Palantir’s Earnings Surprise Sparks 24% Stock Surge

On Monday, shares of big data platform Palantir (NASDAQ: PLTR) amazed investors by exceeding analyst estimates for revenue and profits in its fourth-quarter earnings report.

Following this achievement, Palantir’s stock jumped 24% on Tuesday, rising above $100 per share. This surge led to a market capitalization of approximately $236.5 billion. Over the past year, the stock has gained an impressive 500%, solidifying its role as a major player in the AI sector.

Is Palantir’s Valuation Justified?

Despite these remarkable results, Palantir’s stock appears extremely expensive. Historically, its shares have always seemed overpriced, yet that hasn’t stopped them from continually surprising skeptics.

Could the stock skyrocket again, achieving a $1 trillion valuation and joining the ranks of the Magnificent Seven? There’s an argument to be made for this possibility.

Palantir’s fourth-quarter results showed strong growth, with total revenue increasing by 36% and U.S. revenue growing by 52%. Notably, U.S. commercial revenue soared 64%, while U.S. government revenue rose by 45%. The company also achieved a record new quarterly contract value at $803 million.

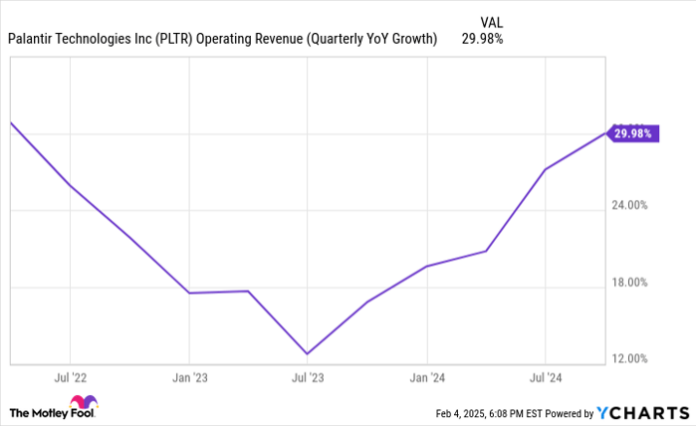

Although GAAP operating income stood at just $11 million (1%), this figure was heavily influenced by “one-time” stock-based compensation (SAR). On a non-GAAP adjusted basis, however, operating earnings reached $373 million, reflecting a robust 45% operating margin. For the full year, Palantir experienced a 29% revenue increase, complemented by a 39% adjusted operating income margin.

Past Performance vs. Future Expectations

These results signify a significant acceleration from previous performance. The year-ago fourth quarter registered only 20% growth, with full-year 2023 revenue growth at 17% and an adjusted operating margin of 28%.

However, the current valuation may seem daunting. Shares are trading at 505 times 2024 GAAP earnings. Even considering an adjusted net income of $1 billion—factoring in stock-based compensation—shares are still valued at around 236 times earnings. Looking ahead, Palantir is priced at 63 times its 2025 sales guidance, despite anticipated revenue growth of 31%, and 148 times adjusted free cash flow. Management did not provide a GAAP net income forecast, which would likely show a lower figure than free cash flow due to high stock-based compensation.

The Bullish Argument for Palantir

Despite concerns over valuation, there is a bullish perspective worth considering. Some analysts, including Wedbush’s Dan Ives, assert that Palantir could become a dominant platform for enterprise AI, akin to how Oracle leads in databases or Salesforce in customer relationship management.

Although Palantir does not build large language models directly, its platform allows enterprises to safely and effectively utilize such models. Launched in the second quarter of 2023, the AIP platform integrates LLMs into Palantir’s core offerings. Following its introduction, growth has resumed.

PLTR Operating Revenue (Quarterly YoY Growth) data by YCharts

How AI Boosts Palantir’s Offerings

Palantir’s platform differs from typical enterprise software, creating what management describes as an enterprise “ontology.” This ontology serves as a digital twin of an organization’s structure, reducing all components to digital objects with defined properties and connections. It requires AI to interface with every aspect of a company’s operations in a secure manner.

During an analysts’ conference call, Palantir’s executive Shyam Sankar noted that automating a single business doesn’t necessitate an ontology platform. Traditional software cannot accommodate the diverse AI needs of varying businesses.

Palantir’s 20-year development of its ontology framework allows for mass customization across diverse industries, making it easier for companies to implement AI solutions. Moreover, Palantir’s initial work with the Department of Defense has instilled a level of trust in its data management capabilities.

“If you have the ambition to build software that works across government and across 50 different industries, you have to build Ontology. It is absolutely the longest path between Point A and Point B. But it gives you superpowers when you show up to your customers,” said Sankar.

The Potential for Market Dominance

It remains uncertain whether Palantir will achieve monopolistic status in the enterprise AI sector, but its rising revenue—despite a modest sales force—suggests a positive trajectory. Dominant software platforms typically benefit from network effects; as users become familiar with a standardized platform, the demand for learning multiple systems diminishes.

This pattern makes enterprise software platforms robust, often leading to substantial profits and cash flow. Therefore, while a $1 trillion valuation may seem distant, Palantir’s growth could eventually reach that milestone.

Disclaimer: The views expressed here represent the author’s opinions and do not necessarily reflect those of Nasdaq, Inc.