Analysts See Growth Potential for Invesco S&P SmallCap 600 Revenue ETF

In a detailed analysis of the Invesco S&P SmallCap 600 Revenue ETF (Symbol: RWJ), ETF Channel examined the current trading prices of its underlying holdings alongside their projected 12-month target prices set by analysts. The findings reveal that the implied target price for RWJ stands at $54.91 per unit.

Current Price and Market Outlook

With RWJ currently trading at $46.97 per unit, it indicates a potential upside of 16.89% based on analyst expectations for the ETF’s underlying holdings. Noteworthy stocks within RWJ include FormFactor Inc (Symbol: FORM), Avanos Medical Inc (Symbol: AVNS), and Stewart Information Services Corp (Symbol: STC), all of which exhibit promising upside potential to their respective target prices. FormFactor’s recent share price is $43.46, yet analysts project it to rise by 27.13% to $55.25. Avanos shares currently stand at $15.92, with a target price of $20.00 suggesting a 25.63% increase. Moreover, Stewart Information Services, priced at $65.08, has a target of $78.00, reflecting an upside of 19.85%.

Performance Comparison

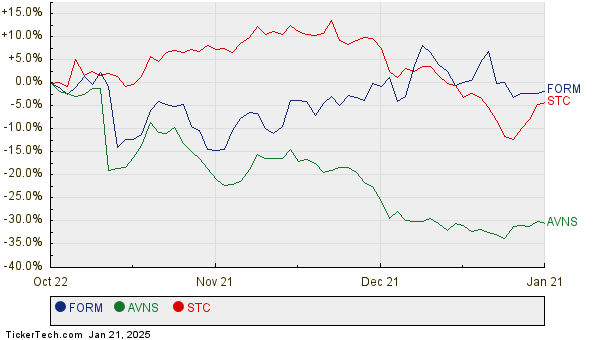

Below, you will find a chart depicting the twelve-month price history for FORM, AVNS, and STC:

Summary of Analyst Predictions

The following table summarizes the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P SmallCap 600 Revenue ETF | RWJ | $46.97 | $54.91 | 16.89% |

| FormFactor Inc | FORM | $43.46 | $55.25 | 27.13% |

| Avanos Medical Inc | AVNS | $15.92 | $20.00 | 25.63% |

| Stewart Information Services Corp | STC | $65.08 | $78.00 | 19.85% |

Questions for Investors

The analyst targets raise questions: Are they realistic based on current market conditions, or are they overly optimistic? Investors should consider whether these projections are based on a solid understanding of recent developments in the companies and their industries. While high target prices can suggest optimism, they might also lead to future downgrades if they are outdated. Understanding these nuances requires further research and patience from investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• VRTS Options Chain

• EWBC Price Target

• UMH Stock Predictions

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.