Bill Holdings: A Rising Star in Cloud Software and AI Automation

Company Profile of Bill Holdings

Bill Holdings (BILL) is a cloud-based software company based in California. With a Zacks Rank of #1 (Strong Buy), it utilizes AI technology to help small and medium-sized businesses (SMBs) automate their back-office financial operations. Bill’s extensive product suite includes software solutions for accounts payable, accounts receivable, supply management, and client management.

Strategic Growth Through Acquisitions

The company’s growth strategy includes both organic development and acquisitions. In 2022, Bill acquired Finmark, a financial planning software provider, enhancing its offerings for SMBs. Additional acquisitions included Divvy, which specializes in spend and expense software, and Invoice2go.

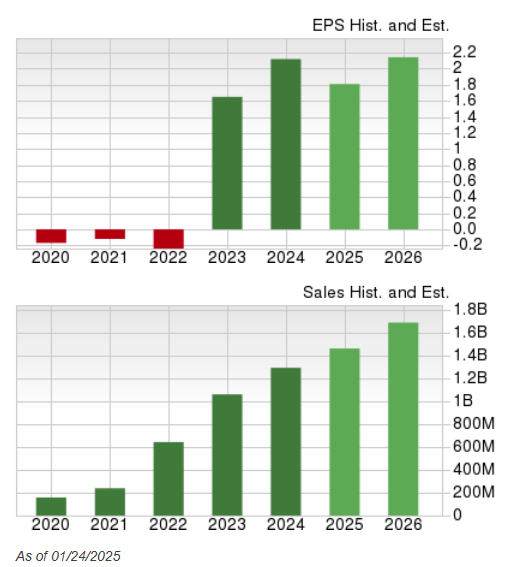

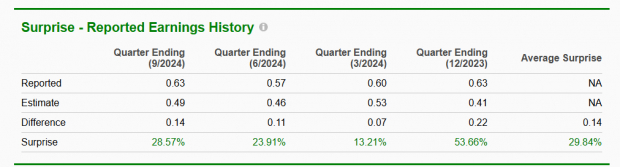

Impressive Financial Growth

Bill Holdings has seen remarkable financial results. With double-digit growth in both sales and earnings for five straight quarters, the company continues to perform well in its niche market.

Image Source: Zacks Investment Research

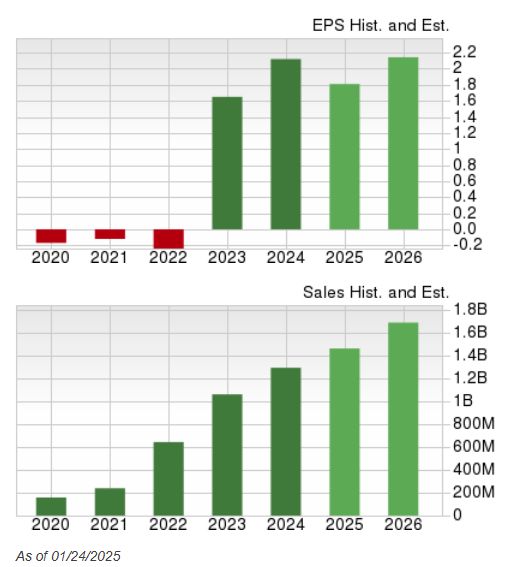

BILL has also consistently exceeded Wall Street expectations for earnings per share (EPS). Over the last four quarters, the company achieved an average EPS surprise of 29.84% compared to Zacks Consensus Estimates.

Image Source: Zacks Investment Research

Impact of DeepSeek on the Software Sector

Recently, the AI model “DeepSeek” has captured the attention of Wall Street. This Chinese-developed model claims that its “DeepSeek-R1” can outperform popular large language models like Meta Platform’s (META) “Llama” and OpenAI and Microsoft’s (MSFT) ChatGPT. Notably, DeepSeek asserts that its model can be trained using less expensive resources compared to Nvidia (NVDA) GPUs, creating ripples throughout the market.

As investors sift through the implications of DeepSeek, many are curious if this will lead to a commoditization of AI technology. If this occurs, software companies utilizing AI, including Bill Holdings, stand to gain significantly. Currently, the software industry is ranked 47 out of 250 sectors tracked by Zacks, placing it in the top 19%.

Despite the turmoil in equity markets, software stocks like Twilio (TWLO) and Snowflake (SNOW) showed solid performance during a recent downturn, which suggests potential optimism ahead.

Positive Chart Developments for BILL

BILL shares are also showing promise on the charts, breaking out of a bull flag pattern after gaining support from the rising 50-day moving average.

Image Source: Zacks Investment Research

Conclusion

In a challenging tech sector, software companies like BILL Holdings stand out as bright spots. Investors may find opportunities as capital shifts away from semiconductor stocks.

5 Stocks Set to Double

Each of these stocks has been carefully selected by Zacks experts as likely to gain +100% or more in 2024. Previous recommendations have shown impressive gains of +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are under the radar of Wall Street, presenting a great opportunity for early investors.

See these 5 potential home run stocks today! >>

For the latest recommendations from Zacks Investment Research, you can also download the report on 7 Best Stocks for the Next 30 Days.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Snowflake Inc. (SNOW): Free Stock Analysis Report

Twilio Inc. (TWLO): Free Stock Analysis Report

BILL Holdings, Inc. (BILL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.