The Road Ahead: Tesla’s Success and Emerging EV Stocks to Watch

It’s clear now that Tesla (NASDAQ: TSLA) has become a dominant player in the electric vehicle (EV) market. The automaker has not only managed to design and produce quality cars but also made owning an electric vehicle exciting and even trendy. For those who might feel they missed out on Tesla’s impressive growth, there are still opportunities to consider with two EV stocks that show promising potential based on their price-to-sales (P/S) ratios. Let’s explore further.

Understanding Price-to-Sales Ratio

The P/S ratio reveals how much investors are willing to pay for every dollar of a company’s sales. This metric is especially insightful when comparing companies that are either unprofitable or still in their early stages of growth.

Stay Updated! Get the latest financial news delivered to your inbox every market day. Sign Up For Free »

Among the EV stocks worth noting are Nio (NYSE: NIO) and Rivian (NASDAQ: RIVN).

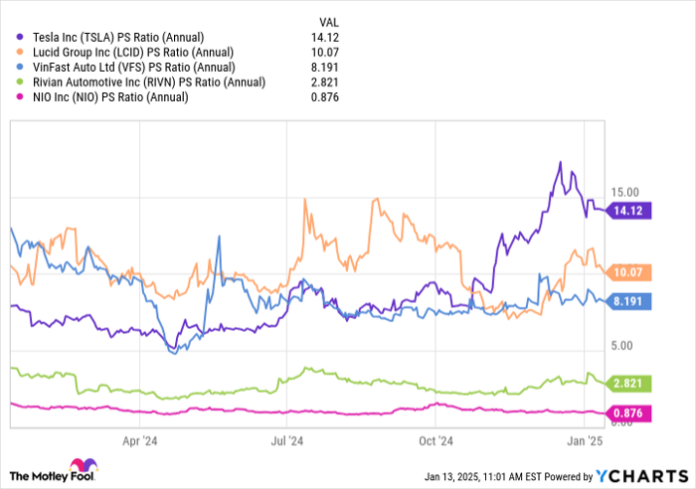

TSLA PS Ratio (Annual) data by YCharts

The chart indicates that Tesla’s success has allowed its P/S ratio to soar to 14 times sales. This reflects the company’s achievements and profitability, making it easier for investors to justify higher valuations. Many investors believe in Tesla’s upcoming robotaxi and artificial intelligence developments, further buoying its stock.

Nio and Rivian display much room for growth in their valuations. Meanwhile, VinFast Auto has started to gain traction, albeit with a largely untested market base outside of Vietnam.

Key Developments on the Horizon

Nio recently announced the launch of two new brands, Onvo and Firefly, which began production in September and December, respectively. These additions are expected to enhance Nio’s sales, projecting company deliveries to double in 2025 to about 440,000 units. If Nio can manage to address concerns related to the ongoing price war in China, it could improve its valuation and stock price.

However, Rivian faces a more challenging path. With no new vehicle launches planned for 2025, the company may struggle to attract investors’ interest. Nonetheless, a crucial aspect for Rivian is its gross profit margins. While production challenges have hindered progress, management is optimistic about turning a profit during the fourth quarter.

As illustrated in the graphic below, Rivian has seen fluctuations in gross profit, but it has shown an upward trend.

Data source: Rivian SEC filings. Image source: Author.

Achieving positive gross profit would be a significant turning point for Rivian, instilling confidence in investors. Despite facing difficulties, Rivian has streamlined its R1 models, reducing costs and refining features.

Interpreting Current Valuations

The relatively low valuations for both Rivian and Nio can be attributed to the absence of immediate catalysts for 2025 and uncertainties within the EV market, particularly with a change in administration potentially affecting political support for the industry. Nio’s challenges in the cutthroat Chinese market, which has dampened its financial performance, also contribute.

Nonetheless, both companies hold promise for immediate upside if they can convince investors of their long-term viability. Growth in gross profits for Rivian or increased deliveries for Nio could quickly narrow the gap in their P/S ratios with competitors, leading to stock price increases.

Should You Consider Investing in Rivian Automotive?

Before making a decision about investing in Rivian Automotive, it’s essential to weigh the following:

The Motley Fool Stock Advisor analyst team has named what they consider the 10 best stocks to buy now, and Rivian Automotive is not included on that list. The selected stocks are projected to generate significant returns in the coming years.

Take, for instance, Nvidia, which made it onto the list on April 15, 2005… if you had invested $1,000 at that time, it would now be worth $843,960!

The Stock Advisor service offers a structured approach to investing, providing guidance on portfolio building, regular market updates, and monthly stock recommendations. Since 2002, the service has more than quadrupled the return of the S&P 500*.

View the 10 recommended stocks »

*Stock Advisor returns as of January 13, 2025

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Tesla. Please see the Motley Fool’s disclosure policy for more details.

The views expressed in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.