Exploring the Wealth of the Magnificent Seven: Technology Giants Drive Market Growth

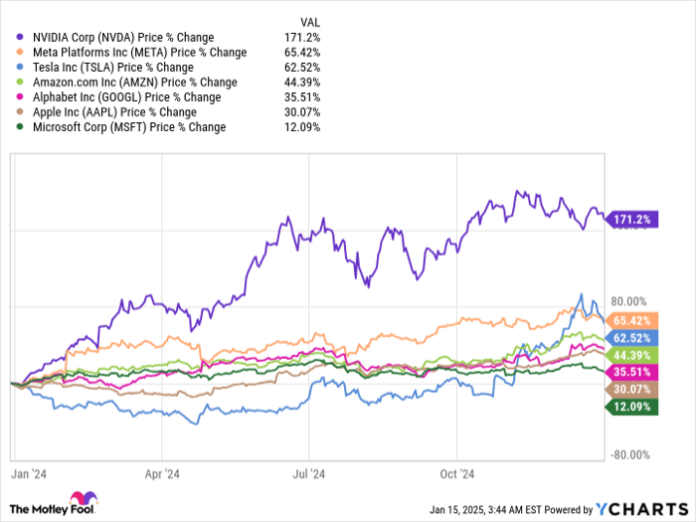

The “Magnificent Seven,” a group of leading technology companies, collectively boasts a market value of $17.2 trillion, accounting for one-third of the S&P 500 (SNPINDEX: ^GSPC). In 2024, these stocks delivered an impressive average return of 60%, contributing significantly to the S&P’s overall gain of 25%.

Invest $1,000 wisely! Our analysts have identified the 10 best stocks you should consider purchasing now. See the 10 stocks »

NVDA data by YCharts.

For investors who didn’t include any of the Magnificent Seven stocks in their portfolios last year, the results would likely have fallen short of the market’s overall performance. These seven companies are leaders across various tech sectors, including emerging fields such as artificial intelligence (AI), and they are expected to keep propelling the S&P 500 higher.

Current Trends Boosting the Magnificent Seven

AI advancement is fueling most of the growth in the tech industry today, positioning Nvidia (NASDAQ: NVDA) as the standout performer among the Magnificent Seven. Demand for Nvidia’s graphics processing units (GPUs) is soaring, as developers require them to create AI models, creating a supply crunch in the process.

Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), and Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG) rank among Nvidia’s major clients, filling their data centers with its chips to develop their own AI solutions. Additionally, they provide businesses and developers access to advanced large language models (LLMs) through platforms like Microsoft Azure, Amazon Web Services, and Google Cloud.

Meta Platforms (NASDAQ: META) is leveraging AI within its recommendation systems on Facebook and Instagram, enhancing user experience by personalizing content. This strategy keeps users engaged longer, leading to increased ad revenue. Meta expects to debut its Llama 4 LLM later this year, which aims to set new industry standards.

Apple (NASDAQ: AAPL) is set to expand its influence in the AI market with its Apple Intelligence software, designed to work seamlessly on its latest devices. With 2.2 billion active devices around the globe, Apple expects these new features to not only boost software sales but also entice customers to upgrade their devices sooner.

Tesla (NASDAQ: TSLA), while known primarily for its electric vehicles, has gained Wall Street optimism regarding its full self-driving software (FSD). This technology could change the company’s financial landscape with the introduction of a new robotaxi service aimed at providing round-the-clock transportation services.

Image source: Getty Images.

Dividend Income from the Magnificent Seven

The Magnificent Seven companies generate substantial cash flow, allowing them to return some profits to shareholders through dividends. While Apple, Microsoft, Nvidia, Meta Platforms, and Alphabet pay dividends quarterly, their yields remain low, with none exceeding 0.75% based on current stock prices.

MSFT Dividend Yield data by YCharts.

Dividend yields fluctuate due to changes in a company’s dividend payments or stock price movements. Although the payout amount may not change, the percentage yield can vary. Microsoft offers the highest yield in this group, but with a market capitalization of $3.1 trillion and a payout of $21.7 billion last fiscal year, its yield remains modest.

If you were to invest $350,000 evenly across the Magnificent Seven, you would receive an average dividend yield of 0.37% on $250,000, while the remaining $100,000 (invested in Amazon and Tesla) would yield nothing. This results in annual dividend payments of approximately $925— a small return compared to potential earnings from a high-yield savings account. Still, it’s a beneficial addition to the capital growth potential of these stocks.

Besides dividends, companies can also reward shareholders through stock buybacks. By repurchasing their own shares on the open market, companies reduce the number of shares available, which can increase the price per share and maximize ownership value for remaining shareholders.

Stock buybacks also provide flexibility, allowing firms to choose when to execute them, often during undervalued periods. All five of the Magnificent Seven companies engaged in buybacks within the last four quarters, spending a staggering $236.9 billion:

AAPL Stock Buybacks (TTM) data by YCharts.

The Future of the Magnificent Seven: Growth and Buybacks on the Horizon

While Amazon and Tesla have not been actively buying back their own stocks recently, both companies are currently profitable. This puts them in a position where stock buybacks could become a viable option in the future. Notably, Amazon repurchased $6 billion in stock back in 2022, indicating their willingness to return capital to investors through this method.

Investors should be particularly interested in the Magnificent Seven stocks, given their impressive history of capital growth. This trend is expected to persist, fueled by the ongoing advancement of the AI revolution, which is still in its infancy. Different forecasts highlight the potential economic impact of AI, with estimates ranging from $15.7 trillion (PwC) to an astonishing $200 trillion (Ark Invest) by 2030.

The Magnificent Seven are likely to be pivotal in driving this significant economic value, making them attractive long-term investment options. Additionally, any dividends received along the way would serve as a nice added benefit.

Is Now the Right Time to Invest $1,000 in Nvidia?

Before making a decision to invest in Nvidia, contemplate this: the Motley Fool Stock Advisor analyst team recently identified what they consider the 10 best stocks for investors right now, and Nvidia was excluded from this list. The chosen stocks are predicted to yield impressive returns in the coming years.

Reflecting on Nvidia’s past, when it made the Stock Advisor list on April 15, 2005, an initial investment of $1,000 would have grown to an astounding $843,960 today!*

The Stock Advisor service offers an accessible strategy for successful investing. Subscribers receive advice on portfolio building, regular analyst updates, and two new stock selections each month. Since its inception in 2002, the service has more than quadrupled the returns of the S&P 500.*

Discover the 10 stocks now »

*Stock Advisor returns as of January 13, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is also on the board. Randi Zuckerberg, former director of market development and spokesperson for Facebook, is a board member as well. Anthony Di Pizio has no positions in any of the stocks mentioned. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. Additionally, they recommend long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. A disclosure policy is in place at The Motley Fool.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.