“`html

Broadcom Stock Surges Following Significant Trading Signal

Broadcom, Inc. (AVGO) saw a notable increase in its stock today, drawing the attention of traders who monitor significant financial movements.

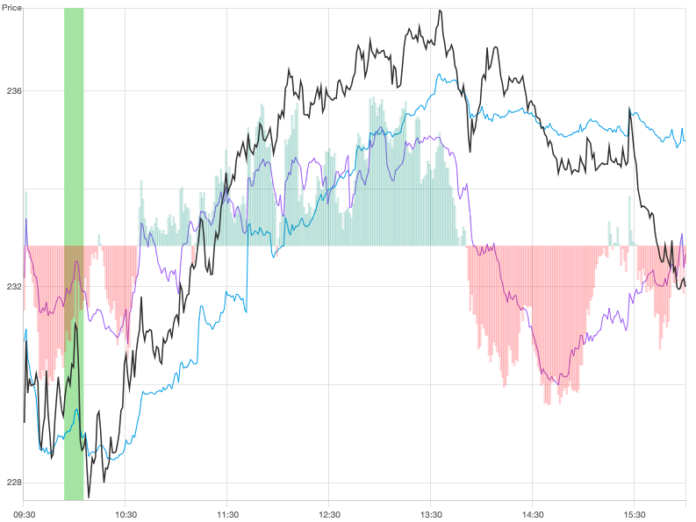

At 10:03 AM on February 5th, Broadcom experienced a Power Inflow at a price of $228.86. This indicator is instrumental for traders aiming to understand the movements of institutional investors, often termed as “smart money.” Such signals may suggest a potential upward trend in Broadcom’s stock, presenting an attractive entry point for those looking to benefit from anticipated growth. Traders interpreting this signal view it as a bullish indicator, anticipating further positive movement in the stock price.

Understanding Power Inflow Signals

Power Inflow is a part of order flow analytics, which scrutinizes the buying and selling activity in the market. This method focuses on the rates of orders from both retail customers and institutional investors. By analyzing various elements such as order size and timing, traders can make more informed decisions. This specific indicator is considered a bullish signal by many active traders.

This type of activity typically occurs within the first two hours after the market opens, providing insights into the stock’s expected trajectory influenced by institutional trading for the day ahead.

Incorporating Risk Management

Utilizing order flow analytics can help traders decode market conditions, identify potential opportunities, and enhance overall trading performance. However, while insights from institutional flows are valuable, effective risk management strategies remain essential to safeguard investments and reduce potential losses. A well-structured risk management plan can assist traders in navigating market uncertainties, thereby increasing their chances of long-term success.

For those wanting timely updates on options trades, services like Benzinga Pro offer real-time alerts on various market movements.

Market News and Data brought to you by Benzinga APIs, including contributions from firms like TradePulse.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

After Market Close UPDATE:

At the time of the Power Inflow, Broadcom’s price was $228.86. Following this signal, the stock reached a high of $237.93 and closed at $232, indicating returns of 4.0% and 1.7% respectively. This demonstrates the importance of a trading plan that incorporates Profit Targets and Stop Losses corresponding to individual risk tolerance.

Past Performance is Not Indicative of Future Results

Market News and Data brought to you by Benzinga APIs

“`