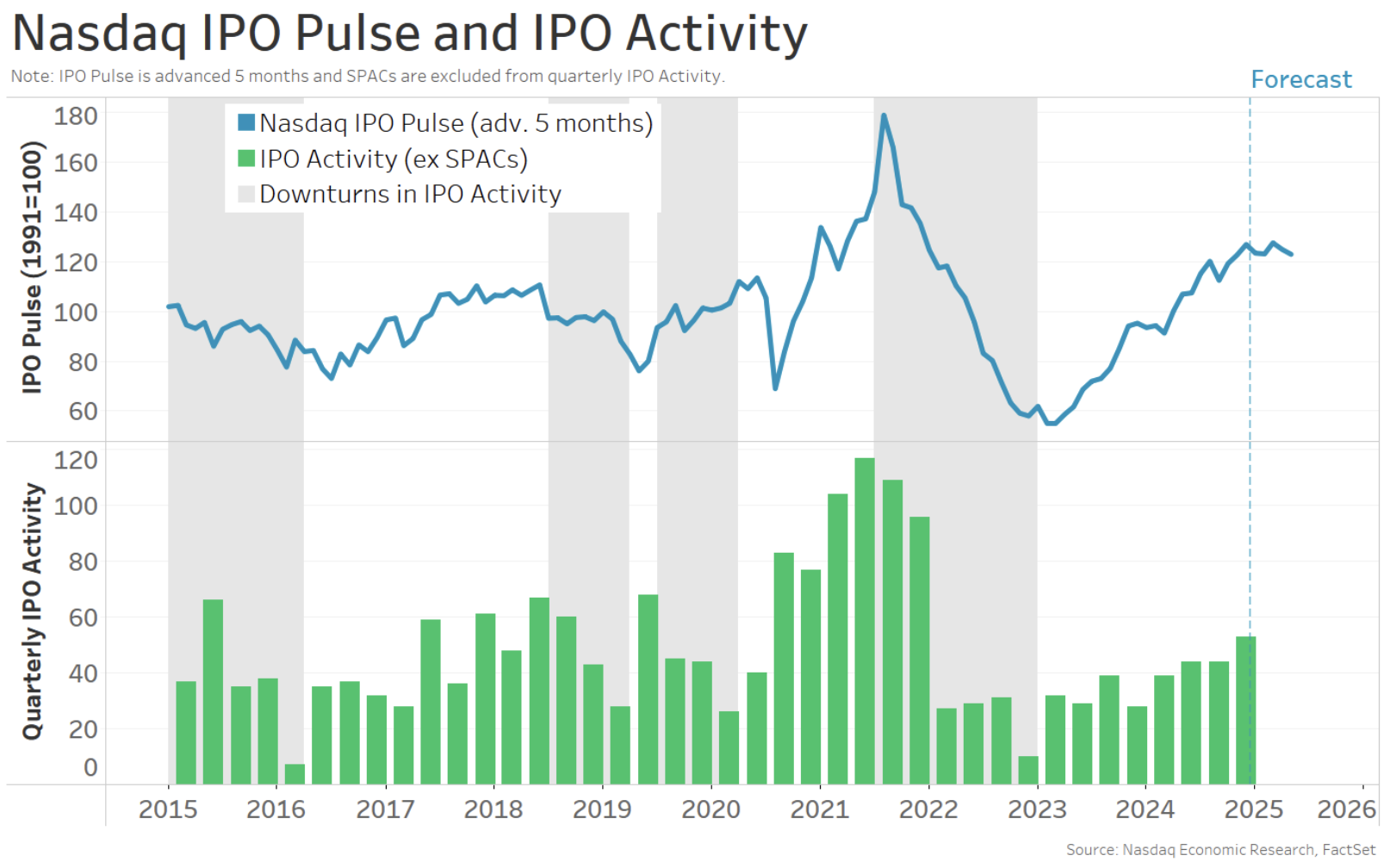

Nasdaq Stockholm IPO Pulse Shows Hopeful Stability

In Stockholm, although the IPO Pulse’s positive trend has slightly waned, it does not yet suggest a downturn.

The Nasdaq Stockholm IPO Pulse had a notable upswing during the first half of 2024, reaching a 2½-year peak in June. While it has since decreased, it remains above the eight-month low observed in October.

Chart 3: Stockholm IPO Pulse Continues Uptrend into Spring

To assess whether the current trend signals an impending downturn, we can compare it with historical downturns. Most past downturns accurately forecasted declines in IPO activity, while a few were false alarms.

Current evidence suggests that the recent decline resembles earlier false alarms, implying the Stockholm IPO Pulse still points toward continuing activity. An upcoming update in April will provide further clarity regarding the potential for a near-term downturn.

U.S. and Stockholm IPO Trends Likely to Persist into Q2 2025

Overall, 2024 marked a recovery in IPO activity for both the U.S. and Stockholm. Based on our IPO Pulses, we project that this positive trend will continue into the mid-year period, particularly in the U.S.

Of course, market conditions can shift over the year, and we will continue to monitor our Nasdaq IPO Pulses each quarter to assess whether the upward trend will extend beyond mid-year or if a change in direction is on the horizon.