Pinnacle West Capital: Anticipated Earnings and Market Performance Overview

Solid Forecasts for Fiscal 2024 Amidst Recent Gains

With a market capitalization of $9.9 billion, Pinnacle West Capital Corporation (PNW) serves as a major utility holding company. It primarily provides electricity through its subsidiary, Arizona Public Service, based in Phoenix, Arizona. Renowned for its commitment to sustainable energy, Pinnacle West is preparing to announce its fiscal year 2024 earnings on Tuesday, February 25, before the market opens.

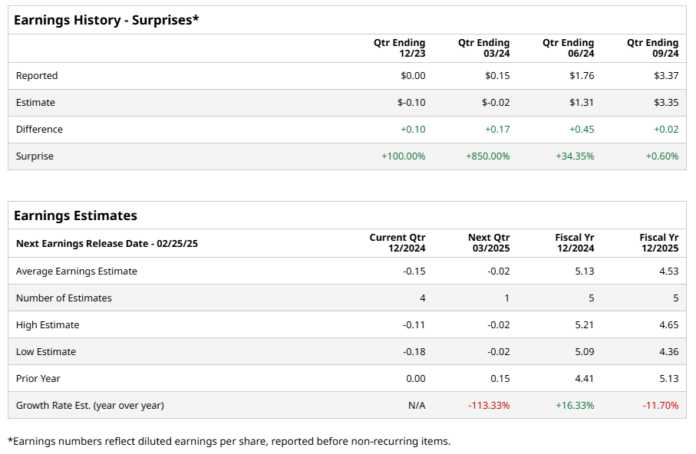

For the upcoming fourth quarter, analysts predict PNW will post a loss of $0.15 per share. However, it is noteworthy that PNW has consistently beaten Wall Street’s earnings-per-share (EPS) estimates over the last four quarters.

The forecast for PNW’s EPS in fiscal 2024 stands at $5.13, reflecting a significant 16.3% increase from the prior year’s EPS of $4.41.

www.barchart.com

Over the past year, PNW shares have climbed 24%. This rise is slightly lower than the S&P 500 Index’s gain of 26.5% and the Utilities Select Sector SPDR Fund’s (XLU) increase of 27.7% during the same period.

www.barchart.com

Pinnacle West’s stock jumped 3.9% on November 6, following Q3 earnings that exceeded expectations in both revenue and earnings. This positive result was largely attributed to the exceptionally hot summer of 2024, which led to a surge in energy use as customers sought relief from the heat.

The consensus rating for PNW’s stock is moderately optimistic, categorized as a “Moderate Buy.” Of the 15 analysts covering the stock, seven recommend a “Strong Buy,” while eight suggest holding the stock.

Pinnacle West’s average analyst price target is set at $93.78, indicating a possible upside of 8.2% from current trading levels.

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is meant for informational purposes only. For more details, please refer to the Barchart Disclosure Policy here. More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.