DeepSeek’s Arrival Sends Shockwaves Through AI Stocks

Recent news about DeepSeek, a new player in the AI market, rattled investors. This left many related stocks, including major tech companies, experiencing significant declines.

DeepSeek, a Chinese startup, specializes in artificial intelligence and has developed open-source large language models (LLMs). Their latest model, R1, competes with established systems like OpenAI’s ChatGPT but was created at a much lower cost.

This situation sparked concerns over the heavy investments made by tech giants such as Microsoft (MSFT) and Meta Platforms (META), which have dedicated substantial funds to enhance their AI capabilities. Investors are now eager to see how the market navigates the implications of DeepSeek’s advancements.

Fortunately, both Microsoft and Meta reported their latest earnings recently.

Microsoft Reacts to DeepSeek’s Competition

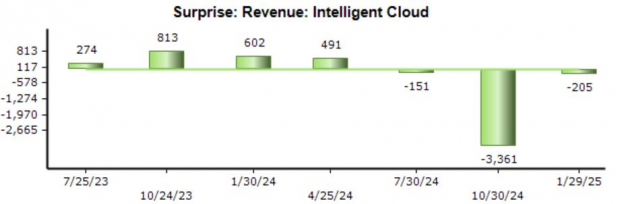

In its recent earnings report, Microsoft announced an adjusted EPS of $3.23 and sales reaching $69.6 billion, showing growth rates of 10% and 12% respectively. These figures surpassed analyst expectations.

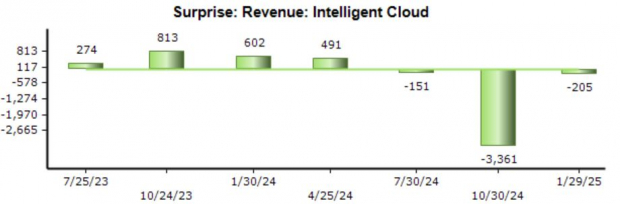

The Intelligent Cloud segment, especially the Azure cloud computing service, was a major highlight. Revenue from this segment hit $25.5 billion, representing a 19% increase from last year.

However, results in the Intelligent Cloud area have generally fallen short of expectations in recent quarters, contrasting earlier strong performances from 2023 and early 2024. This led to a slight setback for Microsoft shares.

Image Source: Zacks Investment Research

During the earnings call, CEO Satya Nadella shared his thoughts on DeepSeek, describing its innovations positively. He said, “I think DeepSeek has had some real innovations. For a hyperscaler like us, this is all good news as far as I’m concerned.”

Additionally, DeepSeek’s R1 model is now part of Azure AI Foundry and GitHub’s model catalog, which features over 1,800 AI models targeting various industries and tasks.

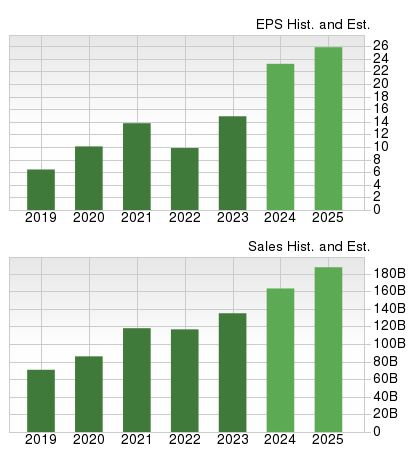

Importantly, Microsoft reaffirmed its capital expenditure outlook for upcoming quarters, maintaining levels similar to Q2 ($22.6 billion) to support its AI development. The stock’s current valuation reflects a forward 12-month earnings multiple of 31.7X, which is above its five-year average and shows a 41% premium compared to the S&P 500. Analysts project earnings to rise by 9% alongside a 13% growth in sales for the current fiscal year, ending in June.

Image Source: Zacks Investment Research

Meta’s Continued Investment Strategy

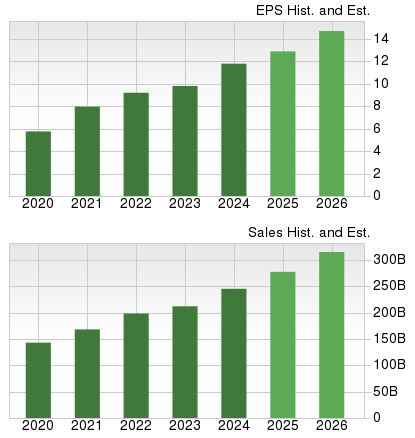

Meta Platforms also reported impressive figures, with an adjusted EPS of $8.02 and $48.4 billion in sales, showcasing growth rates of 50% and 21% respectively. Both metrics topped consensus expectations.

The company’s advertising business remains robust, generating revenue of $46.8 billion and consistently surpassing forecasted figures in recent times.

Image Source: Zacks Investment Research

When asked about DeepSeek, Mark Zuckerberg acknowledged the potential innovations from the new competitor. He noted, “There are a number of novel things that we’re still digesting. I expect that every new company will have advances the rest of the field can learn from.” He suggested it was too early to determine the impact on infrastructure investments and expenditure trends.

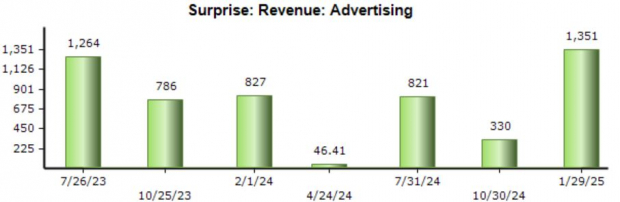

Meta’s current valuation, with a 25.9X forward 12-month earnings multiple, presents a more manageable premium of 16% over the S&P 500. For its ongoing fiscal year ending in December, EPS is anticipated to increase by 6.6% along with a 13% rise in sales.

Image Source: Zacks Investment Research

Conclusion

The news surrounding DeepSeek has brought uncertainty to the AI sector. However, the latest earnings reports from Microsoft and Meta provided glimpses of reassurance.

Both tech giants are sticking to their capital expenditure plans and acknowledged DeepSeek’s innovations, helping to alleviate some investor concerns regarding AI infrastructure expansions. As the situation develops, careful observations will be necessary before making any hasty conclusions based on headlines.

5 Stocks Set to Double

These selections are made by a Zacks expert, highlighting stocks anticipated to gain +100% or more in 2024. Although not every pick can succeed, previous recommendations have achieved remarkable returns including +143.0%, +175.9%, +498.3%, and +673.0%.

Most stocks mentioned in this report remain under the radar of Wall Street, creating an opportunity for early investors.

Today, explore these 5 potential home runs >>

For the latest recommendations from Zacks Investment Research, download the 7 Best Stocks for the Next 30 Days. Click here for this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.