Our analysis of the iShares Russell 1000 Value ETF (Symbol: IWD) reveals an impressive forecast by analysts. They suggest that IWD’s underlying holdings could drive the ETF to an implied target price of $215.10 per unit over the next twelve months.

Current Price vs. Predictions: A 12.34% Upside

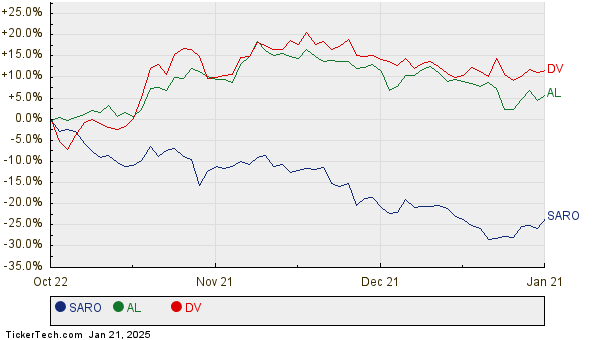

Currently, IWD is trading around $191.48 per unit. This indicates a potential upside of 12.34%, based on the analysts’ average targets for the ETF’s holdings. Notable among these holdings are STANDARDAERO (Symbol: SARO), Air Lease Corp (Symbol: AL), and DoubleVerify Holdings Inc (Symbol: DV), each showing considerable room for growth.

Noteworthy Holdings and Their Analyst Targets

SARO is trading at $24.64 per share, while analysts set an average target of $34.44, suggesting a promising upside of 39.79%. Similarly, AL’s recent price of $46.66 may rise 24.61% to reach an average target of $58.14. Moreover, DV is currently priced at $19.47, with an expected increase of 18.90% to an average target of $23.15. Below is a chart illustrating the performance of these stocks over the past year:

Summary of Analyst Predictions

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Russell 1000 Value ETF | IWD | $191.48 | $215.10 | 12.34% |

| STANDARDAERO | SARO | $24.64 | $34.44 | 39.79% |

| Air Lease Corp | AL | $46.66 | $58.14 | 24.61% |

| DoubleVerify Holdings Inc | DV | $19.47 | $23.15 | 18.90% |

Assessing Analyst Optimism

These analyst targets raise important questions. Are they justified in their optimism, or are they too hopeful given recent changes in the industry? While high price targets can reflect positive expectations, they can also be vulnerable to revisions if circumstances shift. Investors must conduct further research to make informed decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

Funds Holding UBXG

Institutional Holders of FCEL

CNNX Options Chain

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.