“`html

Wall Street Rallies as Earnings Season Kicks Off

Investors are optimistic as inflation cools, hinting at potential rate cuts for 2025. Major firms like JPMorgan and Taiwan Semiconductor have reported strong earnings, contributing to the market’s bullish sentiment.

Check the Zacks Earnings Calendar for critical market updates.

The business world also welcomes the growth-oriented policies coming from the second Trump administration.

In this favorable climate, let’s explore how investors can utilize Zacks screenings to uncover top Zacks Rank #1 (Strong Buy) stocks for 2025.

Zacks Rank #1 (Strong Buy) stocks generally outperform the market regardless of its direction. However, there are more than 200 stocks currently holding a Zacks Rank #1.

Thus, applying specific filters to the Zacks Rank helps narrow the list to the most tradable options.

Filtering Parameters

This screening strategy has three key components, which together can deliver substantial returns.

• Zacks Rank equals 1

Starting with a Zacks Rank #1 is promising, boasting an average annual return of about 24.4% since 1988.

• Percentage Change (Q1) Estimate Over 4 Weeks Greater than 0

This indicates positive adjustments to current quarter earnings estimates over the past month.

• Top 5 Broker Rating Change Over 4 Weeks

These are the stocks with the highest average changes in broker ratings during the previous month.

This approach is part of the Research Wizard and is labeled bt_sow_filtered zacks rank5, found in the Screen of the Week folder.

Here is one of the five stocks that qualified for the Filtered Zacks Rank 5 strategy today:

This Tech Stock is a Top Buy Right Now

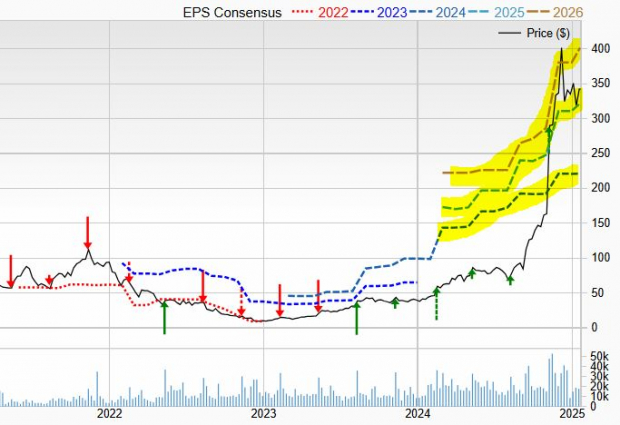

AppLovin Corporation APP has been one of the hottest tech stocks on Wall Street in 2024, soaring 700% over the past year. Its stock has gained 120% since its Q3 results in November.

Image Source: Zacks Investment Research

AppLovin’s growth can be attributed to its AI-enhanced portfolio, which helps companies and app developers attract and retain users while maximizing customer value.

Projecting significant growth, AppLovin is expected to increase revenue by 40% in 2024 and by 24% in 2025, reaching $5.68 billion, a jump from $1.45 billion in 2020.

Adjusted earnings are projected to rise by 314% in FY24 and another 50% in 2025, following years of rapid expansion. Its positive outlook makes it a Zacks Rank #1 (Strong Buy), with recent earnings estimates topping expectations by an average of 26% over the past four quarters.

Image Source: Zacks Investment Research

AppLovin stock has surged 2,800% over the last two years, far outpacing Nvidia’s NVDA 625%. Despite this, it has remained roughly 65% below its all-time highs, with a price/earnings-to-growth ratio of 2.8. The stock remains stable, recently finding support at its 50-day moving average.

Explore the other stocks on this list and start identifying new companies that meet these criteria. It’s simple and may help you discover your next major investment. Utilize the Research Wizard for a free trial today.

Click here for a free trial of the Research Wizard today.

For updates from this author, go to the top of this article and click the FOLLOW AUTHOR button to receive notifications when new articles are published.

Disclosure: Officers, directors, and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options mentioned here.

Disclosure: Performance information for Zacks’ portfolios and strategies is available at: www.zacks.com/performance_disclosure

Latest Picks from Zacks’ Best Screens

Starting now, gain immediate access to new stock picks from our highly effective screenings, which have significantly outperformed the market since 2000. While the S&P 500 averaged +7.0% annually, our results have included: Small-Cap Growth +44.9%, Filtered Zacks Rank5 +48.4%, and Big Money Zacks +55.2%.

You can explore the latest stocks in seconds using Zacks’ Research Wizard stock-picking program or create your own winning strategies. It’s free to try for 2 weeks; no credit card required.

Want the newest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days now.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

AppLovin Corporation (APP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author, and do not necessarily reflect those of Nasdaq, Inc.

“`