Microsoft Faces Growth Hurdles Despite Strong AI Demand

Microsoft‘s MSFT latest earnings report for the second quarter of fiscal 2025 suggests a complex situation for investors. Although the company achieved significant revenue growth of $69.6 billion—up 12% year over year—there are growing worries regarding Azure’s cloud service growth potential due to infrastructure constraints.

Cloud Growth Surges, Yet Capacity Remains Limited

Microsoft’s Azure cloud division grew by 31% in the fiscal second quarter. However, the forecast for third-quarter growth remains flat at 31-32%, indicating a possible halt in its rapid expansion. This comes as AI revenue soared to surpass $13 billion, marking a striking 175% increase from the previous year. Nonetheless, the company’s infrastructure struggles to meet this demand.

Investments in Infrastructure: A Double-Edged Sword

Significant investments of $22.6 billion in capital expenditures during the quarter highlight Microsoft’s commitment to expanding data center capacity. CEO Satya Nadella remarked that the company is “capacity constrained” for AI services, with a hope to align supply and demand by the end of fiscal 2025.

According to CFO Amy Hood, over half of the spending on cloud and AI is focused on long-term assets that will generate revenue for the next 15 years. This solidifies Microsoft’s long-term vision but raises concerns about short-term growth due to infrastructure issues.

Execution Hurdles Amidst Competitive Landscape

Despite surpassing expectations in AI services, Microsoft is facing execution challenges with its non-AI Azure offerings. The company has reported difficulty in allocating resources effectively between traditional cloud migrations and new AI workloads. Balancing service quality with rapid infrastructure expansion poses a risk for near-term performance.

Moreover, fierce competition from industry players like Alphabet GOOGL-owned Google, Nvidia NVDA, and Oracle ORCL could further impact Microsoft’s market position. With new regulations looming, there is uncertainty about the growth potential of AI services across the industry.

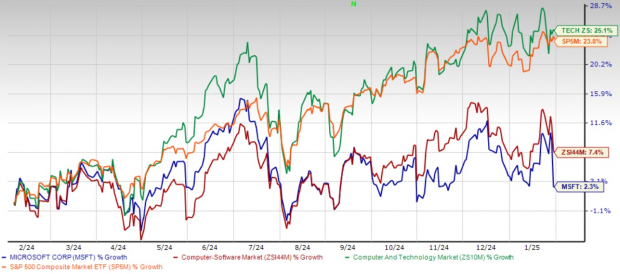

While Microsoft has gained 2.3% over the past year, this performance lags behind the Zacks Computer & Technology sector and the S&P 500 indexes, which grew by 25.1% and 23.8%, respectively, raising questions about the future impact of Microsoft’s AI innovations on its stock performance.

1-Year Stock Price Performance

Image Source: Zacks Investment Research

Market Standing and Risk Factors

Despite facing growth constraints, Microsoft’s competitive edge remains intact. Its partnership with OpenAI has led to notable Azure commitments, contributing to a 67% increase in commercial bookings. Rapid adoption of Microsoft 365 Copilot and notable momentum in AI products are positive indicators.

However, investors must consider significant risks, such as limited near-term growth potential due to infrastructure issues, execution difficulties in non-AI services, high capital expenditure affecting margins, and the risk of decreased pricing as AI services enter a more competitive phase.

Investment Projections and Stock Valuation

The Zacks Consensus Estimate for Microsoft’s fiscal 2025 revenue stands at $276.19 billion, projecting a 12.67% year-over-year growth. The earnings estimate is $13.03 per share, suggesting a 10.42% increase over the same period.

Image Source: Zacks Investment Research

Strategic Insights and Recommendations

Microsoft is committing to enhancing its infrastructure capacity while also being cautious with pricing, which could lead to long-term value creation. However, near-term growth expectations may leave some investors disappointed, especially those seeking rapid advancement. Recent sluggishness in stock price reflects these concerns, but it may not yet present an appealing investment opportunity given execution risks and infrastructure challenges.

For current investors, maintaining positions may be wise due to Microsoft’s long-term potential in AI. New investors may want to wait for more favorable entry points later in 2025, as the company addresses its infrastructure and execution hurdles. Monitoring Azure growth beyond the current 31-32% range is crucial, as it would signal effective scaling and execution improvements across Microsoft’s cloud offerings.

Additionally, continual assessments of data center capacity expansion, transition of AI demand into revenue, and overall market performance will be critical for informed investment decisions.

Conclusion

Although Microsoft remains a key player in technology with promising long-term prospects, its current high valuation coupled with short-term growth limitations suggest that investors should consider holding their current positions while waiting for more favorable entry points. As infrastructure issues and operational challenges are resolved, better buying opportunities may arise in the second half of 2025. Microsoft currently has a Zacks Rank #3 (Hold). You can view a complete listing of Zacks #1 Rank (Strong Buy) stocks here.

Only $1 to See All Zacks’ Buys and Sells

We’re not joking.

Years ago, we surprised our members with a 30-day access offer to all our picks for just $1. You have no obligation to spend more.

Thousands have seized this chance, while others hesitated, thinking it couldn’t be true. We want you to familiarize yourself with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which closed 228 positions with double- and triple-digit gains in 2023.

See Stocks Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to receive this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.