Analysts See Potential Upside in SPDR Dow Jones REIT ETF and Key Holdings

Analyzing the performance of ETFs tracked by ETF Channel, we’ve evaluated the trading prices of their underlying stocks against the average 12-month analyst target prices. For the SPDR Dow Jones REIT ETF (Symbol: RWR), the implied target price based on its holdings stands at $111.68 per unit.

Current Trading vs. Analyst Expectations

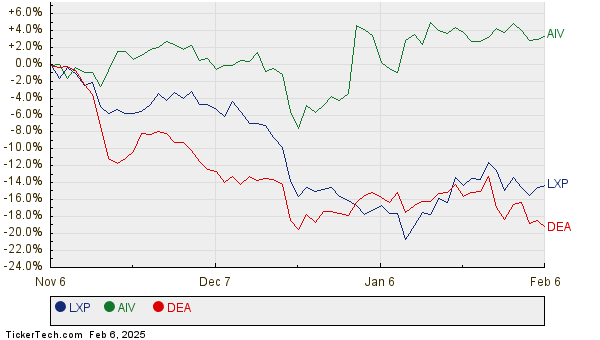

With RWR priced lately around $100.81 per unit, analysts project a 10.78% increase in value for the ETF according to their target predictions. Notably, three of the ETF’s holdings show significant upside potential. LXP Industrial Trust (Symbol: LXP), Apartment Investment & Management Co (Symbol: AIV), and Easterly Government Properties Inc (Symbol: DEA) are highlighted for their expected gains.

LXP recently traded at $8.35 per share, yet analysts have set an average target price of $11.00 per share, indicating a possible 31.74% increase. Similarly, AIV’s recent price of $8.99 suggests a 27.92% upside to its average target of $11.50 per share. Analysts expect DEA to rise from its current price of $10.94 to a target of $13.00 per share, presenting an 18.83% upside. Below is a chart showing the price history for LXP, AIV, and DEA over the last year:

Summary of Analyst Targets

Here’s a concise overview of the current analyst target prices discussed:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Dow Jones REIT ETF | RWR | $100.81 | $111.68 | 10.78% |

| LXP Industrial Trust | LXP | $8.35 | $11.00 | 31.74% |

| Apartment Investment & Management Co | AIV | $8.99 | $11.50 | 27.92% |

| Easterly Government Properties Inc | DEA | $10.94 | $13.00 | 18.83% |

Analyzing Analyst Targets

Do analysts have a solid basis for their target prices, or are they being overly optimistic about these stocks’ future performance? Price targets that are significantly higher than current trading prices may suggest confidence in upcoming growth. However, they might also lead to potential downgrades if those targets reflect outdated information. Investors should conduct further research to understand these predictions better.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Funds Holding INVZ

• OPTZ Videos

• EURN Price Target

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.