Snap Inc. (SNAP) Reports Strong Earnings But Stock Drops

Snap Inc. delivered strong results for the fourth quarter, but its stock fell over 8% to $10.63 in Wednesday’s trading, despite gaining 7% in the previous day’s after-hours trading. The company reported revenues of $1.56 billion, reflecting a 14% growth compared to last year, and achieved its first quarterly profit of $9 million since going public, a significant turnaround from a $248 million loss in the same quarter last year.

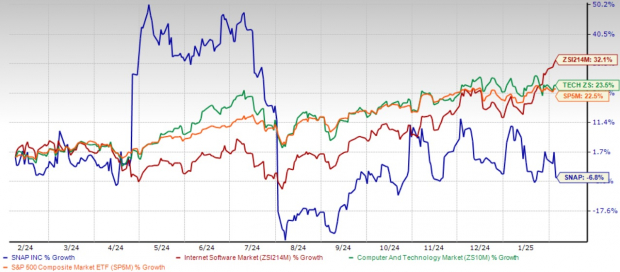

However, concerns about the company’s guidance for the first quarter of 2025, along with uncertainties in the broader market, overshadowed these successes. Over the past year, Snap’s stock price has declined 6.8%, significantly underperforming the Zacks Computer and Technology sector, which recorded a 23.5% return. This situation has led investors to reconsider their positions in the company.

SNAP Stock Performance Over the Past Year

Image Source: Zacks Investment Research

Fourth Quarter Highlights

In the fourth quarter of 2024, Snap showed strong operational performance, with daily active users reaching 453 million, a 9% year-over-year increase. The Average Revenue Per User (ARPU) rose to $3.44, while the company’s Snapchat+ subscription service saw its subscriber base double, hitting 14 million. This growth translates to an annual revenue run rate of over $500 million. Notably, small and medium-sized businesses have become significant drivers of ad revenue, indicating a successful move towards diversifying revenue sources.

The TikTok Factor

Current uncertainties surrounding TikTok’s future in the United States create both opportunities and challenges for Snap. CEO Evan Spiegel mentioned that Snap noticed an increase in engagement when TikTok was temporarily unavailable, though he warned against drawing strong conclusions from this “imperfect experiment.” This environment allows Snap to attract advertisers who are looking to spread their investments across various platforms. Spiegel noted that “advertisers are very focused on contingency planning and diversifying their spend,” during the earnings call.

Current Strategies and Ongoing Challenges

As it looks forward to 2025, Snap is focusing on several growth drivers such as enhancing user experience with updates like Simple Snapchat, expanding ad formats like Sponsored Snaps and Promoted Places, and improving its machine learning capabilities for better ad engagements. The company is also working on boosting its augmented reality (AR) ecosystem with over 375,000 creators building more than four million lenses using Lens Studio.

Despite these advancements, Snap continues to face difficulties, including a 1% year-over-year decline in brand advertising revenues. The company faces fierce competition from industry giants like Meta Platforms (META) and Alphabet (GOOGL), in addition to economic factors that affect advertising spending. Moreover, an overwhelming majority of Snap’s brand advertising comes from a limited number of large clients, particularly in North America.

With a price-to-book ratio of 8.07, which exceeds the industry average of 4.14, Snap’s stock is viewed as having high growth expectations but also comes with increased risk.

Valuation Concerns for SNAP

Image Source: Zacks Investment Research

Financial Projections for 2025

Looking ahead to the first quarter of 2025, Snap expects revenues between $1.325 billion and $1.36 billion, with adjusted EBITDA estimated between $40 million and $75 million. The company’s shift from solely being a social media platform to a more diversified tech entity highlights growth potential, especially with the expansion of the Snapchat+ service and advertising outreach to smaller businesses.

Snap’s financial condition remains robust, boasting $3.4 billion in cash and marketable securities with very little debt due in 2025. The company’s Free Cash Flow for the fourth quarter was $182 million, indicating enhanced operational efficiency.

The Zacks Consensus Estimate anticipates a revenue growth of 13.62% year-over-year, reaching $6.09 billion for 2025, while earnings are expected to see a 44.8% growth year over year, reaching 42 cents per share.

Image Source: Zacks Investment Research

Check for the latest earnings estimates and surprises on Zacks Earnings Calendar.

Investment Outlook for SNAP in 2025

Given the current market uncertainty despite Snap’s beating of earnings expectations, investors might want to wait before committing to new investments. Market reactions indicate skepticism about the company’s short-term growth and sustainability of profits. As the TikTok situation evolves and potential headwinds surface throughout 2025, waiting for clearer signals about Snap’s strategic direction may present more favorable investment opportunities.

A Cautious Approach Ahead

For those considering investing in Snap stock, a cautious approach is recommended. Observing key factors such as how the TikTok situation unfolds, sustained profitability, and consistent Free Cash Flow will be critical. Stakeholders should also pay attention to how well Snap can scale new revenue avenues like Sponsored Snaps and stabilize brand advertising expenditures while monitoring growth in Snapchat+ subscriptions and ARPU. Furthermore, it’s essential to assess the impact of artificial intelligence and augmented reality investments on user engagement and monetization strategies.

Conclusion

Snap’s performance in the fourth quarter and its ongoing strategic initiatives indicate potential, yet the current market climate and mixed forecasts suggest that caution is necessary. While the stock could be an attractive proposition in 2025, investors may want to wait for clearer insights into market conditions and Snap’s execution of strategy. The company’s progress in diversifying its revenue base, expanding its user base, and focusing on profitability showcases promise; however, the current high valuations and market uncertainties merit a careful evaluation. Snap currently holds a Zacks Rank #3 (Hold).

Discover the Top Stocks for the Next Month

Recently released: Our experts have identified 7 top-performing stocks from our list of 220 Zacks Rank #1 Strong Buys. These are the companies most likely to experience early price increases.

Historically, this full list has outperformed the market more than twofold since 1988, achieving an average gain of +24.3% annually. Be sure to pay close attention to these carefully selected stocks.

See them now >>

To access the latest stock recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days for free.

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Snap Inc. (SNAP): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein belong to the author, and do not necessarily reflect those of Nasdaq, Inc.