Assessing Ford Motor Company’s Dividend Amidst Financial Challenges

Investors pondering shares of Ford Motor Company (NYSE: F) face important considerations before making decisions. Last year, warranty costs significantly increased for Ford, and projections indicate an approximate loss of $5 billion within its electric vehicle sector for 2024. Additionally, the company has found it difficult to achieve substantial earnings in international markets.

Despite these challenges, Ford’s enticing 6% dividend yield is a major factor for income investors. However, the critical question remains: Is this dividend secure amidst the company’s ongoing issues?

The Allure of Dividends

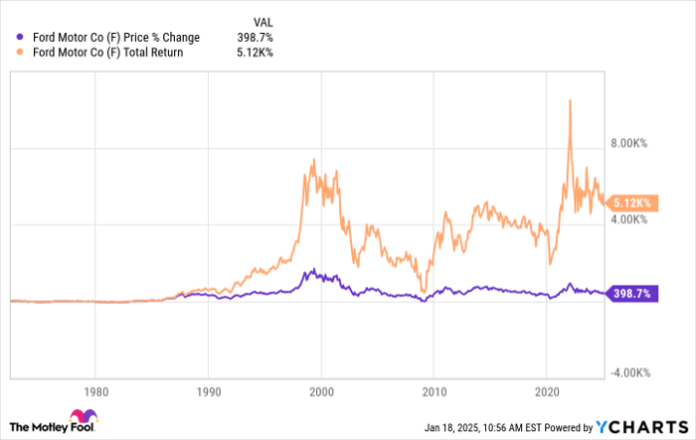

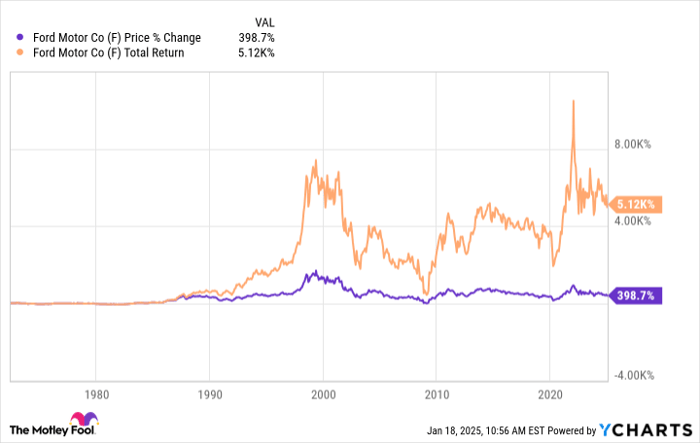

Ford’s dividend is appealing for several reasons. Its yield of 6% significantly surpasses the average yield of 1.2% offered by the S&P 500 (SNPINDEX: ^GSPC). Furthermore, the reinvestment of dividends can transform Ford into a long-term wealth generator. Observing Ford’s overall return, which includes dividends, compared to its stock price increase over the years illustrates this potential well.

F data by YCharts

Indeed, Ford’s dividend serves as a crucial avenue for wealth generation, especially given that the stock’s value has diminished by 32% over the past decade.

Moreover, Ford regularly pays supplemental dividends in periods of healthy cash flow or significant events, as seen when the company sold its substantial stake in Rivian several years ago. Management aims for a consistent return of 40% to 50% of adjusted free cash flow (FCF) to shareholders.

Yet, the question still lingers: Is the dividend safe?

Ford Family Influence

In many ways, investors who purchase Ford stock for dividends align with the interests of the Ford family. The family holds special Class B shares, representing a minor portion of equity but granting them control over 40% of board elections. This effectively means the Ford family still maintains significant influence over company operations and benefits from the same dividends as common shareholders.

Given the family’s vested interest in steady dividend payouts while guiding company strategy, it is unlikely they would permit a cut unless absolutely necessary. This is also a reason Ford has refrained from initiating large share repurchase programs, which would provide less income to the Ford family compared to utilizing that capital for dividends.

Despite challenges related to electric vehicle losses, difficulties in China, and increased warranty expenses, Ford continues to generate strong cash flow. Specifically, the company recorded approximately $6 billion in adjusted FCF during the first nine months of 2024. Additionally, Ford’s balance sheet reveals $28 billion in cash and a total liquidity of about $46 billion. By reducing plans for approximately $12 billion in EV projects, Ford is strategically lowering capital expenditures to enhance free cash flow.

Understanding the Implications

The dividend plays a crucial role for both Ford and its investors. The company has reiterated its commitment to shareholder value, primarily through dividends rather than stock buybacks. Although the cyclical nature of the automotive industry may prompt concerns about dividend stability in light of various global challenges, significant apprehension is unwarranted unless a drastic situation, like a global pandemic or financial crisis, arises.

While the dividend remains a key attraction for potential investors, it’s essential to recognize that Ford’s stock has stagnated for several years. For future price growth, the company will need to improve numerous operational aspects.

Should You Invest $1,000 in Ford Motor Company Right Now?

Before proceeding with an investment in Ford Motor Company, keep these points in mind:

The Motley Fool Stock Advisor team has recently identified what they consider the 10 best stocks to purchase right now, and Ford Motor Company did not make the list. The selected stocks possess potential for substantial returns in the upcoming years.

Reflect on Nvidia’s selection on April 15, 2005—if you had invested $1,000 at that time, you’d today have seen that investment grow to $843,960!*

Stock Advisor simplifies investing by offering guidance on portfolio development, regular analyst updates, and two new stock picks monthly. This service has outperformed the S&P 500 by more than fourfold since its inception in 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Daniel Miller has positions in Ford Motor Company. The Motley Fool has no positions in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.