Tesla’s Stock Surge: The Factors Behind the Rise and What Investors Should Consider

Tesla (NASDAQ: TSLA) has experienced significant growth recently, with its shares almost doubling in just a few months. Investors are optimistic about the electric vehicle (EV) company’s future as it continues to expand into new markets like autonomous vehicles and robotics.

While stock momentum can be impressive, the ultimate price trajectory remains uncertain. The company’s fundamentals will determine whether the rising stock price can be sustained or will falter as reality sets in.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to buy at this time. See the 10 stocks »

Is now the right time to buy Tesla stock while it trades under $450 per share? Here’s what you should know.

The Real Drivers Behind Tesla’s Stock Growth

Investors often note that Tesla is not just another car company; it is increasingly viewed as a tech firm due to its diverse business segments. With projects like the planned Cybercab and Optimus humanoid robots, Tesla could tap into vast markets in the coming years.

Speculation suggests that this innovation has fueled the stock’s recent success. CEO Elon Musk has strategically aligned with the Trump administration, potentially easing regulatory challenges for Tesla’s autonomous ride-hailing service. Since the election on November 5, shares have surged nearly 70%.

According to Musk, ride-sharing services are expected to launch in Texas and California this year, with Cybercab production ramping up in 2026. Furthermore, he aims to introduce Optimus robots by 2026 as well, as the company develops advanced AI for the technology.

Exciting Prospects but Caution is Needed

Musk believes Tesla’s future value relies more on these new projects than on its current automotive sales. Yet, investors must remain grounded in the present. The automotive sector, which recently experienced its first production drop in 2024, still accounts for nearly all of Tesla’s revenue and profits.

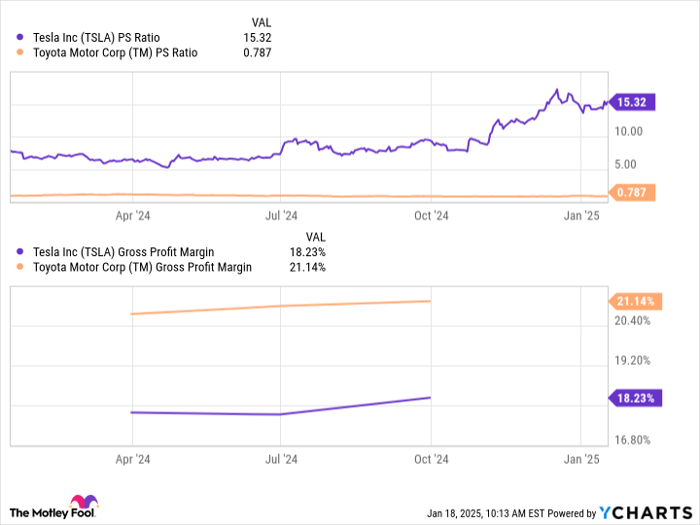

There’s a distinct advantage in marketing Tesla as a tech company, reflected in its high valuation relative to competitors. Currently, the stock trades at over 15 times sales, while Toyota boasts better gross profit margins but maintains a price-to-sales ratio of less than 1. Even though Tesla is growing rapidly, such a dramatic valuation difference raises questions.

Data by YCharts.

What should investors take away from this situation? Tesla’s potential in technology is exciting, but it is essential to recognize that these prospects are already reflected in the stock price. Currently, there are several unknowns:

- Will Tesla successfully launch these products?

- When might these innovations significantly influence the company’s finances?

- How much profit can these products generate?

There is a plausible scenario where Tesla succeeds with its upcoming products yet the stock remains stagnant while financial performance aligns with the valuation. Conversely, delays or failures in the rollout could lead the market to reassess its support for such high valuations.

Should You Invest in Tesla Stock Now?

There is a chance that Tesla’s Cybercab and Optimus could yield impressive profits from the outset, driving the stock even higher.

However, investment decisions often revolve around educated predictions founded on various potential outcomes. Current evidence suggests there are more scenarios that might lead to disappointing returns for the stock than positive ones. Although Tesla operates beyond mere vehicle manufacturing, purchasing shares at almost $450 each seems unjustifiable without stronger financial backing.

For those interested in Tesla, a market correction could offer better entry points. Exercise patience to allow the company’s current trends to unfold. If you worry about missing out, consider gradually investing smaller amounts while keeping some capital available for potential dips.

Don’t Miss This Chance at a Potentially Valuable Investment

Have you ever felt like you missed your opportunity to invest in successful stocks? Here’s a chance to act.

Our expert analysts sometimes issue a “Double Down” stock recommendation for companies they believe are poised for significant returns. If you think you’ve missed your investment window, now might be the perfect time.

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $357,084!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,554!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $462,766!*

We’re currently issuing “Double Down” alerts for three compelling companies, and this opportunity may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.