VICI Properties Anticipates Solid Earnings Amid Market Challenges

Fourth-Quarter Results Scheduled for Feb. 20, Analysts Optimistic

VICI Properties Inc. (VICI) operates as a real estate investment trust (REIT) specializing in gaming, hospitality, and entertainment venues. With a market capitalization of $32.2 billion, this New York-based company owns 93 properties across the U.S. and Canada. These include famous Las Vegas attractions such as Caesars Palace, MGM Grand, and the Venetian Resort, featuring 54 gaming locations and over 500 dining and entertainment options. Investors are keenly awaiting the company’s fourth-quarter earnings announcement for fiscal 2024, set to occur after the market closes on Thursday, February 20.

Analysts Predict Growth in Funds from Operations

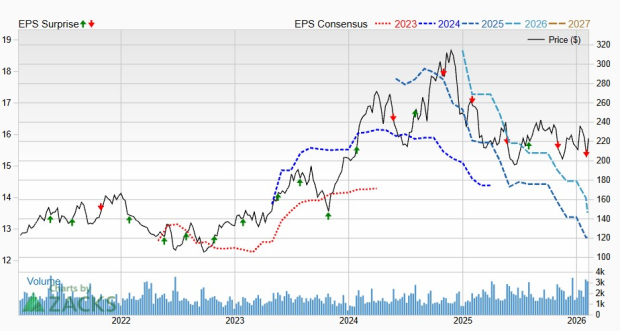

In advance of the earnings release, analysts project VICI will report a funds from operations (FFO) of $0.57 per share on a diluted basis. This marks a 3.6% increase from last year’s $0.55 per share. It’s notable that the company has consistently either met or exceeded Wall Street’s earnings per share (EPS) forecasts in its last four reporting periods.

Year-End Projections Indicate Steady Growth

Looking to the full fiscal year, analysts expect VICI to achieve an FFO of $2.26, representing a 5.1% rise compared to $2.15 in fiscal 2023. Additionally, the EPS is anticipated to increase by 2.2% year-over-year to $2.31 in fiscal 2025.

Stock Performance Underwhelms Compared to Major Indices

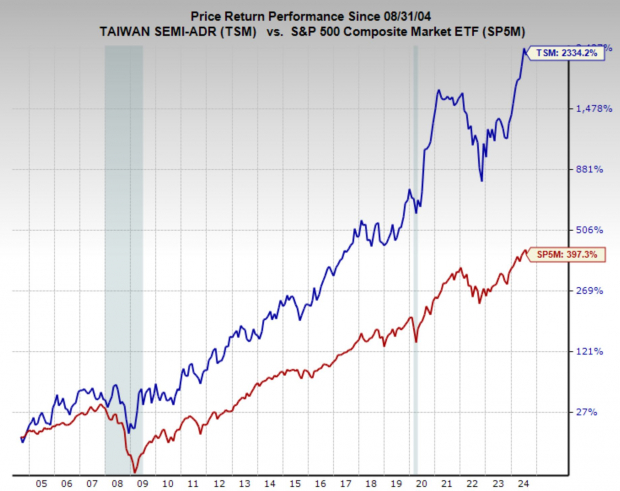

Over the past 52 weeks, VICI’s stock performance has lagged behind the S&P 500’s ($SPX) impressive 22.9% gains, showing only a slight increase during this timeframe. The company also underperformed relative to the Real Estate Select Sector SPDR Fund’s (XLRE) 9% gains.

Challenges Ahead

VICI’s recent underperformance has raised investor concerns regarding its non-gaming expansion strategies, potential refinancing challenges due to rising interest rates, inflationary pressures, and broader economic uncertainty.

Recent Earnings Show Positive Trends Despite Stock Slide

On October 31, VICI shares fell by 2% following the third-quarter earnings report. The adjusted FFO was $0.57 per share, reflecting a 5.6% increase from the same quarter last year. Revenue also saw growth, reaching $964.7 million, up by 6.7% year-over-year.

Analysts Remain Optimistic Post-Earnings

A consensus among analysts remains highly favorable, branding VICI stock with a “Strong Buy” rating overall. Out of 22 analysts following the stock, 17 recommend a “Strong Buy,” one advises a “Moderate Buy,” and four suggest holding the stock. The average analyst price target stands at $35.40, suggesting a potential upside of 15.9% based on current trading levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.