Disney Breaks Box Office Records with Multiple Billion-Dollar Hits in 2024

Disney DIS solidified its status as an entertainment leader in 2024, with three films each exceeding the billion-dollar mark globally. Inside Out 2 topped the list at $1.69 billion, followed by Deadpool & Wolverine at $1.3 billion, and Moana 2 at $1.1 billion. This remarkable success allowed Disney to be the only studio to exceed $5 billion in worldwide box office revenues for 2024, the first time this has occurred since 2019. With 32 of its films now in the billion-dollar club compared to 24 from non-Disney studios, Disney’s dominance in blockbuster entertainment is unmatched.

Robust 2025 Projected Releases and Park Enhancements

Disney plans an impressive 2025 theatrical slate featuring 12 major films, including potential hits like Captain America: Brave New World, Avatar: Fire and Ash, and The Fantastic Four: First Steps. In addition, Disney’s parks division will see significant expansions with new experiences such as Disney Villains: Unfairly Ever After and the Disney Starlight nighttime parade. However, weather challenges and pre-launch expenses may impact short-term results. The parks’ guidance projects a 6-8% increase in operating income for fiscal 2025, showcasing cautious optimism amid these developments.

Disney’s Strategic Evolution and Market Edge

A major strength for Disney lies in its ability to leverage intellectual properties across multiple formats. The performance of Moana 2 exemplifies this competency, as the film broke records in various international markets, becoming the highest-grossing Walt Disney Animation Studios film in numerous areas. The company’s focus on franchise expansion is evident in its heavy reliance on sequels and remakes within its upcoming 2025 content slate, indicating a cautious yet potentially reliable strategy for content development.

Streaming Gains Amidst Rising Competition

Disney’s streaming service is showing positive trends, reporting a $253 million operating profit in the fourth quarter of fiscal 2024. However, Disney+ continues to face fierce competition from established players like Netflix NFLX, Amazon AMZN-owned Amazon Prime Video, and Apple AAPL-owned Apple TV+, which have led to expectations of modest subscriber growth into early 2025. Additionally, revenues from Linear Networks fell by 6.4% year over year to $2.46 billion, mirroring shifts in how audiences consume content. Balancing subscriber growth and profitability remains a challenge within this evolving streaming landscape.

Financial Forecasts and Investment Outlook

According to the Zacks Consensus Estimate, Disney’s revenues for fiscal 2025 are expected to reach $94.94 billion, reflecting a year-over-year growth of 3.91%. Also, earnings per share are predicted to rise by 8.85% to $5.41. These figures suggest moderate but steady growth in the near future.

Image Source: Zacks Investment Research

For the latest on earnings estimates and surprises, visit Zacks Earnings Calendar.

Investors must carefully examine Disney’s significant debt of $45.81 billion against a cash position of $6 billion. The company’s premium valuation, sitting at 2.13X (3-year trailing 12-month P/S), stands in contrast to the Zacks Media Conglomerates industry’s 1.09X.

Current Price-to-Sales Ratio Trends

Image Source: Zacks Investment Research

Anticipated high-single-digit growth in adjusted EPS for fiscal 2025, alongside a $3 billion stock repurchase initiative, reflects management’s faith in future performance. Yet, these strategies must be assessed against the current market landscape and competitive pressures faced by the entertainment industry.

Investment Considerations

Disney’s recent box office successes and strategic initiatives indicate potential for long-term growth. Still, current valuations and short-term challenges suggest that investors might want to exercise patience. A combination of successful film releases, improving streaming profitability, and park expansions supports a positive outlook on the company’s transformation. Given the high valuation and considerable debt, thorough consideration is crucial.

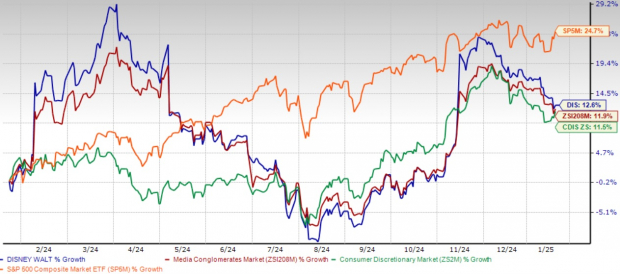

For prospective investors, seeking more attractive buying opportunities may be wise. Notably, the stock has gained 12.6% over the past year, outperforming the Zacks Consumer Discretionary sector’s 11.5% growth, indicating that much optimism might already be factored into the price.

Annual Performance Overview

Image Source: Zacks Investment Research

Final Thoughts

Although Disney’s long-term outlook remains promising, underpinned by a strong IP portfolio and multi-platform revenue strategies, current valuation levels coupled with near-term challenges suggest a wait-and-see approach is prudent. Investors should attentively track quarterly performance data—especially with regard to streaming subscribers, park results, and debt management—before making new investment decisions. Disney currently holds a Zacks Rank #3 (Hold). Check Zacks for today’s #1 Rank (Strong Buy) stock list.

Top Stock Picks for the Upcoming Month

Recently released: Experts have identified 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys, labeling these tickers as “Most Likely for Early Price Gains.”

Since 1988, the entire list has outperformed the market more than twice, with an average annual increase of +24.1%. Be sure to pay attention to these selected 7 stocks.

Want the latest recommendations from Zacks Investment Research? Today, you can download the report on the 7 Best Stocks for the Next 30 Days for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.