Ralph Lauren Corp. Shows Strong Gains, But Traders Eye Potential Decline

Ralph Lauren Corp. RL shares are soaring higher on Wednesday, following the company’s impressive earnings report that exceeded analyst expectations.

Traders Prepare for Possible Market Reversal

Despite today’s gain, some traders anticipate a potential drop in stock prices. If this occurs, they could benefit by purchasing put options, which increase in price when the stock value declines. This rationale is why Ralph Lauren has been selected as our Stock of the Day.

The Reversion to the Mean Strategy

Many trading strategies focus on the idea of reversion to the mean. When a stock becomes overbought, traders may expect it to revert back to its usual price range. Thus, they may enter the market as sellers, exerting downward pressure on the stock.

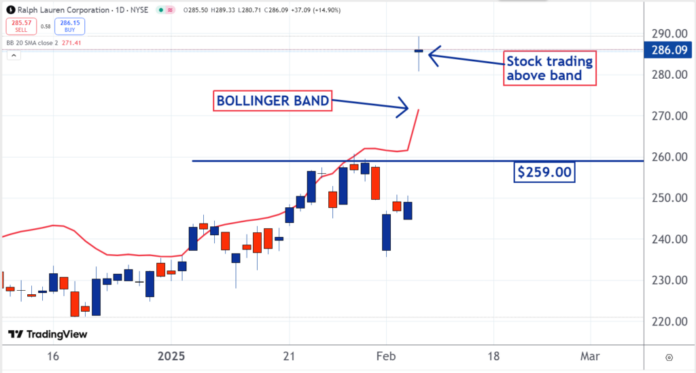

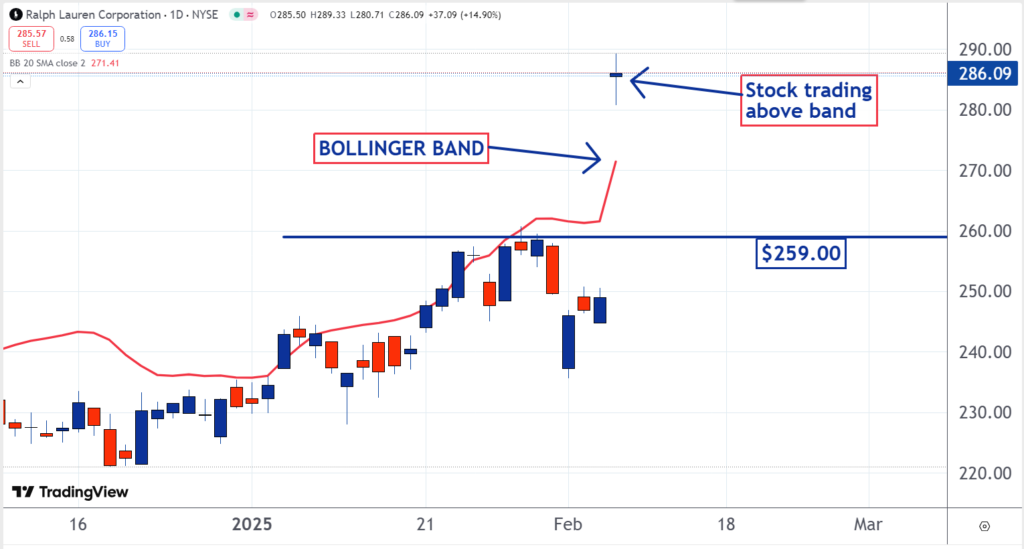

The accompanying chart shows a red line, indicating two standard deviations above the 20-day moving average. Markets typically see 95% of trading occurring within this range. Since shares are trading above this mark, they are identified as overbought.

Evaluating Support Levels

Expert traders often wait to buy put options until the stock crosses back below the two-standard deviation line, signaling a potential price reversal. A downside target has been identified at the $259 level, where there is a likelihood of support.

This price point has previously served as a resistance level, which may now provide support. Historically, traders who sold around $259 in January believed they had made a smart move when the stock subsequently dropped. However, as it rose past that threshold, some buyers regretted their decision to sell.

If the stock returns to approximately $259, those remorseful sellers may place buy orders in hopes of reacquiring shares. If many buyers act on this impulse, it could create a support level at that price, effectively limiting further declines.

Conclusion

Setting a downside target around $259 appears sensible, as it could establish a price floor supported by prior trading activity.

Read Next:

• Arthur Hayes Blasts Strategic Bitcoin Reserve, Regulatory Bill As ‘Net Negatives’

Photo: Shutterstock

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs