“`html

DeepSeek’s Troubling Accuracy and Its Impact on the AI Landscape

The developments surrounding DeepSeek keep unfolding, revealing information that requires close attention.

Let’s start with Reuters:

According to a NewsGuard audit, Chinese AI startup DeepSeek’s chatbot demonstrated only 17% accuracy when delivering news, placing it tenth out of eleven compared to Western competitors like OpenAI’s ChatGPT and Google Gemini.

The chatbot also repeated false claims 30% of the time and provided vague or unhelpful answers 53% of the time in response to news-related inquiries, leading to an overall fail rate of 83%, as reported by NewsGuard.

However, there are mounting concerns regarding how DeepSeek caught up with U.S. AI platforms so quickly, hinting at possible unethical practices.

From The New York Post:

OpenAI, which oversees ChatGPT, alleges that DeepSeek used its proprietary technology to develop a competing AI model, raising alarms about intellectual property violations in a rapidly growing field.

OpenAI claims that DeepSeek, founded by mathematician Liang Wenfeng, utilized a technique known as “distillation.” This common practice in AI helps smaller models enhance their performance by learning from larger ones.

However, OpenAI asserts that DeepSeek may have misused this method to build its own AI system…

Furthermore, security researchers from Microsoft, a major investor in OpenAI, found last fall that individuals associated with DeepSeek were reportedly collecting large amounts of data through OpenAI’s application programming interface, or API, according to sources cited by Bloomberg.

Despite these claims, Microsoft has expressed continued support for DeepSeek.

As noted by Bloomberg:

“DeepSeek has demonstrated real innovations,” said Microsoft CEO Satya Nadella during an investor call following the release of Microsoft’s quarterly results.

“Obviously, now that all gets commoditized, and it’s going to be widely used.”

As we consider the implications of DeepSeek’s technology for the U.S. AI landscape, it’s evident that new insights and perspectives are quickly developing.

Let’s take a closer look at what we know about DeepSeek and how this might affect your investment choices.

Our experts, including Louis Navellier, Eric Fry, and Luke Lango, recently engaged in a roundtable discussion with our Editor-in-Chief, Luis Hernandez. This discussion provides valuable insights into DeepSeek’s potential impact on the AI sector and suggests investment strategies to consider.

The Shifting Landscape: How DeepSeek Could Boost the U.S. AI Sector

While DeepSeek’s emergence introduces some competition, it may ultimately benefit the U.S. AI sector rather than hinder it.

However, the entry of DeepSeek signifies a shift in the AI landscape, presenting challenges for certain sectors, particularly if the company does not fulfill its ambitious claims.

Understanding how DeepSeek stands against established U.S. AI models is crucial, especially given its ability to operate at significantly lower costs and energy requirements.

This efficiency stems from adopting a Mixture-of-Experts (MoE) architecture, as detailed by our technology expert, Luke Lango, in a recent issue of Hypergrowth Investing:

Since the AI Boom began, the U.S. has enforced strict export bans on AI chips to China. This has compelled Chinese developers to adopt a “do more with less” approach.

DeepSeek’s innovative use of MoE architecture means that only the relevant sub-model is activated when a question is posed, leading to substantial savings in computing power per query. This efficiency contributes to accomplishing the same level of AI performance as leading models for about 95% lower costs.

While reduced costs can be advantageous for AI companies, it raises a critical question: Why did many AI-related stocks decline sharply earlier this week following news of DeepSeek?

Understanding the Concerns: The Implications of Cost Efficiency in AI

The recent selloff underscores a significant concern…

Lower-cost AI solutions imply that major AI players (the so-called “Mag 7”) may no longer need to invest billions in AI development.

This potential shift could negatively impact chipmakers, datacenter operators, and suppliers who expected billions in revenue from ongoing tech expansions.

While this prospect is important, it’s also essential to acknowledge the opportunities that lower-cost AI technologies present.

As highlighted by Luke, such advancements benefit what he terms the “AI Appliers” — companies that integrate AI into their operations to enhance profit margins.

For these businesses, adopting AI at lower costs facilitates the development and delivery of advanced products and services affordably, positively impacting their profitability.

These changes create new revenue avenues for companies providing AI applications and solutions as well.

Luke elaborates:

This breakthrough by DeepSeek represents a significant opportunity.

We recommend our subscribers to investigate prospects in the “AI Application Layer,” particularly companies producing advanced AI applications…

Our outlook is particularly positive for AI software and services stocks like Meta and Apple (AAPL), along with companies such as Spotify (SPOT), Intuit (INTU), ServiceNow (NOW), and Atlassian (TEAM) — those at the forefront of creating and deploying AI solutions.

Assessing the Impact on AI Infrastructure Companies

Now, let’s examine the potential ramifications for AI infrastructure companies anticipating substantial revenues from Big Tech.

Initially, it appears that high-end chipmakers and datacenter operators might face challenges. Should AI solutions become less reliant on expensive chips, firms like Nvidia could see their financial outlooks impacted.

Likewise, if AI technologies no longer demand significant energy resources, it could create hurdles for datacenter and power industry stakeholders.

Does this mean it’s time to divest from these stocks?

Not necessarily.

To understand why DeepSeek may not spell disaster for AI infrastructure firms, consider insights from Christophe Fouquet, CEO of prominent chipmaker ASML, shared during an interview yesterday.

“`

The Rise of DeepSeek: How AI Efficiency May Boost Power Demand

Lower Costs and More Applications Could Drive Change

A lower cost of AI could lead to more applications, which means that demand will grow over time. This increase in demand presents an opportunity for chip manufacturers.

The Challenge of Cost and Energy Consumption

For AI to truly flourish in the coming years—among hyperscalers like Microsoft, Amazon, and Google, and for general users on their phones and PCs—two key issues must be addressed: cost and energy consumption.

Anything that reduces the cost of AI is generally welcomed, as it allows more applications to be available on a wider range of devices.

Implications for AI Datacenters

The conversation turns to AI datacenters. If DeepSeek’s technology operates using significantly less energy than traditional U.S. platforms, it could lead to a dramatic decrease in power consumption compared to earlier predictions.

This potential shift raised questions recently, prompting Bank of America analysts to highlight worries over high expectations for power demands in AI, noting that DeepSeek is “raising doubts about the high expectations for…power requirements.”

Understanding Jevons Paradox

However, Jevons Paradox suggests that rising efficiency might not be a setback for power companies. As explained by Luke:

Originated by 19th century British economist William Stanley Jevons, Jevons Paradox posits that improvements in a resource’s efficiency can lead to increased overall consumption of that resource.

More efficiency often equates to lower costs, which can then spark higher demand.

In simpler terms, DeepSeek’s technology is expected to lower the energy costs for running AI datacenters. But rather than decreasing overall power consumption, this may create a surge in new businesses eager to utilize AI at these reduced energy costs.

As a result, while the cost of energy to run AI projects could decline, the overall demand for energy may soar, further supporting the datacenter ecosystem—similar to trends seen in coal usage in the 1800s.

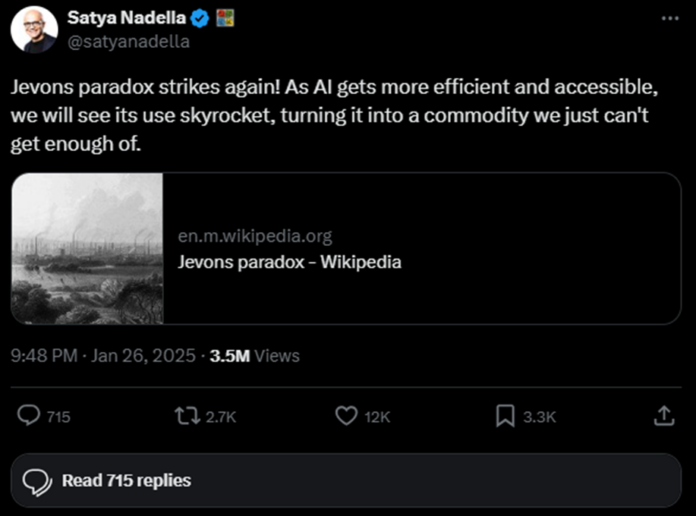

Even Microsoft’s CEO, Satya Nadella, referenced Jevons Paradox in relation to DeepSeek’s developments on social media.

Source: @satyanadella

Evaluating Expectations for AI Infrastructure

Despite the potential for significant growth in chip and power demand, Luke maintains a cautious approach toward expectations for AI infrastructure investments.

He shares his perspective on Nvidia:

We wouldn’t get overly optimistic about AI hardware and semiconductor stocks like Nvidia.

Some may lose their pricing power as the hardware market matures, resulting in tighter margins and slower profit growth.

That being said, it is still too early to conclude that it’s time to exit these stocks. A more measured “wait and see” approach is advisable for the present.

Exploring DeepSeek’s Broader Impact

There are many additional details about DeepSeek and its implications for U.S. AI stocks that we have yet to cover. Experts Louis Navellier, Eric Fry, and Luke Lango recently engaged in a roundtable discussion with our Editor-in-Chief, Luis Hernandez.

The trio is known for developing the AI Revolution Portfolio last December, showcasing a selection of promising AI stocks based on their individual methodologies.

This carefully curated portfolio boasts a return of over 21% last year and continues to outperform the market in 2023. Thus, their insights on DeepSeek’s effect on AI stocks are particularly relevant.

In the video of their roundtable discussion below, they analyze the significant implications of DeepSeek’s emergence and advise investors on potential strategic moves.

Click here (or press the play button below) to watch them break down the winners and losers in this AI revolution, as well as the moves that savvy investors need to make today.

For more information on the standout AI stocks in their AI Revolution Portfolio, click here.

In Conclusion

As Wall Street assesses the implications of DeepSeek, thoughts and predictions surrounding its effects are likely to evolve in the coming weeks and months. At present, the outlook appears promising for AI stocks and your investment portfolio.

Luke’s final remarks encapsulate the sentiment:

In our opinion, DeepSeek’s breakthrough will significantly accelerate AI model progress and may lead to Big Tech companies achieving Artificial General Intelligence (AGI) much sooner than anticipated.

We regard DeepSeek’s efficiency improvement as advantageous for the whole industry—and, importantly, for AI stocks as well.

Contrary to concerns that DeepSeek’s advancements could undermine Big Tech or signal the decline of AI, we believe such fears are misplaced.

Have a good evening.

Jeff Remsburg